Adjustable-rate mortgages are a perfect fit for a large portion of homeowners, a necessary cog to refit the purchase mortgage space.

Chairman and CEO of PennyMac, Stanford Kurland, gave a presentation at the 2013 Barclays Global Financial Services Conference in September in which he extolled the virtues of the adjustable-rate mortgage in an environment of interest rate volatility. In the chase for mortgage origination crumbs, Kurland noted that ARMs “have become more attractive relative to fixed-rate mortgages.”

But while ARMs make the grade in this regard, the revival is marked with certain caveats.

In a mainly positive light, the revised Qualified Residential Mortgage proposal mirrors the Qualified Mortgage rule released earlier this year by the Consumer Financial Protection Bureau. Mortgage bankers, lenders, servicers and securitizers all breathed a sigh of relief at the alignment. However, the rules may dampen the recent surge in adjustable-rate mortgage originations — and will most certainly kill off some of these products come January.

Under the Dodd-Frank Act, lenders are required to ensure borrowers have the ability to repay their loans. Lenders issuing loans meeting the QM definition under the CFPB’s new regulations will need to comply with the ability-to-repay rule, thereby offering special protection to investors under the rules.

The QRM rule addresses loans that are securitized. Lenders must retain at least 5% of the risk of loans they securitized that aren’t deemed a QRM. QRM is supposed to be a quality measure that ensures prime loans are made responsibly.

Adjustable-rate mortgages, which by several accounts played some part in triggering the housing-market collapse, fall under the QRM definition. These loans will be exempt from the 5% credit risk retention rule, if the proposal is passed as law.

But what sounds on the surface like good news changes tune when digging deeper.

Unlike regular fixed-rate mortgages that have the same rate and monthly payment throughout the life of the loan, rates on ARMs change, which can lead to larger monthly payments that make it harder for a borrower to afford the loan.

QRM RULE

However, adjustable-rate mortgages fall under the scope of the QRM rules, with certain caveats that make the product less risky. And there may be decent logic to this reasoning.

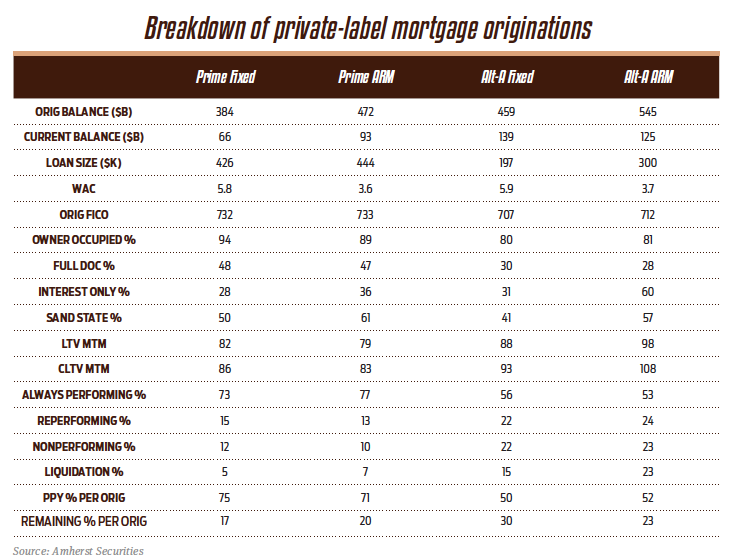

Under QRM, there is absolutely no room for negative amortization, interest-only or balloon features. Historically, these nonagency ARMs perform worse than fixed-rate product of the same type, but not nearly as poorly as other nonconforming mortgages.

From their offices in New York City, Deutsche Bank analysts Ying Shen and Jichun Wu crunch mortgage numbers pulled from CoreLogic. The two look for trends in performance between differing mortgage products to put in an “RMBS Observer” document for investment clients.

Recently, they noted that delinquencies in the 2006 and 2007 vintages of Alt-A mortgages are around 25%. If it’s an Alt-A ARM, add another 10% to that, though delinquencies are improving during the current home-price appreciation. Prime ARMs, on the other hand, are only around 15% delinquent, not far from delinquencies in prime, fixed-rate mortgages. Judging by the work of Shen and Wu, investors could comfortably invest in securitized, prime ARMs, which are still doable, as long as lenders follow the rules.

Another important caveat is that adjustable-rate mortgage payments must be underwritten using the maximum interest rate that may apply during the first five years after origination. So instead of using the introductory rate of ARMs, once a big marketing ploy, lenders are required to consider the loan’s fully indexed rate in their calculations. This is defined as the margin the lender has on that loan, plus the index to which the loan is pegged.

For instance, an ARM with a 225-basis-point margin (or 2.25 percentage points) that’s pegged to the one-year Libor — currently at 0.84% — would have a fully-indexed rate of 3.09%. The lender would have to make sure the borrower has the ability to make the loan’s monthly payments at this rate, even if the initial rate they’re offered is lower. At press time, the fixed rate on a 5/1 ARM, which has a fixed rate for the first five years and adjusts annually after that, averaged 3.27%, according to Zillow estimations.

STRINGENT

This, says Walt Schmidt, senior vice president of mortgage strategies at FTN Financial, is an important facet of the QRM proposal “because the lender must assume that the rate will get as high as it possibly can and then calculate the debt-to-income ratio for the borrower.”

“The bottom line is that unless you pass these really stringent tests effectively, the loans are not allowed,” said Schmidt. That means that any interest-only origination or negative amortization origination would require 5% risk retention under the proposed QRM and would not meet the ability-to-repay requirements.

Greater transparency on the product comes at a time when interest in ARMs is obviously increasing. In the first half of the year, the dollar value of ARM applications accounted for 16% of mortgage requests, the highest share since July 2008, according to the Mortgage Bankers Association.

While sources say this market share will decrease in the run-up to QRM and QM during the second half of the year, it’s notable that much of the interest in the product is on the back of a volatile interest rate environment.

For example, the average interest rate on a 30-year fixed mortgage was at 4.73% the week of Aug. 30, from 4.80% the previous month, according to a report by the MBA.

For that same time period, the average interest rate for 5/1 ARMs decreased to 3.49% from 3.50%, with points remaining unchanged at 0.37 (including the origination fee) for 80% LTV loans.

This higher interest rate has helped boost the popularity of adjustable-rate mortgages, albeit from a very low level of origination, according to Laurie Goodman, the outgoing senior managing director at Amherst Securities.

“The differential between the rate on ARMs and fixed-rate mortgages is expanding as rates back up,” Goodman said in an e-mailed statement to HousingWire.

Still, she said that when there is only a modest differential between the two, as there is now, borrowers prefer fixed rates. “When given an opportunity to lock generational lows in rates, borrowers prefer fixed rates,” said Goodman.

Lisa Schreiber at New Penn Financial said that even with rates on a 30-year fixed looking “really, really good,” when the rates rise and homebuyers notice, they’ll start looking for that lower rate. “ARMs are a good option in that regard,” she said.

“Anytime in history you have seen a rise in the interest rate environment, you have seen the ARM market resurrect itself,” said Rick Seehausen, president and CEO of LenderLive. “The ARM market and the home equity market will resurrect — we see both happening.”

But the current ARMs revival is driven mostly by standard one-, three-, five- or seven-year ARMs — an amortizing loan that is right for the individual who plans to be in their home a short period of time, depending on the duration they pick. “There’s nothing wrong with that product,” said Seehausen.

“I think we got over our skis as an industry in exotic ARM products in the period leading up to the housing crisis,” adds Seehausen. “Those are not likely going to return anytime soon.”

At the Salt Lake City operations center of independent mortgage lender W.J. Bradley Mortgage Capital, ARMs have always played a part in the company’s origination portfolio, though in recent years at lower levels. “ARMs are a great utility product. However, when you have rates as low [as they have been], fixed rates outshine,” said J. Michael Kime, chief operating officer at W.J. Bradley.

Still, for the sophisticated lenders in the business, ARMs are a great product for customers that don’t stay in homes for 30 years, particularly hybrids, explains Kime.

It’s why he believes the 10-year product has remained such “a great option” against the 15- and 30-year fixed. “People historically don’t stay in homes more than seven years,” said Kime. “People’s needs are different. We transition. ARMs are a great solution to that and people need to be offered options.”

Kime said that over the last 18 months, with the resurgence of nonagency jumbos, the majority of the nonagency ARMs today are from higher loan-to-value customers.

He believes that the one real catch to growth will be the provisions that prohibit interest only.

On basis risk complexity, ARM execution is a lot wider to fixed than traditionally, so there is arbitrage in the product today. The products being pushed are fully amortizing, but they are ARMS, so theoretically there is more risk. But the yield curve is quite steep.

“You can’t show a borrower a reduced rate from fixed into fixed; it’s certainly not a reduced payment,” said FTN’s Schmidt. “You might be able to go from 30 to 15 and show a reduced rate, but the payment is going to go up because the amortization schedule is shorter. But you can save 150 bps at least at the current rate moving a 20-year into a 5-year ARM.”

That is allowed under the CFPB rules. But from a debt-to-income standpoint, issuers must underwrite the loan as though it were fully indexed — even though the rate today is much lower than the fully indexed rate would be. This aspect of QRM is sure to put some downward pressure on ARM production, according to Kime.

Kime also points to the lack of liquidity in the capital markets today for nonagency products as another factor that may keep ARM production subdued. “There’s just a wipeout of money-center aggregators, and the ability for smaller players to originate and hedge security [for] ARMs is much more difficult,” he said.

Smaller players can’t aggregate, so bigger players need to come in and support the market. The contrary to that statement, said Kime, is the bank portfolio. Because of rising interest rates, banks will want to make the shorter duration play so their prices on ARMs will improve. “Assuming they can figure out how to aggregate into portfolios, they will become comfortable with the origination of that asset,” said Kime.

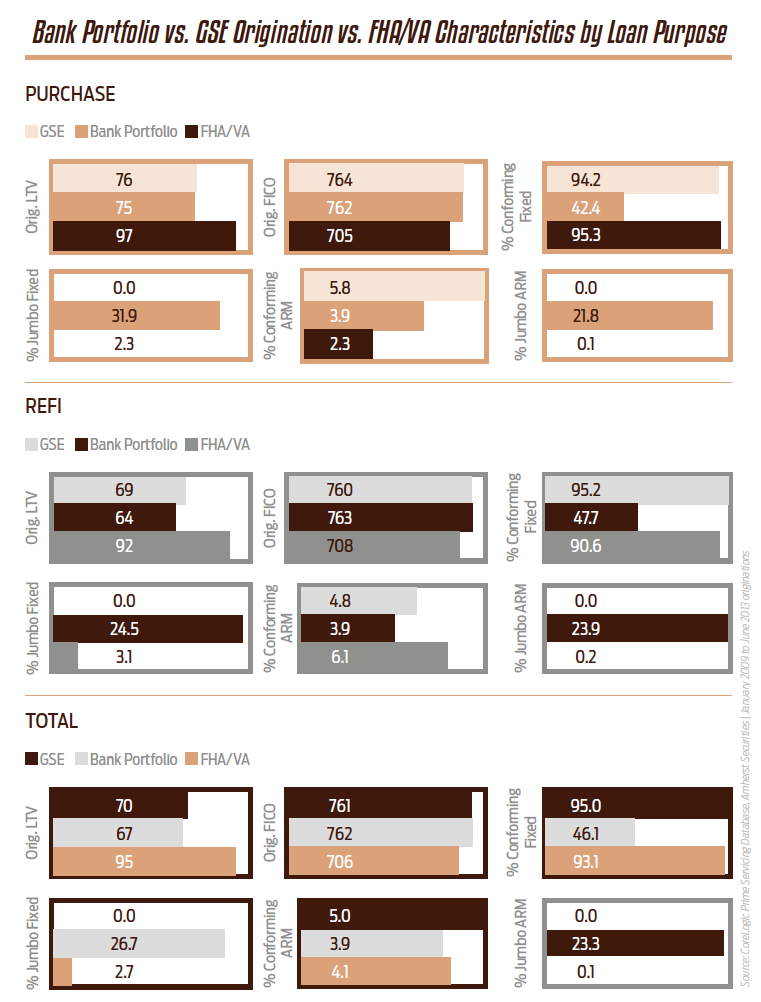

According to Goodman, whole loan investors do prefer the shorter duration ARMs, and bank portfolio lending is much more even in fixed/ARM than is agency production. “Securities investors like the shorter duration, but value the liquidity of TBA even more,” she said.

Government regulations may stop the ARMs party for the time being, leaving the product to trade aggressively in the banking sector. It’s only a matter of time before lenders recognize the allure of ARMs, especially to the jumbo sector. And all things considered, it’s then just a step away from playing a part in the revitalization of the private-label securities market — and then the revival will be back on.