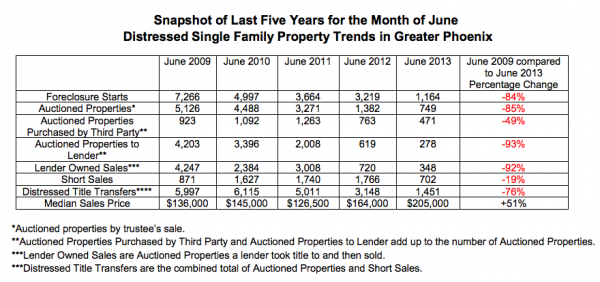

Lenders took title to 4,203 single-family properties at foreclosure auctions in Phoenix back in 2009. Fast forward to June 2013, and that number has plummeted to 278.

There are still advertisements saying thousands of lender-owned properties are going to flood the market, just not the Greater Phoenix market. Sure, there was a flood of cheap properties at one point in time, but that time has passed.

Four years ago, in 2009, 86,315 single-family properties in Greater Phoenix went into the foreclosure process leading to a property dumping. In the first six months of 2013, only 8,776 properties went into foreclosure.

Although the distressed property market will be with Greater Phoenix for a while, it will be very mild in comparison to where the sand state was.

A report put together by Fletcher Wilcox, a real estate analyst at Grand Canyon Title Agency, compares seven distressed property categories for the last five years, for the month of June as well as quarterly since 2009.

Rising home values and improving job numbers have pushed all seven distressed categories down. In June 2013, the median single-family sales price was $205,000, compared to $164,000 in June 2012. This represents a 25% annual increase.

In May 2013, Greater Phoenix reported 95,900 more non-farm jobs than two years prior in May 2010. Early on in the real estate recession, Greater Phoenix made it through the foreclosure mess quicker than many states did as Arizona allows for a non-judicial process as opposed to a judicial process, which typically takes longer to complete a foreclosure.

Wilcox, who is from Arizona, told HousingWire, "Looking at these numbers, it’s a shocking difference compared to where we were."

According to Fletcher, back in 2007 there were only six single-family homes in Greater Phoenix that sold for less than $50,000. In 2009, that number has spiked to 7,724.

However, once foreclosure notices started to slow, the number of lender-owned auctions followed suit, and home values started to pick back up.

Fletcher said the median single-family sales price, which was recorded at $205,000 in June, was up from $200,000 in April. "Running the data yesterday for the first part of July, it's at about $210,000," added Fletcher. "Although that could go up or that could go down."

For now, however, it seems that the sand state has made quite the turnaround from four years ago. It will be interesting to see whether sales and home values will be affected as rates continue to rise.