Although its not issuing securitizations at the rate it did in 2013, things are starting to pick up a bit for Redwood Trust (RWT). The real estate investment trust was prolific in its issuance of prime jumbo residential mortgage-backed securitizations last year, issuing roughly one a month in 2013.

Things have slowed down considerably in 2014, with Redwood only issuing one jumbo RMBS through its Sequoia platform in the first six months of the year. Redwood issued its second jumbo RMBS in July and now it's prepping its third such offering.

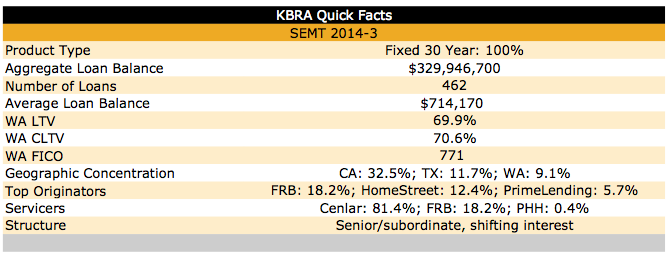

Redwood’s Sequoia Mortgage Trust 2014-3 is backed by 462 mortgage loans with an average loan balance of $714,170.

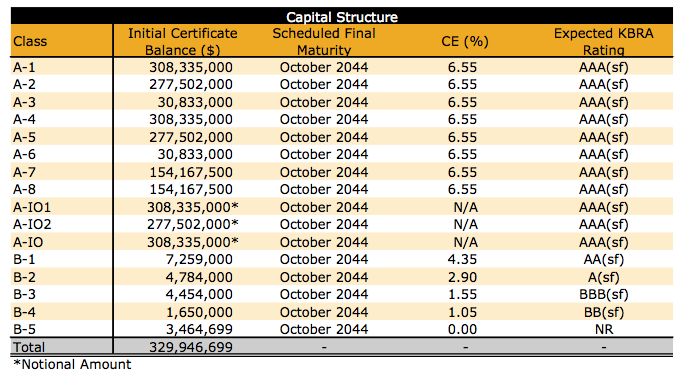

Kroll Bond Ratings Agency has issued its presale ratings for SEMT 2014-3 and has awarded AAA ratings to the vast majority of the $330 million deal.

Click the image below to see a breakdown of Kroll’s presale ratings.

According to Kroll’s report, 100% of the underlying loans are fixed 30-year notes and the pool has a weighted loan-to-value average of 69.9%. The underlying borrowers carry a weighted average FICO score of 771.

Kroll cites the high quality of the collateral as a positive of the deal. “The collateral pool’s weighted average loan-to-value ratio (69.9%) and the pool’s weighted combined loan-to-value ratio (70.6%) provide a substantial margin of safety against potential home price declines,” Kroll’s presale report states.

Kroll also notes the high credit ratings of the underlying borrowers as a positive as well. “Borrower credit quality is strong, as evidenced by the WA credit score of 771,” Kroll’s report states. “A significant portion of the borrowers exhibit high levels of verified assets, and most loans indicate prudent debt-to-income ratios, especially given relatively high borrower incomes. Borrower income and assets are generally well documented for all mortgages.”

Click the image below to see Kroll’s breakdown of the offering’s makeup.

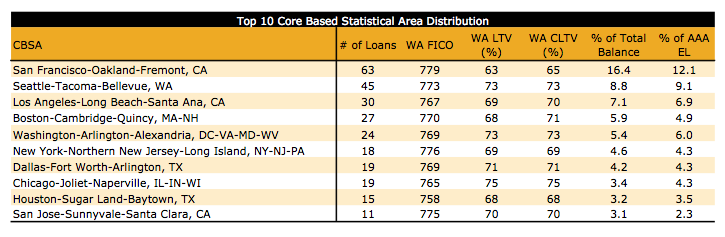

Kroll does caution that the geographic makeup of the pool is a concern. As with most of the recent jumbo RMBS offerings, the largest percentage of the underlying properties are located in the San Francisco metro area.

HousingWire chronicled this very situation last month after the largest earthquake in 25 years hit the San Francisco Bay Area. The magnitude-6.0 earthquake was centered in the Napa Valley but the earthquake was a reminder of the potential risks that come from investing in properties located in that region.

San Francisco has long been home to some of the most expensive real estate in the nation and the prices keep rising. According to the latest data from the National Association of Realtors, the median sales price for a home in the San Francisco-Oakland-Freemont metro area was $769,600 in the second quarter of 2014.

Given those high prices, it’s not a surprise that jumbo securitizations feature San Francisco-based properties in large numbers.

According to Kroll’s data, 16.4% of the total balance of the underlying properties in SEMT 2014-3 are located in the San Francisco-Oakland-Fremont area.

Click the image below for a breakdown of the location of the underlying properties.

In the course of its presale research, Kroll identified four loans within SEMT 2014-3 that were in the most highly affected areas from the most recent earthquake. “The four loans have an average outstanding balance of $505,493 and account for 0.6% of the subject pool, with a WA credit score of 755 and a WA CLTV of 69.4%,” Kroll writes.

“Redwood provided post-disaster inspection reports for the four identified loans, evidencing that no disaster-related damage occurred with respect to the related properties.”

In each of the previous jumbo RMBS transactions that HousingWire has reviewed, California ranked first with the largest portion of underlying properties.

Kroll’s fellow ratings agencies share its level of concern about the risks to the San Francisco market.

For each of these securitizations, DBRS, Standard & Poor’s, and Fitch Ratings have also cited the geographic concentration of the underlying properties as a potential concern.

“Pools concentrated in geographic regions may be sensitive to deteriorating regional economic conditions, fluctuations in regional risk factors or other risks like unexpected industry shifts or natural disasters,” Fitch said in its ratings of JPMorgan’s JPMT 2014-2, for example.

Despite the inherent risks, Kroll still issued AAA ratings to nearly all of the tranches in SEMT 2014-3.