Default rates on Federal Housing Administration-backed mortgages originated at the height of the mortgage bubble have risen to 36%, according to a new report from the Urban Institute.

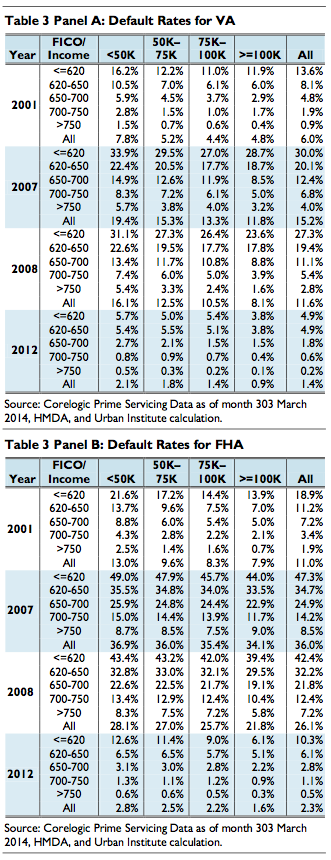

Using Corelogic’s Prime Servicing Data and Home Mortgage Disclosure Act data, the Urban Institute calculated the default rates for FHA-backed loans originated in 2001, 2007, 2008, and 2012. For FHA mortgages written in 2001, the default rate is 11%, while the default rate for loans written in 2007 is more than triple that figure, at 36%.

The default rate has begun to fall for mortgages of more recent vintage. The default rate for FHA mortgages written in 2008 is 26.1% and for mortgages originated in 2012 the default rate has fallen to only 2.3%.

But the Urban Institute says there’s still more room to improve on that number.

In its Housing Finance Policy Center Commentary, the Urban Institute’s Laurie Goodman, Ellen Seidman and Jun Zhu write that the FHA should adopt a practice that the Veterans Administration uses when considering a borrower for a loan — the residual income test.

The residual income test looks at the borrower’s ability to pay for food, clothing, transportation, medical expenses and other day-to-day living expenses after paying for all of their home-related expenses.

According to the Urban Institute, the calculation begins with a borrower’s after-tax income, subtracts the monthly payment on debt and other obligations, as well as the mortgage payment and estimated property taxes, hazard insurance, flood insurance if applicable, maintenance and utilities, and any homeowner association dues or condo fees. The result of this calculation is the amount available for family support.

Goodman, Seidman and Zhu suggest that the residual income test should be considered in addition to the traditional debt-to-income ratio test when considering a borrower’s application.

“The difference between DTI and residual income is important,” they write. “DTI provides some indication of ability to repay. But because it is a ratio, it does not measure whether the borrower has sufficient income to cover living expenses after paying the mortgage and related costs.”

The analysts compare FHA default rates with VA default rates and in every year cited, the VA default rates are at least half of the FHA default rates. For example, the default rate for VA mortgages written in 2007 is 15.2%, compared to the FHA default rate of 36%. For loans written in 2012, the VA default rate is 1.4%, compared to 2.3% for FHA loans.

Click the image below to see the comparision of FHA and VA default rates.

The analysts do note that it’s not exactly an apples-to-apples comparison because of the different designs of the FHA and VA lending programs.

Perhaps the most critical difference beyond the obvious — the VA’s requirement of military service — is that in the VA program, the lender has a “stake” in how the borrower performs.

The analysts break it down:

A major difference between the two programs is the extent of continuing lender responsibility for the loan’s performance. The FHA is responsible for 100% of the principal and interest payments for its loans. In contrast, the VA guaranty is much more modest, leaving the VA lender at some financial risk if the loan defaults.

The maximum VA guaranty is 25% of the loan amount, up to the county loan limit, with a minimum guaranty of $36,000. The lender is responsible for any loss above the VA guaranty.

But even considering all of the inherent differences between the two programs, VA loans outperform their FHA counterparts. “Even when income, credit, and mortgage burden are comparable, VA loans perform better than FHA loans,” the analysts write.

Goodman, Seidman and Zhu cite other factors that could contribute to the lower default rate of VA loans:

Military culture – Some have suggested that members of the military could be inherently more disciplined and responsible, and hence less apt to default on their loans. This has never been proven or disproven.

Direct contact – The VA has a statutory requirement to service its borrowers, and direct contact is required. The FHA does not engage in direct contact with borrowers; the servicer contacts the borrower. As a result, the VA intervenes at an earlier point in the delinquency cycle and in a more uniform fashion.

“Skin in the game” – In contrast to the FHA’s 100% guarantee, VA lenders have residual risk after the VA’s first-loss obligation is exhausted.

Lender concentration – VA lending has been more concentrated than FHA lending, particularly in recent years. The top 10 lenders accounted for 54% of VA loan originations, and only 32% of FHA loan originations.

But the analysts say the one change that could be most easily adopted would be the residual income test.

That change wouldn’t come without side effects though. Adding the residual income test could make it more difficult for borrowers to obtain credit, which is a problem that the FHA is already attempting to remedy.

“This (the suggested adoption of the residual income test) effectively makes it more difficult for low-income homebuyers to qualify for a mortgage, because it requires that they have sufficient excess income to meet unanticipated expenses that might lead them to default,” the analysts write.

“On the other hand, the residual income test may also protect borrowers from entering into mortgage transactions that have a high likelihood of failure, and instead lead them to delay purchase, purchase a less expensive house, or put down a larger down payment.”

The analysts also believe that the residual income test could have applicability outside of the VA or FHA markets. “We understand that the Consumer Financial Protection Bureau considered using residual income rather than DTI in the Qualified Mortgage rule,” the analysts say. “The evidence from the VA’s experience suggests that when the CFPB reviews its mortgage rules in five years, residual income is worth another look.”

Goodman, Seidman and Zhu also suggest that lenders making higher-cost QM loans should consider residual income tests to provide more certainty that they will not run afoul of the ability-to-repay test.

“Adding a residual income test when underwriting a high-cost QM could make lenders more willing to make loans whose risk level would, for other reasons, warrant a higher interest rate,” the analysts write.