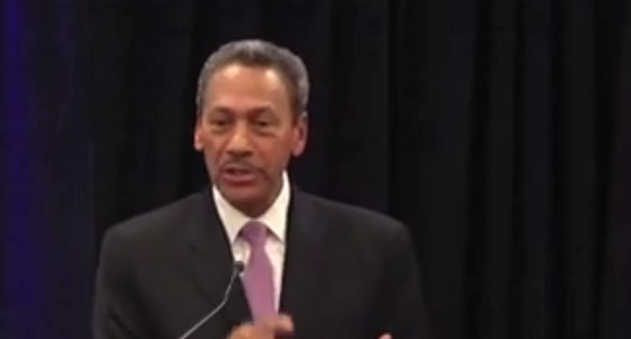

There are 800,000 families nationwide that could still benefit from the Home Affordable Refinance Program, Federal Housing Finance Agency Director Mel Watt said in Atlanta on his nationwide public campaign to urge more borrowers to take advantage of the Home Affordable Refinance Program.

So far, 3.1 million mortgages have refinanced through HARP, but many of the consumers left who can refinance are staying out of the market due to fear.

“HARP is designed to reward those borrowers who are the most committed in this country. This is not a scam,” Watt said.

Watt is making a point to reach out to homeowners he feels could benefit under HARP. But he also wants the mortgage industry to understand why some people still hold trepidations toward the mortgage finance industry.

“As it stands now, people don’t trust their lenders and it’s creating uncertainty. All of this research and anthropological evidence contributes to the downturn. Still there are casualties to this war and the industry would do right to honor that,” Watt said in an exclusive interview with HousingWire magazine. “Today, there’s just a lot of people — and no one pays enough attention to it — who got burned.”

And this is exactly what Watt is trying to combat. "By engaging directly with local community leaders, faith-based organizations, local elected officials and lenders, our goal is to leverage these trusted sources to reach as many 'in-the-money' borrowers as we can," Watt said about the campaign.

"We know that there are hundreds of thousands of borrowers who can still benefit from Home Affordable Refinance Program and are essentially leaving money on the table by not taking advantage of the program," said Watt.

The FHFA released a new interactive map as well to show the number of estimated in-the-money borrowers eligible for the program across the country. It even dives down to specifics of every zip code, county and metropolitan statistical area in the country.

[Skip to 3:10 for quote]