Each weekday morning, Kendra Taylor settles into her cubicle at Nationstar Mortgage and fires up a computer and two monitors. With a few keystrokes, she sends out a morning greeting: “Happy Monday! We hope everyone had a fantastic weekend. We’re back to work and ready to help out if you need us!”

She hits return and the message appears on one of Nationstar’s Twitter handles, @Nationstar_Help.

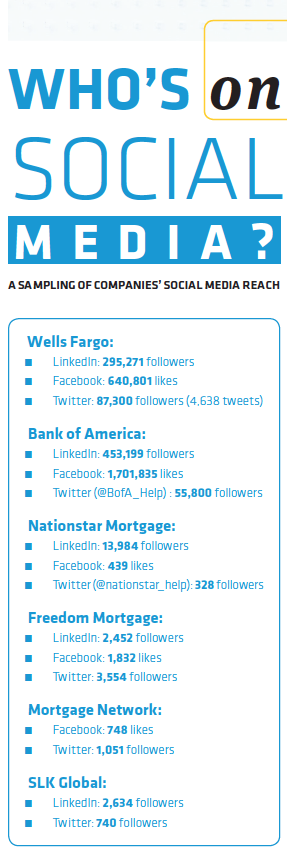

Later, before she goes home, she’ll send a farewell tweet, but in between the hello and the good-bye, the real work goes on. Taylor, 28, is the social media specialist at Dallas-based Nationstar Mortgage, the country’s sixth-largest mortgage servicer. Despite its size, Nationstar didn’t dip its toe into social media until last fall when it launched two Twitter feeds, @nationstar_help and @nationstar_news. Just in March, it activated a Facebook page.

To be sure, some financial services companies have been involved in the social space for several years now, but for many it remains a new commodity still fraught with uncertainties for the highly regulated industry. Navigating social media requires a certain amount of finesse, and some businesses remain on a learning curve — still surprised by how ordinary folks can quickly bring low a powerful company.

Just ask JPM.

On social media website Twitter, people message each other left and right. The messages are brief and can end up going anywhere, reaching anyone. What’s more, any term with a hashtag at the front is organized into an easily searchable and comment-able category.

JPMorgan Chase created the #AskJPM hashtag last year to promote a Q&A between college students and a senior executive on Twitter. People could ask a question and it all appeared together, easily searched by entering #AskJPM. It quickly became a catalog of snarky complaints before the senior executive even sat down for the session.

It backfired, and thousands of people used the hashtag to taunt the big bank whose reputation was tarnished during the housing crisis and more recently for the London Whale trading debacle.

“If you are going to operate in that medium, you have to own it,” said Pat Sahm, customer experience and channels practice lead at Carlisle & Gallagher Consulting Group, a Charlotte, N.C.-based consultant to the financial services industry. Still, Sahm said she believes JPMorgan made a nice recovery by making fun of itself in the tweet in which it canceled the Q&A.

(After several days of abuse, JPM tweeted: “Tomorrow’s Q&A is cancelled. Bad Idea. Back to the drawing board.”)

Financial service firms have been in and out of social media for several years. Some experienced so much negativity about their brands during the housing crisis that they exited the medium, Sahm said.

“What they saw, in their minds was not helpful,” she said. “I would actually disagree with that.”

Pulling out, however, isn’t a smart move, as going dark only hurts the brand. On the bright side, companies that leave can always return, but must do so wiser and more prepared.

“They re-entered with a different mindset to put forth ideas, information and to service clients, knowing they will have some people, who — because they can — will post comments that are not very appropriate,” Sahm said.

CONNECTING WITH CUSTOMERS

Nationstar’s Taylor, who’s been with the mortgage servicer for three years, worked her way up the customer service channel as a customer service representative, a research resolution analyst, and a customer relations specialist.

“All of those positions have been customer-facing roles, so she’s truly a customer service employee using social media — and not a PR person providing customer service,” said John Hoffman, Nationstar’s senior vice president of corporate communications.

It’s a different twist from companies thathouse their social media personnel under the marketing umbrella. Taylor is out on the floor with the customer service advocates —scanning tweets and Facebook posts pulled in via a marketing department who uses Radian 6 software to monitor mentions. On average, she’s connects with five to six customers each day via social media. The goal is to respond to a complaint within 24 hours and to have it resolved within three working days.

Not everyone she connects with is in a good mood. Take this post that came across her screen from @BradyM11.

“Worst mortgage company and customer service in the world. Been trying to get 1 question answered for 3+ months now. Horrible.”

Taylor keeps her response upbeat: @BradyM11 We’d be happy to address your concerns. Please DM your info and details so we can follow up. Thanks! ^KT

Nationstar takes personal issues offline to resolve them. There’s good reason for that approach. For one, customers often don’t want to air their financial issues in detail for everyone to see. In addition, financial services firms face stringent regulations related to customer privacy.

In fact, a full 90% of customers prefer to discuss their banking concerns in private, according to a Carlisle & Gallagher survey.

After an initial connection via social media, more detailed follow-up often occurs via phone or email to resolve an issue. Taylor has access to Nationstar’s servicing platform to call up an individual’s loan file as she communicates with customers.

She also keeps a database open on her second monitor where she tracks the status of the complaints she’s handling. The work she does also gets copied into an application that allows Nationstar to sort the data and review it. Reports are reviewed and discussed at a monthly meeting.

Nationstar, which became a publicly traded company in 2012, realized after its IPO that it needed to do a better job connecting with shareholders, customers and the public, said Hoffman, who was hired about a year ago to head up corporate communications, a newly created position. The company also brought aboard Dana Dillard, executive vice president and chief customer officer, to fill a new position focusing on customer outreach.

The mortgage servicer’s social media strategy was developed soon after the two new hires came aboard and quickly implemented.

Marisa Barker, vice president of community outreach at Nationstar, said the company looked at what the other large mortgage servicers were doing in social media as a guide and launched focus groups to review how Nationstar was being mentioned in the social space and to discuss how it should be responding.

The servicer opted for two Twitter handles: @nationstar_news covers information geared toward shareholders and the media and @nationstar_help interacts with customers. Taylor manages the help handle and Hoffman manages the news handle.

“The spirit of the way we are approaching it, is we need to meet the customer where they are,” Dillard said.

LEARNING FROM EXPERIENCE

Freedom Mortgage “officially” entered the social media space three years ago, but before that dozens of individual branches were doing their own thing in a disjointed approach, said Seth Kronemeyer, senior vice president of emerging technology and solutions at Freedom.

So Kronemeyer pushed the company toward establishing a social media strategy overseen from the firm’s Mount Laurel, N.J., headquarters.

Twenty-two Facebook pages were reduced to a single Facebook page focusing on Freedom’s corporate brand. Freedom also operates a Twitter handle, a LinkedIn company page and a blog, he said.

“It’s a necessary part of having a brand in 2014,” he said. “We want to make sure we are communicating with our customers and providing the best possible service out there.”

Although Freedom operates a national customer call center, it wanted to be open to multiple methods of communication, he said.

“If you come home from a hard day’s work and you are already on Facebook and want to send us a private message, no problem,” he said. “We want to be there to receive communication from our customers any way they want to send it.”

Like Freedom, Mortgage Network’s social media presence is also three years old. Its goal was to give its individual loan officers a voice on social media while also having a corporate brand, said Maureen Cioni, Mortgage Network’s social media/PR coordinator.

Cioni offers a monthly live Q&A webinar chat with loan officers, providing them guidance on how to most effectively use social media. About 20% of Mortgage Network’s loan officers are using social media, mainly Facebook and LinkedIn to prospect for business, she said.

The lender has a social media policy that all loan officers receive when they join the lender and it gives guidance on what should and shouldn’t be posted.

HUNTING FOR PROSPECTS

SLK Global is taking a different tack in the social space. The India-based company opened a U.S. operation in Dallas last year and provides business process outsourcing to U.S. banks, title insurance companies and mortgage servicers.

As a business-to-business company, SLK’s social media presence is focused largely on prospecting for new clients, said Jagjit Soni, vice president of mortgage banking at SLK Global.

It’s been in the space since July 2013.

“We started with a couple of main objectives. One was to enhance our reach to more and more relevant people within the mortgage space, and secondly, to start communicating messages around our capabilities and what SKL Global would like to be known for as a specialist in the industry.”

It uses LinkedIn, Twitter and YouTube. On LinkedIn, it joined relevant groups and began posting content. It also began following people and companies on Twitter with the goal of gradually building up a follower base. To communicate its capabilities, SLK started a blog and posts informational videos to YouTube. In a bold decision, it purposely stays away from Facebook, seeing it as too consumer oriented.

‘We’ve been able to significantly increase our pipeline of prospects,” he said. “We’ve had a quantum leap in the number of discussions and dialogues with our prospects. It hasn’t necessarily resulted in a confirmed sale yet, but I think we are getting really close.”

THE FUTURE LOOKS BRIGHT

Financial services firms may have a ways to go to effectively reach more customers via social media. According to the Carlisle & Gallagher survey, 68% of consumers in the survey said they would never use social media to resolve a complaint.

More than half the respondents to the Carlisle survey — 52% — believe banks’ use of social media is ineffective, and a much higher percentage, 87%, find banks’ use of social media annoying, boring and unhelpful.

But financial services firms are getting more involved in the social space. American Banker wrote about Wells Fargo’s command center, launched in February, where dozens of employees monitor social media posts five days a week, 12 hours a day.

Sahm harkens the social media phenomenon to mobile banking back when mobile banking first emerged and had a host of problems. Improvements were made in each cycle. Today, mobile banking has a lot of functionality and is a service customers have come to expect from their financial institutions.

Sahm sees social media in a similar light. Companies will need to go through several cycles before they get it right, she said.

“Your first foray into social media will be fraught with questions, problems and issues,” she said. “It might be boring and, in some ways, irritating to the consumer.”

But don’t give up, she said. Those survey statistics should improve as financial institutions become more savvy in the social media space.

“I do think it’s possible,” she said, “to have a fun experience, a helpful experience, one where you are learning something in a financial services space.”

Sahm and others stressed the importance of having a solid strategy around social media and to be thinking ahead on what the impact will be when social media is used to interact with customers.

According to Sahm, financial institutions have several things they should do or acknowledge as part of their social media strategy:

Answer marketing questions about products and services.

Resolve consumer complaints.

Acknowledge that there will be anonymous and vague criticisms that cannot be addressed via social media, so don’t bother trying.

In cases where a misstep is made on social media, acknowledge it and move on.

“I think it will be interesting to see it develop and grow,” Sahm said. “About two years from now, when you talk to some of these servicing companies, it will be a different environment.”

Social media, like online banking, will go through several cycles and come out on the other end with some strong functionality, she believes.

“It’s here to stay,” Sahm said, “so any institution that feels they don’t need a social media strategy — good luck with that because at some point they will become irrelevant.”