The anticipation and excitement is palpable. With two single-family rental securitizations on the market at press time and more likely in the works, this new asset class has the financial market energized.

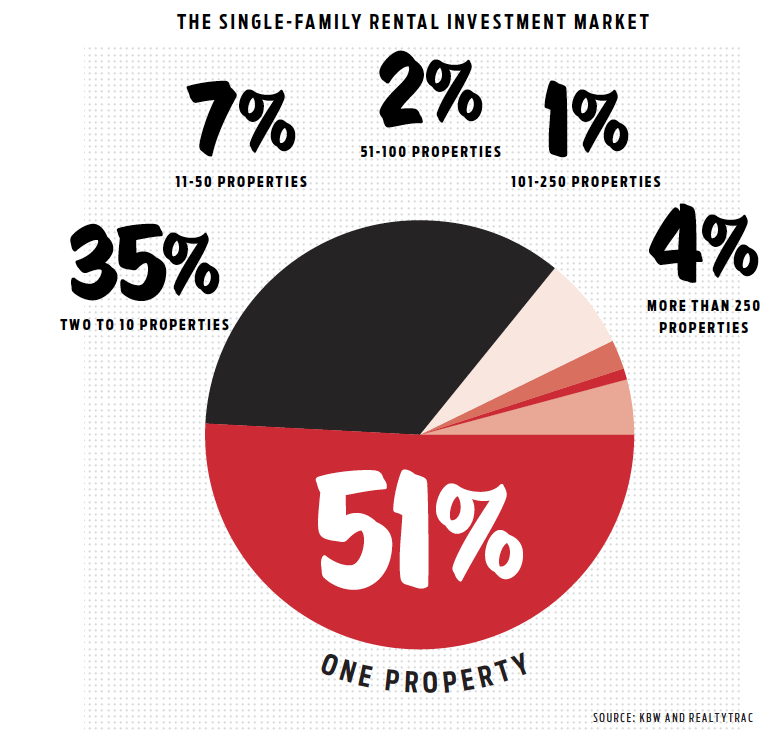

To be sure, it still remains to be seen whether institutional zeal for single-family rental securitizations will catch on with smaller investors who control the vast majority of rental homes in the United States. But if these smaller investors opt to pool their properties into multi-borrower securitizations, the SFR securitization market could balloon in size and alter the U.S. housing landscape.

The market opportunity is sizable. If smaller investors follow on the heels of large institutional players in the single-family rental market, the addressable opportunity in the sector could reach $1 trillion to $1.5 trillion, according to a KBW research report.

KBW analyst Jade Rahmani estimates the market could reach $16 billion to $22 billion per year in securitizations within the next three to four years, but cautions this depends on the capture rate on total investor holdings. Eventually, annual production could reach or exceed $30 billion, depending on capture rates, he said.

Institutional investors began snapping up REOs to convert to rentals in large numbers in mid-2012. Within a year, about a dozen large institutional investors — hedge funds, private equity groups and REITs — had purchased roughly 130,000 homes. Some experts in the housing industry credit this activity with providing a floor that allowed for the housing recovery that quickly followed.

THE ART OF THE DEAL

Blackstone is at the forefront of this movement, buying more homes than any other firm. Blackstone has invested $7.8 billion and purchased 41,000 homes since mid 2012. The next biggest player, real estate investment trust American Homes 4 Rent, has committed $3.6 billion to buy an estimated 21,000 homes. A total of 13 major institutional-grade players have invested in more than 130,000 properties, according to company disclosures, media reports and KBW research.

Deutsche Bank was there at the beginning as well, lending money to Blackstone (and others) via short-term warehouse loans that they envisioned refinancing through securitization.

“We had people telling us that we couldn’t do it and certain ratings agencies that said they wouldn’t rate it,” said Stephen Blevit, a partner with Los Angeles-based law firm Sidley Austin, who represented Deutsche Bank in Blackstone’s Invitation Homes 2013-SFR1, the first SFR securitization out of the gate last fall. Since then, Colony Capital and American Residential Properties have brought securitizations to market.

Deutsche Bank originally proposed a securitization structure that didn’t put mortgages on the properties, opting instead for a pledge of equity of the borrower. But the ratings agencies did not favor the structure and one publicly stated that a nonmortgage structure could not obtain a AAA rating.

At issue was risk. A mortgage provides the lender with the first lien on the asset, the most common way a piece of real estate is secured in the United States. Without mortgages, other creditors could intervene in the highly unlikely scenario of a substantive consolidation in a bankruptcy case, Blevit said.

Substantive consolidation occurs when the court decides a parent company and its subsidiaries are essentially the same company. Under such a scenario, the lender would have had to get in line along with other unsecured creditors, and its ability to recover its loan could have been impaired.

“We spent some time working with the ratings agencies on it,” Blevit recalled, about the original structure that only pledged equity of the borrower. “They wouldn’t budge off their position.”

So Deutsche Bank and Blackstone began investigating a new securitization structure that used mortgages.

“The cost of providing individual mortgages was a concern,” Blevit said, recalling early conversations. “Think about it. You are putting a mortgage on 3,000 to 4,000 homes at a time.”

Ultimately, Blackstone and Deutsche Bank decided it wasn’t as impossible as they first feared.

“We did some more work with the ratings agencies to figure out what the savings would be and then we realized that the savings from having mortgages would be significant,” he said. “We’d be able to get a higher rating than without mortgages, which would enable more investors to buy the bonds, which would create more demand for the bonds and lower interest costs to the borrower.”

They opted to keep the equity pledge in the structure as well, which lets the lender foreclose, if necessary, very quickly compared to the months or years it currently takes to foreclose on a single-family residence.

Once the new structure was in place, it garnered AAA ratings on a significant portion, a surprise to some.

Morningstar Credit Ratings LLC was among the agencies rating the Blackstone deal.

Becky Cao, a managing director of RMBS at Morningstar, said in reviewing the deal, the ratings agency looked at net cash flow to see if it would support the debt obligation and also studied property values. Among the variables studied: rental rates, concessions, vacancy costs and capital expenditure.

Morningstar, she said, evaluated the property values based on two methods. One was a capitalization income approach like that used in rating commercial mortgage-backed securities because the rental homes are considered investment properties.

The second was a home price index method. To get the AAA rating in this transaction, the properties had to be able to survive a 57% haircut from the property’s broker-price-opinion value at the time the bonds were issued, she said.

Brian Grow, a managing director of RMBS at Morningstar, said AAA-rated tranches must also be able to survive a house price decline of 30% more than the worst-ever house-price decline seen in the region being rated. To get A-rated, it must survive the worst decline ever experienced since the 1970s.

EXAMINING THE RISKS

The Blackstone deal, and other rental-home securitizations, come with risks. There’s the potential for another housing downturn. Demand for single-family rentals could drop, causing vacancy rates to rise more than anticipated.

“Securitization can be a good thing,” said U.S. Rep. Mark Takano, D-Riverside, Calif. “It can spread risk and make capital more available.”

But amid the euphoria over this new asset class, Takano is sounding the alarm.

He believes risks in RMBS sold during the run-up to the housing crisis — which included subprime mortgages that garnered AAA ratings — were hidden from investors.

And he wonders what risks might be lurking in these single-family rental bonds that have yet to surface.

“There are risks that need to be more fully examined,” he said. Takano wants those potential risks fully aired in a public setting and Takano said he’d heard from several congressmen at a recent caucus meeting who also support public hearings.

In a December 2013 report, the Federal Reserve said investor activity in the single-family rental market “may pose risks to local housing markets if investors have difficulties managing such large stocks of rental properties or fail to adequately maintain their homes.”

Takano’s district covers foreclosure-ravaged Riverside, Calif., the cradle for California’s middle class. Housing values there plummeted during the financial crisis as REOs flooded the market.

“My community feels they were the victims of Wall Street during the subprime crisis,” Takano said.

Now rents are rising faster than income — up 20.9% in Riverside County over the past six years compared with much smaller increases in neighboring counties, according to U.S. Census data.

In 2012, as housing prices bottomed, institutional investors swooped into Riverside to buy up cheap REOs, and Takano wonders if residents will again feel victimized by Wall Street if owner-occupants get shut out of affordable housing by institutional players flush with cash.

EXTENDING THE ASSET CLASS

The single-family rental market, to be sure, is in transition. Just recently, three of the big institutional players formed lending arms to provide financing to small and regional investors in the rental-home space. It’s a move that industry players believe could eventually lead to multi-borrower SFR securitizations.

Blackstone formed B2R. Cerberus Capital founded FirstKey Mortgage, and Colony Financial started Colony American Finance.

These new companies are expected to follow a CMBS model of financing, treating borrowers as commercial enterprises and providing financing based on cash flows from investment properties.

KBW said it believes each company hopes to originate loans in excess of $1 billion in the next 12-18 months. Loan terms generally include five- and 10-year loans with 30-year amortization periods. Interest rates are running between 5% to 7%, with 70% to 80% loan-to-value ratios.

“It is worth noting that senior personnel at many of the entities involved in SFR lending are seasoned securitization professionals — both in CMBS and RMBS — who are considered leaders in structured finance, which may help drive the successful development of the SFR lending business,” KBW said in a research report.

These new lending platforms differ from the conforming mortgages on investment properties historically available via GSE securitization. Under the GSE model, loans are underwritten as residential mortgages, and borrowers are not treated as commercial enterprises.

Strict guidelines limit availability of financing. Fannie Mae allows only 10 investment properties and Freddie only four. Requirements include reserves for principal, interest, taxes, and insurance ranging from two to six months, according to KBW.

THE FUTURE

As home prices began to rise in 2013, institutional buy-to-rent investment slowed. By May 2013, Carrington Holding Co.’s Bruce Rose — one of the first to enter the market with $450 million in funds from Oaktree Capital Group — said his hedge fund had stopped buying REOs. But he told Bloomberg at the time that he could be back should other large institutional investors discover they can’t make the returns that justify the prices they paid.

In fact, one market expert who spoke to HW said institutional involvement in the single-family market could help minimize future housing downturns.

“Once prices get to a certain level where it makes sense for institutions to buy, they’ll step in and fill that void because they have the machine built now. They’ll be able to step in much more quickly, which means prices shouldn’t fall as much.”

But whether institutional buyers will stay in the rental-home market long-term is a chapter that hasn’t yet been written. Some likely will sell their assets while others will rent the homes permanently on a large-scale basis.

The securitization structure of the Blackstone deal allows for either scenario. There is no restriction against Blackstone selling the homes. However, if they do, the proceeds would go to pay off the bondholders.

Blackstone must pay a premium to the bondholder to ensure the bondholders don’t get cherry-picked with the best assets getting sold out of the trust. The deal also includes a pre-payment lockout.

Industry experts expect $5 billion to $6 billion in issuance this year via five to 10 single-borrower transactions, with the possibility of a multi-borrower securitization hitting the market by year-end.

One industry expert notes that it’s interesting to contemplate why Blackstone’s Invitation Homes deal got institutional buy-in. One reason is that the underlying collateral isn’t new. “Debt on the assets is securitizable. That has been factually proven,” the source said.

Whether a multi-borrower deal could garner a AAA rating remains to be seen. Either way, expect more activity, said Morningstar’s Grow.

“There is staying power,” he said. “There are 14 million single-family rental properties in the U.S. and most are operated by small mom-and-pop property managers.”

Institutions now testing the waters could ultimately alter the rental home landscape, Grow said.

“If they can manage the homes more efficiently and do the marketing and leasing more efficiently than the mom-and-pop investors, then my guess would be that they will continue to take market share from mom-and-pops and institutionalize the single-family rental market.”

The United Kingdom provides a precedent for rental securitization, especially for the smaller investors. There, it’s more widely accepted for individuals to own rental properties, and such properties have been securitized for many years, Rahmani said.

“This could lead to a potential paradigm shift in the U.S. housing market if it gains wider acceptance, meaning if more people consider houses as an investable asset class,” Rahmani said. “The opportunities could just be beginning.”