They drove in by the hundreds on a frosty, but mercifully sunny December day. The destination, The Black Academy of Arts and Letters in downtown Dallas, has seen its share of wear and tear and could use someone, anyone, to give it a new beginning.

They came from Austin. They came from Houston. They came from across big metropolitan Texas cities. And they all came to do one thing: vent.

Everyone who attended the field hearing that day in Dallas sought to tell their story to the director of the Consumer Financial Protection Bureau (CFPB), Richard Cordray, who was the main attraction.

And while they had come from far away, Cordray’s journey was no less long.

Immediately after the wake of the financial crisis, Cordray, the Ohio attorney general at the time, went to work to personally sever any dangling legal injustices. He relentlessly went after the breakers of the law, as he saw it. He quickly assembled nine lawsuits against mortgage servicers and the world’s largest credit rating agencies, accruing at least $2 billion in recovered damages.

To many in the mortgage finance space in Ohio, he was a big dog with a big bite.

Yet this was just a mere taste of the power he would soon hold.

Two years later and a failed attempt at re-election for Ohio AG, Cordray assumed a much greater role as director of the CFPB. And although he carries a different title, not much has changed for the man behind the giant consumer regulator.

In early 2011, even though the voters of Ohio decided to go in another direction, the nation saw the opportunity. President Barack Obama nominated Cordray to run the CFPB.

“We’ve cracked down on credit card companies that charge hidden fees, and forced those companies to make things right,” Obama said in regard to his nomination, which would take a year to get approval. “And through it all, Richard has earned a reputation as a straight shooter and somebody who’s willing to bring every voice to the table in order to do what’s right for consumers and our economy.”

That’s a tall order, and although Cordray’s latest title wields significantly more power, the motivation and duties remain in line with his time as attorney general. At the end of the day, Cordray will be there for the consumer.

TAKING THE REINS

TAKING THE REINS

In an exclusive interview with HousingWire, Cordray said that there are enormous differences between being director of the CFPB and the Ohio AG. “First of all, we have nationwide authority not confined within a single state. Second, our authority is broader, with more tools to deal with issues and problems,” he explained.

When he was attorney general, Cordray said he only had two options to deal with a problem: either do nothing or launch an investigation leading to litigation. While there are upsides and downsides to that approach, the CFPB has significantly more options.

“We have the supervisory examination tool, which is a very effective way to solve a lot of problems. We have the ability to write rules, which is a very comprehensive way to address an issue with the marketplace rather than just against one company,” he said.

Additionally, they have the consumer education engagement tool and the consumer response complaint tool, which has proved very significant in terms of changing industry behavior and causing companies to pay more attention to resolving issues with their customers, Cordray said.

The tools and the CFPB’s ability to actually make a positive change for people across this country is enormous, Cordray said.

LOOKING BACK

As Ohio’s AG, Cordray’s depth of power still had a strong footing.

In a previous HousingWire interview when Cordray was the attorney general, he explained that there are many different fronts that an attorney general can use to attack the problems in the mortgage industry.

“I think ‘all hands on deck’ describes the situation we’re in. It’s an unprecedented situation. I feel whatever we can do to attack it from the standpoint of my office, we need to be doing that,” the director said.

In that interview Cordray was disheartened that the problem was difficult to attack on the scale and the volume necessary to make a real dent.

“Whatever the courts can do to retard some of the disintegration of our communities, they should be doing,” he said. “Whatever Congress and the state legislature can do, they should be doing. I think we can make progress on this.”

Before long,that dream would become a reality for him.

CREATING THE BUREAU

Sen. Elizabeth Warren, D-Mass., was the mastermind behind the creation of the CFPB, but faced an uphill battle to get Cordray nominated as its director. However, the majority of the battle was not over whether Cordray was a good fit to lead, but instead whether the CFPB was a good idea at all.

When the CFPB was being launched, Rep. Patrick McHenry, R-N.C., criticized the agency’s structure and the perceived lack of oversight when it came to the CFPB’s power to effectuate the direction of lending institutions.

Warren was adamant, assuring critics the bureau had checks and balances, in addition to the agency also being watched by Congress 24-7.

“Many [senators] don’t like either the agency nor the ideas that led to its creation,” Warren said in early 2011. During one televised interview she dismissed her critics by merely saying: “I don’t get it.”

In 2013, at a meeting with Congress over the potential of a second leadership term for Cordray, Warren defended him, arguing that he had earned his nomination.

She even went so far as to publicly support him, sending a congratulatory tweet when he was nominated: “I couldn’t be more pleased that Rich Cordray will finally get the vote that he deserves. This is a historic day for working families!” Warren’s tweet read.

MAKING PROGRESS

Cordray’s trek to Dallas fulfilled part of the CFPB’s goal to leave the politics in Washington and step out into the world of the consumer. Every month or so the director hosts an event outside the capitol with the purpose of learning firsthand how consumer financial products and services are affecting people around the country, with housing topping the priority list.

Consumers packed the audience in the public field hearing in Dallas. Each distraught, frustrated borrower patiently waited to express their concerns to the director of a powerful, if controversial, agency. And he listened.

Cordray heard their strong words of frustration and diligently took notes.

The director not only looked at the borrower, but saw the story and problem they represented, hanging onto every word said.

But as each borrower began to speak, the time allotted for questions and answers quickly started to run out. Many speakers took the time to comment at length, and most encouraged the CFPB to come back again.

Throughout the session Cordray remained engaged with the consumers, going well over the allotted time for the field hearing.

At the end of it, Cordray worried he would miss his flight. He declined the pre-arranged sit-down with HousingWire and dashed out the door, but only after a compromise was met: a brief phone interview on his drive to the airport.

DEFINING NEW RULES

“As Frank Lloyd Wright once said, ‘There is nothing more uncommon than common sense.’ That quotation epitomizes the heady years preceding the financial crisis of 2008,” Cordray said in a speech to the Consumer Federation of America on Dec. 5.

“Reason and sound judgment were absent when many banks and other mortgage businesses lent to consumers without even considering whether they could pay back the money. The supposedly rational market had become wildly irrational.”

The CFPB has progressively worked to heal the market and protect borrowers since the downfall in 2008.

“At the Consumer Bureau, we started right off by focusing on [the mortgage] market — the single-largest consumer finance market in the world, valued somewhere between $9 and $10 trillion,” Cordray told HousingWire.

With the implementation of the new mortgage rules, the CFPB hoped to return to a “back-to-basics” approach to mortgage lending practices. “No debt traps. No surprises. No runarounds. These are bedrock concepts backed by our new common-sense rules,” Cordray said.

Back when Cordray was the Ohio attorney general, he said he would not characterize himself as an enemy of servicers, but, “I would certainly say that we’re highly dissatisfied with their work.

“I would characterize myself as a friend of theirs in the sense that we are trying to get them to do what’s in their long-term self interest rather than their short-term self interest, and we’re trying to get them to be responsive to their customers as we think they should be,” he said.

ACCEPTING CHANGE

But as the housing industry shifts into the new era of mortgage rules, lenders and servicers are more concerned with the fruition of these tools.

There has been some concern in the industry in terms of the breadth of the changes, and whether lenders, especially smaller institutions, feel confident about continuing the kind of lending that most of them typically engage in, Cordray said.

“We have attempted to encourage financial institutions that if you are a small lender who has lent responsibly, and you pay close attention to your customers, and you have had good performance on your loans, even through this terrible financial crisis that we’ve all be through, then you should continue to feel very confident about lending along this model,” he added.

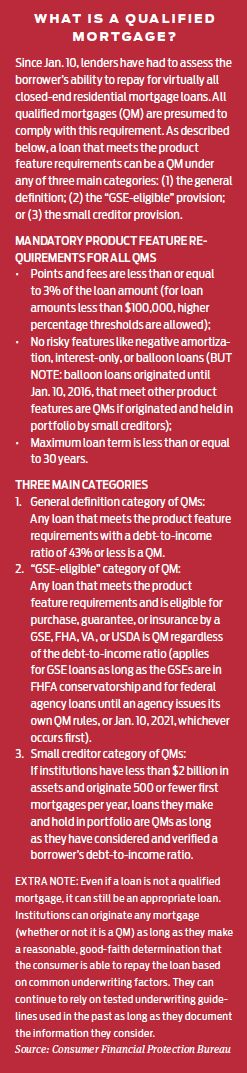

“Whether a loan happens to qualify as a QM or non-QM loan, they are good loans and are not going to default. You want to continue serving your customers, and we think that is a very good thing,” Cordray emphasized.

As the qualified mortgage rule that applies to new mortgage applications on or after Jan. 10 is implemented, there will be a period of 45 to 60 days when applications will still be processed that are not affected by the rules, leaving room for a gradual transition.

“We have said to institutions that are going through a lot of implementation here, that what we are looking for in the early months are good faith efforts to come into substantial compliance with the rule, which we do not expect them to be perfect right off the dot,” Cordray said.

MAKING AN EFFORT

However, the CFPB does expect those good-faith efforts to be substantial, resulting in compliance with the rule.

“I think that these rules are going to both better protect consumers, but also improve this marketplace so that we can never again see the kind of dysfunctions that really cratered the entire economy,” the director said.

In addition, Cordray made sure to emphasize the importance of applying the new rules to servicers. “There have been a lot of problems in that industry. I have seen them very close up when I was a public official in Ohio. It is important for them to take this very seriously and improve their performance and come into compliance with these rules,” he said.

MOVING AHEAD

“Our new rules will help every borrower, whether or not they struggle to make their payments, by bringing greater transparency to the market,” Cordray said.

“All of the new protections will help end a failed process in which too many struggling homeowners have been kept in the dark about where they stand.”

The CFPB is continuously working with the industry to get the mortgage rules right. “It is important to us that they not just be right on paper but that they be right in practice and that people are implementing them so consumers can actually see the benefit,” Cordray said.

The new regulations apply to the market as a whole, bringing more lenders under the compliance umbrella. Before the newest regulations implemented on Jan. 10, banks, credit unions and chartered institutions were regulated but many of their competitors were not.

“Now we will be able to enforce a level playing field across the entire market,” Cordray said.