A down payment is one of the first hurdles borrowers have to tackle when they are trying to buy a home, but there is just one giant problem: they have no savings.

A survey by NeighborWorks America in April found that almost 70 million working age Americans – about one-third – have no emergency savings, and 25% only have enough saved to cover 30 days of living expenses.

About one in five have enough savings to cover three months – about the average time of unemployment for many Americans – while 28 % expect their emergency funds to cover a year.

But saving might not be as hard as people think.

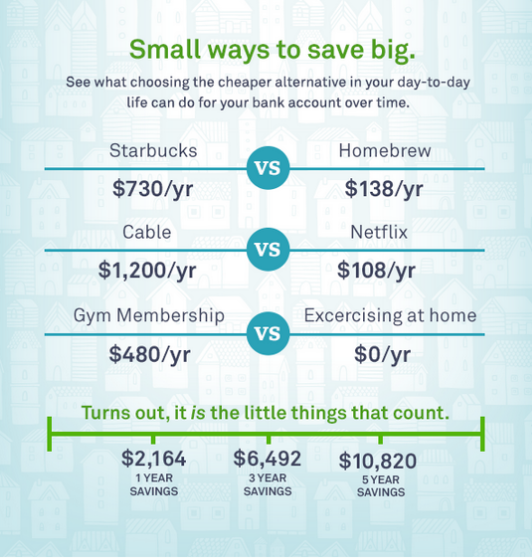

Trulia (TRLA) outlined simple, but feasible, ways people can save over $10,000 in as little as three years if they just cut back in various areas.

For example, on average Starbucks can cost $730 a year. But if you swap Starbucks for brewing coffee at home, people would only be spending $138 a year. This alone would save $1,776 over three years.

And this same situation can be applied to so many other areas.

(source Trulia: click for larger image)