Consumer default rates rose in August, reversing a long downward trend, the most recent S&P/Experian Consumer Credit Default Indices showed.

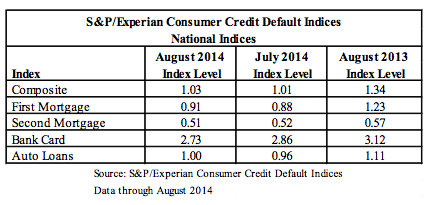

The overall national composite jumped two basis points from last month’s historical low to 1.03% in August.

The indices show a comprehensive measure of changes in consumer credit defaults.

And after nine months of decline, the first mortgage default increased to .91%.

But that modest increase might be expected as home sales grow.

“With the recent and continued growth in the economy, sales of automobiles and existing homes have gained since the start of the year,” says David Blitzer, managing director and chairman of the Index Committee for S&P Dow Jones Indices.

“These factors may be leading to more borrowing and modest increases in default rates. No return to the extreme default experience of a few years ago is imminent,” Blitzer said.

(Source S&P/Experian; Click for larger image)

In addition, the auto loan default rate also rose to 1% in August, while the bank card rate declined 13 basis points to 2.73%.

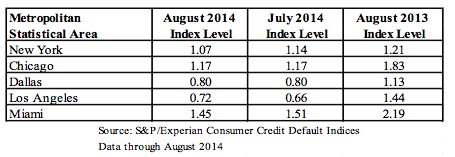

Looking across the nation, Chicago and Dallas’ default rates remain unchanged at 1.17% and 0.80%, respectively.

New York came in at 1.07%, its lowest default rate since July 2006.

Meanwhile, Miami saw its rate decrease to the lowest level since August 2006. But its still has the highest default rate of 1.45%.

Los Angeles was the only city to see its rate increase and continues to maintain the lowest default rate.

It is important to note that all five cities – Chicago, Dallas, Los Angeles, Miami and New York – remain below default rates seen a year ago.

(Source S&P/Experian; Click for larger image)