Kroll Bond Ratings Agency has joined Morningstar, which released its presale report on Tuesday, in awarding $147.75 million in AAA ratings to a REO-to-rental securitization from Silver Bay Realty.

The offering, referred to as SBY 2014-1, is backed by a single loan with a balance of $312.7 million and is secured by a first priority of mortgages in a pool of 3,089 single-family rental properties.

This is the sixth and smallest of the REO-to-rental securitizations to date.

Of note in the securitization is that the floating rate loan requires interest-only payments and has a two-year term with three 12-month extension options.

The fact that the loan is interest-only is a concern for Kroll. In its presale report, Kroll says that IO loans are riskier than amortizing loans, “which provide for natural deleveraging over the loan term that results in lower risk of maturity default. In addition, should the loan default later in its term, it will experience a higher loss given default relative to an amortizing loan owing to its higher principal balance.”

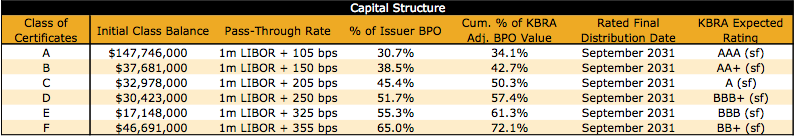

There are seven total classes of certificates to be issued in the securitization.

Click the image below to see Kroll’s presale ratings on the various tranches.

There are 3,089 single-family rental properties that make up the underlying collateral. The homes are located in 12 metro areas in seven states, which is the smallest geographic spread of any of the REO-to-rental securitizations.

The top three states represent 79.7% of the aggregate broker price opinion value and include Arizona (34.7%), Georgia (22.8%), and Florida (22.1%).

The top three metro areas represent 72.6% of the BPO value, and include Phoenix, AZ (31.6%), Atlanta, GA (22.8%) and Tampa, FL (18.2%).

The geographic concentration of the homes is another potential concern for Kroll’s analysts. In the previous REO-to-rental securitizations, the least amount of metro areas as the basis of the pool was 19.

“The geographic footprint of the portfolio reflects the sponsor’s focus on investing in regions with the most attractive investment opportunities,” Kroll’s report states.

“The need for local property knowledge and economies of scale in managing properties in a particular region can be viewed as a positive aspect of the portfolio’s regional concentration. However, the risk of being significantly impacted by a local downturn in the economy and/or property markets is elevated.”

The portfolio is comprised primarily of homes with three or more bedrooms (97.4%) and two or more bathrooms (96.2%). The homes have an average estimated square footage of approximately 1,703 square feet.

In its presale report, Kroll references the relative youth of the asset class as a potential cause for concern on the securitization’s performance.

“Large-scale institutional ownership and management of SFRs is a fairly new business model and US securitization structures of the assets are still evolving,” Kroll’s report states. “While SBY 2014-1 is the sixth transaction of its kind, performance data for the sector is limited.”

According to Kroll’s report, among the positive considerations for the securitization is its low loan-to-value ratio, which is 65%. “This is lower than each of the five SFR securitizations that have been completed to date, which had LTVs ranging from 70.0% to 75.0%,” Kroll’s report states.

Single-family rentals have come under fire lately from the national housing activist group Right to the City Alliance, which recently published a report entitled Rise of the Corporate Landlord: The Institutionalization of the Single Family Rental Market and its impact on Renters.

The report, which is critical of the rise of REO-to-rental and single-family rentals, says the proliferation of such rental properties have “proven disastrous for many low-income communities – with rents skyrocketing and corporate, absentee landlords proliferating in urban areas across America.”

One of the concerns raised by the Right to the City Alliance’s report was the rising cost of rent in single-family homes, but the average monthly rent payment for a home in the Silver Bay pool is $1,139, which is lower than all the other SFR securitizations’ average rent.