The Consumer Financial Protection Bureau is continuing its efforts to make it easier to comply with the requirements of the Truth in Lending Act.

In March, the CFPB issued its TILA-RESPA compliance guide which was designed to help smaller lenders and other mortgage companies understand and comply with the new mortgage disclosure rules designed to make it easier for consumers to understand loan documentation.

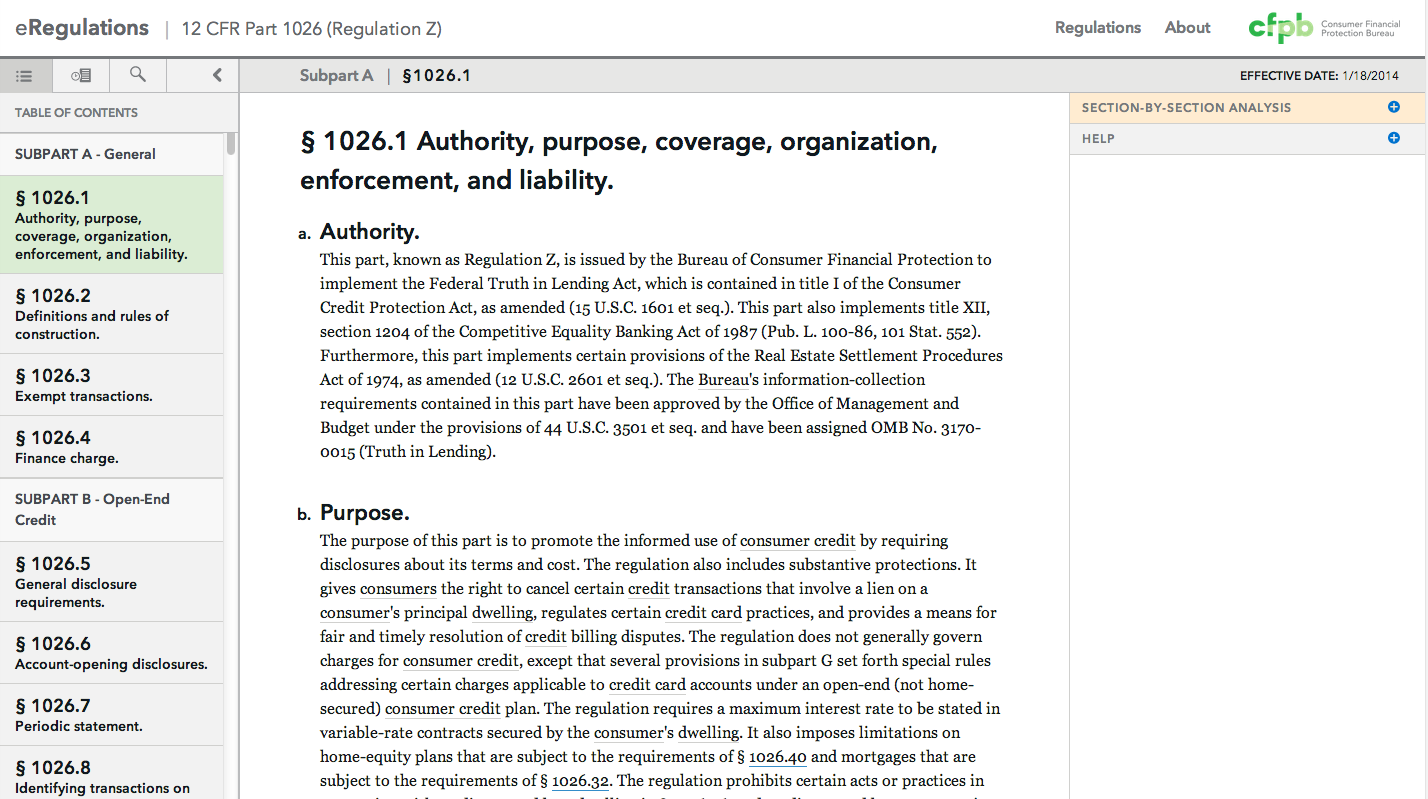

Now, the CFPB is launching eRegulations, an “intuitive, easy-to-navigate electronic format of Truth in Lending regulations.” The CFPB said that it expects eRegulations to make it easier to implement and use the recently adopted mortgage rules.

According to the CFPB, eRegulations makes the TILA regulations “easy to read and navigate.” The website features clear typography and a “persistent table of contents” to ensure fast access to any section of the regulation.

Specifically, eRegulations highlights TILA’s “Regulation Z” which protects people when they use consumer credit. Regulation Z defines consumer credit as: mortgage loans, home equity lines of credit, reverse mortgages, open-end credit, certain student loans and installment loans.

The eRegulations website also features a regulation timeline which shows recent revisions of the regulation organized by the effective date of the revision. Users can also compare any two versions of the regulation, word for word, by selecting a date in the menu.

The website also features inline official interpretations and highlighted defined terms.