For the second month in a row, home sales in Las Vegas were at the slowest pace in five years. Las Vegas’ February home sales figures reached their lowest level since 2009, according to data released by DataQuick. In fact, sales have fallen on a year-over-year basis in each of the past five months.

In February, 3,230 new and resale houses and condos closed escrow in the Las Vegas-Paradise metro area (Clark County). That was down 0.1% from the month before, when 3,232 homes sold. February’s numbers were down 19.6% from 2013. February’s home sales were 14.5% below the average number sold during every February since 1994.

Of the homes sold, resales of houses and condos combined were 9.0% above average for the month of February; while sales of newly built homes were 60.5% below the February average. Condo resales in February were 26.0% higher than the February average since 1994.

In February, sales of homes priced below $100,000 dropped 47.9% compared with a year earlier, while sub-$200,000 transactions fell 36.1% year-over-year. February sales of homes priced from $200,000 to $500,000 increased 20.2% from a year ago, while the number selling for $500,000 or more rose 17.7%.

Las Vegas region buyers paid a median $180,000 for all new and resale houses and condos purchased in February, up 1.5% from $177,300 in January and up 24.1% from $145,000 a year earlier. That marks the 16th consecutive month with an annual gain of more than 20%.

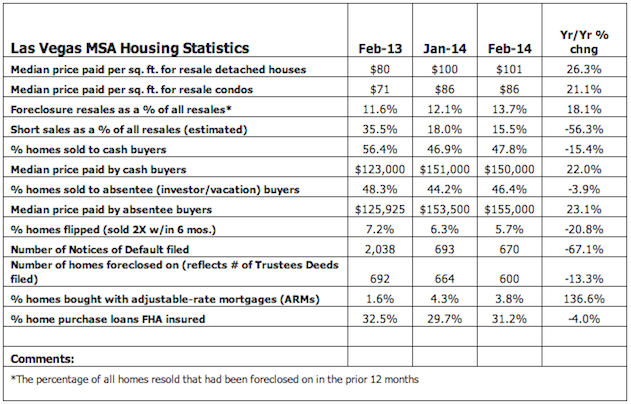

Investor purchases did increase slightly over January’s numbers. Absentee buyers, which would include investors and some vacation-home buyers, bought 46.4% of the homes sold in February, up from 44.2% in January but down from 48.3% a year earlier.

“In recent months home sales have been constrained by a combination of factors, including higher prices and mortgage rates, a fussy mortgage market and the relatively low supply of homes for sale, especially in the lower price ranges,” the DataQuick report said. “Some owners still can’t afford to sell their homes because they owe more than they are worth. Also, lenders aren’t foreclosing on as many properties, further limiting the supply of homes for sale.”