Despite the majority of the housing market losing momentum, there are a handful of divergent regions that haven’t slowed.

"We didn’t notice a large decline in any one market this month, but more of softening across the board,” said Freddie Mac deputy chief economist Len Kiefer.

The latest Freddie Mac Multi-Indicator Market Index recorded the national MiMi value at 73.4, indicating a weak housing market overall and showing a slight decline (-0.45%) from June to July and a 3-month decline of (-0.98%).

However, there were a few anomalies that shared one commonality.

“The one area where momentum hasn’t slowed is among the hardest hit markets. Places like Las Vegas, Miami, Chicago and Riverside, among others, are still showing double-digit yearly improvements, but that’s largely a reflection of significant gains in the local employment picture as well as a real improvement in borrowers making timely mortgage payments,” Kiefer continued.

Click the next page for the top 5 improving metro areas month-over-month.

5. Seattle, Washington (+0.27%)

(source Freddie Mac: click for larger image)

Seattle’s housing market may be weak, but it is improving. The Seattle MiMi is 73.8 for the month, improving .27% over last month and .14% over the last three months. Most of the improvement is due to the 3.85& increase in the Current on Mortgage indicator over the past three months.

Recently, an article in The Seattle Times said that Seattle’s Mayor Ed Murray vowed to address Seattle’s housing affordability crisis the same way he handled the debate earlier this year over raising the city’s minimum wage: by seeking recommendations from an advisory committee.

“The Advisory Committee will review every piece of the housing puzzle, including exploring innovative ideas to pilot new types of housing, the impact of accessory dwelling units, new efforts to preserve existing affordable housing, opportunities to stretch our valuable housing levy dollars using public-private partnerships, and more,” a Murray news release said.

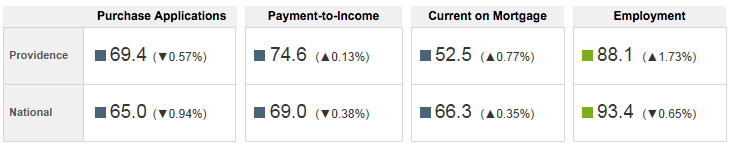

4. Providence, Rhode Island (+0.56%)

The metro’s housing market was significantly boosted in July due to the 7.57% increase in the Employment Indicator over the past three months. And while Providence’s market is weak, it is improving.

According to an article in the Providence Journal, the city launched a new program that aims to rehabilitate hundreds of abandoned properties in order to help revive neighborhoods.

3. Las Vegas, Nevada (0.62%)

Although Las Vegas ranks 50th among the top 50 metros, it is still improving. The city improved .62% from last month, largely due to the 10.77% increase in the Current on Mortgage indicator over the past three months.

Statistics show a rebound in Vegas’s overall housing market, which was one of the hardest hit during the 2008 recession, an article in FOX Business said.

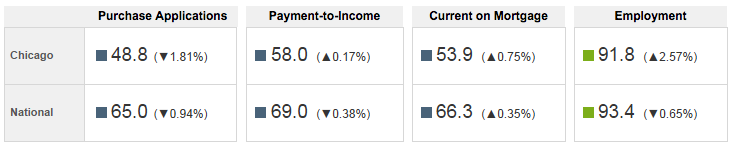

2. Chicago, Illinois (+0.64%)

Chicago witnessed an improvement of .64% over June thanks to the 11.81% increase in the Employment indicator over the past three months.

But according to an article in the Chicago Tribune, the city is experiencing a slowing economy as real estate agents slowly watch their business whither.

1. Miami, Florida (+0.88%)

Miami is officially the top improving metro largely due to the 17.29% increase in the Current on Mortgage indicator over the past three months. The city improved .88% over June and 1.17% over the last three months.

A recent article in the Miami Herald explained that while existing homes are surging in the area, sales of new homes remain well below pat records.