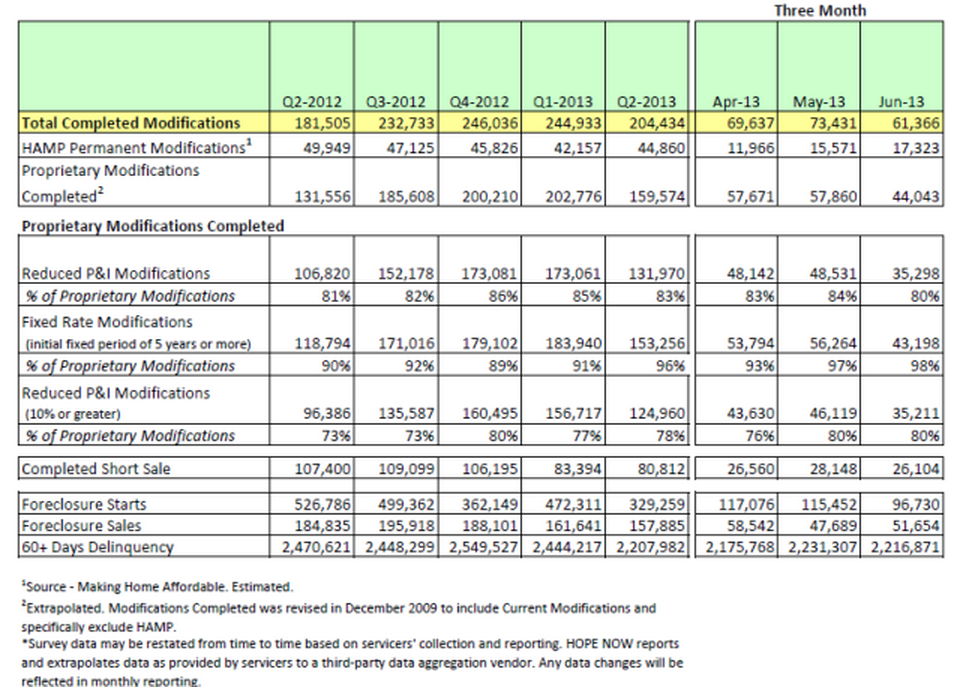

From April through June of this year, an estimated 204,000 homeowners received permanent loan modifications from mortgage servicers. Of those modifications, approximately 160,000 homeowners received proprietary loans modifications and 44,860 homeowners received loan modifications completed under the Home Affordable Modification Program.

“Our mission since 2007 remains the same – to reach out and assist as many homeowners as possible using all of the tools at our disposal. In addition to the progress made via our solution data, HOPE NOW sponsored over 140 face to face events in more than 70 markets nationwide and has been a driving force in bringing together all mortgage stakeholders in the interest of improving the nation’s housing market,” said Eric Selk, executive director of HOPE NOW.

The mortgage industry completed more than 6.52 million total permanent loan modifications for homeowners since 2007. More than 5.31 million of those loans were proprietary programs and 1,223,449 were completed via HAMP.

In the second quarter, approximately 81,000 short sales were recorded, bringing the total to more than 1.32 million since December 2009. When combining both loan modifications and short sales, the total number of permanent, non-foreclosure solutions was more than 7.84 million.

Second quarter numbers were at an estimated 329,000 foreclosure starts, compared to 472,000 during the previous quarter, a drop of more than 30%, and 527,000 in the second quarter of 2012, a decline of 38%.

Interestingly enough, completed foreclosures in the second quarter were approximately 158,000 compared to 162,000 for the first quarter, down 2%. In the second quarter of 2012, foreclosure sales were at 185,000, 15% above current numbers.

Short sale completions in the second quarter were an estimated 81,000 compared to 84,000 in the first quarter, a drop of 3%. Year-over-year, short sale completions were down 25% from 107,000 in the second quarter of 2012.

Month-over-month, foreclosure starts were estimated at 97,000 in June compared to 115,000 in May, down 16%. Foreclosure starts were estimated at 52,000 in June were down 8% from May’s 48,000. On a monthly basis, short sales completed dropped 7% from 28,000 in May to 26,000 in June.

Delinquencies of 60+ days remained unchanged in June at 2.22 million.

But numbers don’t tell the whole picture. It’s important to know why foreclosures are on the decline.

Daren Blomquist, vice president of RealtyTrac, believes many markets have finally worked their way through the large batch of bad loans originated during the housing bubble years.

“On top of this, as home prices have now bottomed out in most markets, that is helping to lift all boats and allow some homeowners to avoid foreclosure through refinancing or even the sale of their home,” said Blomquist.

“Lastly, the persistent foreclosure prevention efforts over the past few years have waged a war of attrition on the foreclosure problem, helping to keep a lid on foreclosure activity,” he added.

Blomquist noted that regulations could be playing a key role in keeping foreclosures from going through. “In some cases, state legislation has slowed foreclosure activity quite dramatically — above and beyond the natural slowing of foreclosure activity that was already occurring,” he said.

Blomquist mentioned the example of California, where the Homeowners Bill of Rights that took effect in January, causing a 60% drop in foreclosure starts in a single month. “The still-unanswered question with regulations like this, however, is are they actually preventing foreclosures in the long-term or are they delaying them to next year or beyond?”

But the decline in foreclosures is a positive sign for the housing market. “Rising prices have helped some people regain equity, giving them an escape hatch to avoid foreclosure, and also giving them hope to keep making payments, rather than just walking away via a strategic default,” Blomquist said.