As the industry gears up for the spring home-buying season, first-time homebuyers are once again stuck trying to gauge exactly how affordable their market is, along with if it’s even one they are able to jump into.

Experts recently weighed in on what this year’s housing market will look like, projecting another year of extremely tight inventory and rising interest rates, which doesn’t paint a positive picture for first-time homebuyers.

But not all markets are created equal, and this new report from Bankrate shows what markets are ideal for Millennials, who make up the majority of first-time homebuyers.

And of course, there are the states that rank at the bottom of the list, making up the worst markets for first-time homebuyers.

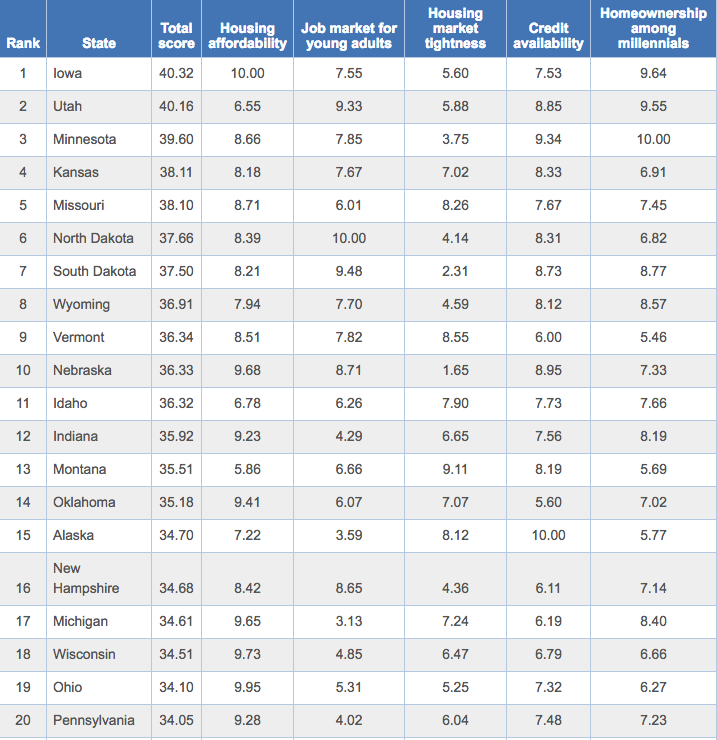

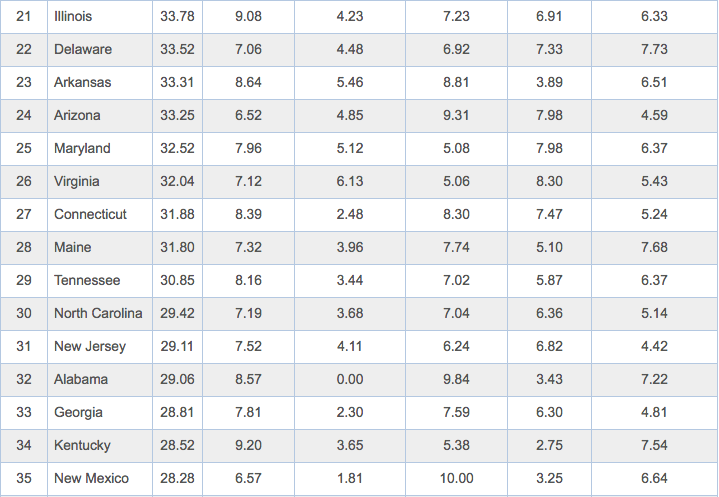

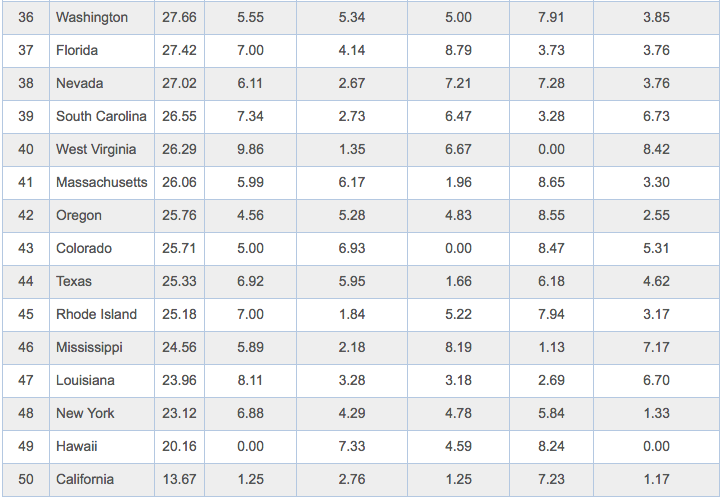

The chart below, which includes all 50 states, ranks the toughest and easiest states for first-time homebuyers based on five key measures:

- Housing affordability

- The job market for young adults

- Housing market tightness

- Credit availability

- Homeownership among the under-35 crowd

Following the chart below, there will be a more thorough explanation of the different ranking methodologies. The five different methodologies are important since even though a state ranked low overall, it still could have a higher ranking in at least one methodology.

The chart shows the five different measures, along with an overall score.

Click to enlarge

(Source: Bankrate)

1. Affordability

Affordability is a huge issue for first-time buyers, especially in states with large and growing metro areas, says Rolf Pendall, co-director of the Metropolitan Housing and Communities Policy Center at the Urban Institute.

According to Bankrate, principal and interest payments in the least affordable states consumed more than a third of household income, versus just 13 percent in the most affordable states.

- Top three states for affordability: Iowa, Ohio, West Virginia

- Bottom three: Hawaii, California, Oregon

2. Credit availability

To find out how access to home financing varies across states, Bankrate looked at data from millions of mortgage applications available under the Home Mortgage Disclosure Act.

- Top three states for credit availability: Alaska, Minnesota, Nebraska.

- Bottom three: West Virginia, Mississippi, Louisiana.

3. Job market

Bankrate analyzed the 2016 government employment data, giving states with low unemployment rates for workers in the prime first-time homebuyer demographic of 25-34 the highest marks.

- Top three states for 25-34 employment: North Dakota, South Dakota, Utah.

- Bottom three: Alabama, West Virginia, New Mexico.

4. Housing market tightness

When there’s an inventory shortage, it typically makes it difficult for first-time homebuyers to jump in. Bankrate analyzed Census data to calculate how tight the housing market is.

- Three states with least tight housing markets: Alaska, Vermont, New Mexico.

- Three tightest: Colorado, California, Texas.

5. Homeownership among the under-35 crowd

This last measure looks at how many other Millennials have already successful purchased a home. Using Census data one again, Bankrate calculated the percentage of households under 35 living in owner-occupied housing.

- Top three states for millennial homeowners: Minnesota, Iowa, Utah.

- Bottom three: Hawaii, California, New York.