Housing stocks – along with most of the rest of the big boards – were a bloody mess most of the week.

Despite some stellar news on Wednesday on new home sales, the HW 30 – HousingWire’s proprietary index of stocks that drive the housing economy – had a rough go of it, especially the stocks that straddle housing and technology.

After Thursday’s across the board sell off, which looked like the closing scene in 1983’s “Trading Places,” the last best hope for a rebound this week may be in Friday morning’s final estimate report on the second quarter GDP.

In late August, the second estimate for the 2Q reading printed at 4.2%, well above analyst expectations. If it’s revised upward again, it could give stocks a boost.

Declining economic activity and a serious drop in existing home sales opened the door for housing stocks to take a beating Monday. Tech stocks in general were hit hard on Monday as the Nasdaq saw a sell off but every single one of the HW 30 except for Bank of America (BAC) closed down.

Zillow (Z) and Trulia (TRLA) – being housing and tech – seemed to take the brunt of it, with Trulia down 4.63% on the day and Zillow down 4.02%.

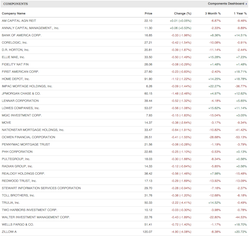

Click to enlarge.

Pictured: Thursday's closing HW 30 numbers. It smells like pennies.

It was much the same story for the rest of the week for the HW 30 to one degree or another.

The National Association of Realtors reported on Monday that sales of existing homes dropped 1.8% in August, blaming the drop on all-cash investor sales retreating. That definitely had an impact early in the week.

The Census report on Wednesday that new home sales skyrocketed, buoying housing stocks temporarily, but they gave up those gains pretty quickly.

Friday will be an interesting time. Watch HousingWire for the latest.