The Obama Administration’s foreclosure mitigation programs continue to assist million of homeowners throughout the country as housing continues to bounce back from a crisis that left too many homeowners underwater.

Nonetheless, the government is staying cautious about issues in mortgage servicing. Delinquencies remain high, the Obama Administration’s scorecard revealed, especially when compared to historic levels.

“The Administration’s HAMP program has provided direct assistance to more than one million homeowners while creating standards that have helped millions more,” said Treasury Assistant Secretary for Financial Stability Tim Massad.

“HAMP was designed so that assistance would go to those homeowners most in need and that the modifications provided would be sustainable. Clearly without HAMP, national foreclosure rates would have been much higher and many borrowers would not have received the assistance they needed,” he added.

The Making Home Affordable Program has helped more than 1.7 million homeowners since it began in 2009, including more than 1.2 million permanent modifications via HAMP — a 39% savings from their previous payment. This compares to 1.6 million in last month’s scorecard.

The Federal Housing Administration had offered nearly 1.9 million loss mitigation and early delinquency interventions, continuing to encourage improved standards and processes in the servicing industry.

As of June, Hope Now lenders have offered families and individuals more than 3.7 million proprietary mortgage modifications.

Re-default data, released on a quarterly basis, revealed the performance of HAMP modifications continues to improve over time and payment relief is strongly correlated to sustainability.

Because of this, HAMP modifications continue to show lower delinquency and re-default rates than industry modifications as reported by the Office of the Comptroller of the Currency.

In June, nearly 112,000 second-lien modifications have been completed via the Second Lien Modification Program. Also, approximately 170,000 homeowners have exited their homes through a short sale or deed-in-lieu of foreclosure with help from the Home Affordable Foreclosure Alternatives Program.

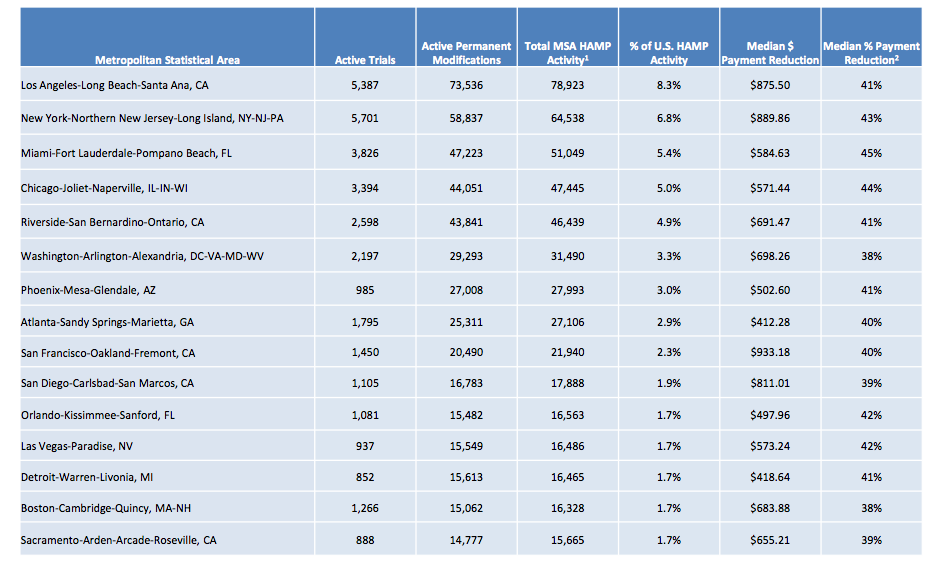

The 15 metropolitan areas with the highest HAMP activity included Los Angeles-Long Beach-Santa Ana, Calif.; New York-Northern New Jersey-Long Island, NY-NJ-PA; Miami-Fort Lauderdale-Pompano Beach, Fla.; and Chicago-Joliet-Naperville, IL-IN-WI.

Since the Making Home Affordable Programs began nearly four years ago, the Treasury has required participating servicers to take specific action to improve their processes through ongoing reviews.

Bank of America (BAC), Citi Mortgage (C) and JP Morgan Chase (JPM) were the top three servicers for June.