Although I had pockets of joy in 2020, these moments were subsumed in a haze of stress, uncertainty and fear for our country. And, at times, I have found it difficult to keep these emotions from clouding my economic thinking. But despite all the sorrow and frustrations of this year, I have found solace in the immortal world of math, facts and data. From this stronghold I have been able to see past the chaos and view the economy and the 2021 housing market through the lens of my core economic principles.

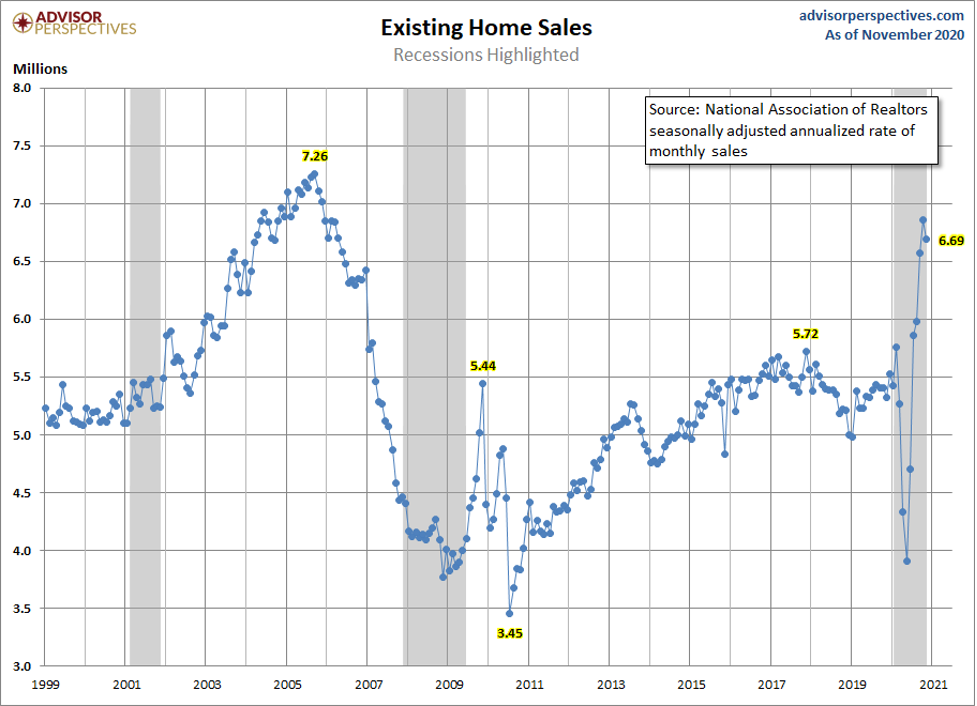

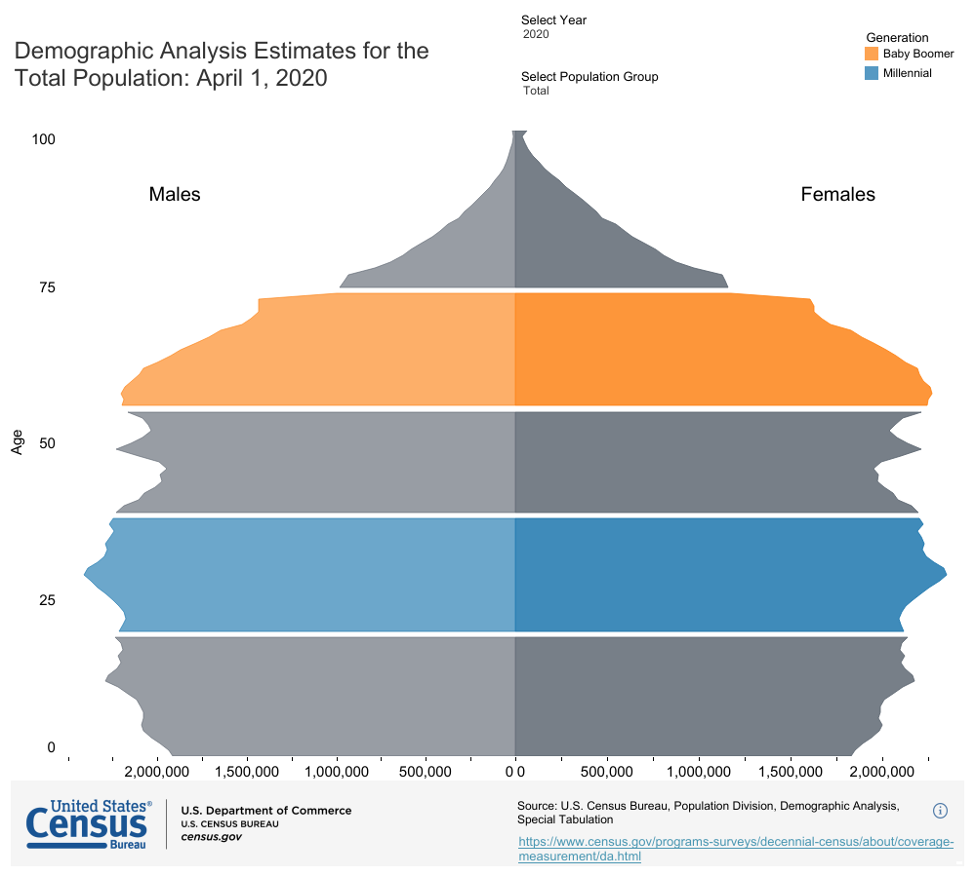

One of those key principles is that demographics power the economy. In 2020, the U.S. entered into a period of the best demographics for housing ever recorded. I have long held that because of the favorable demographics, the years 2020-2024 would be a period when housing could outperform other economic sectors. During these years, total home sales should get to 6.2 million or higher.

Of course, having your housing thesis tested by COVID-19 could bring chaos theory into the equation. On April 7, I published a HousingWire article that put forth an economic model that described economic and COVID-19 data lines — with certain key dates — that would show that the American economy was back on track. In an article published on Dec. 9, I described how each of those data lines had been passed: COVID fought the law of demographics and the law won.

We need to remember that the economic data was getting better going into this crisis. Housing data, in particular, was robust in February of 2020, right before the first wave of stay-at-home mandates and the fear of virus took hold of the economy. Today, we expect total home sales for 2020 to be over 6.2 million, my number for an outperforming market. We’ve come a long way, folks. With more disaster relief, two vaccines being administered and more in the works, we do see the light at the end of the tunnel. Here’s what I think that means for the 2021 housing market.

The 10-year yield and mortgage rates

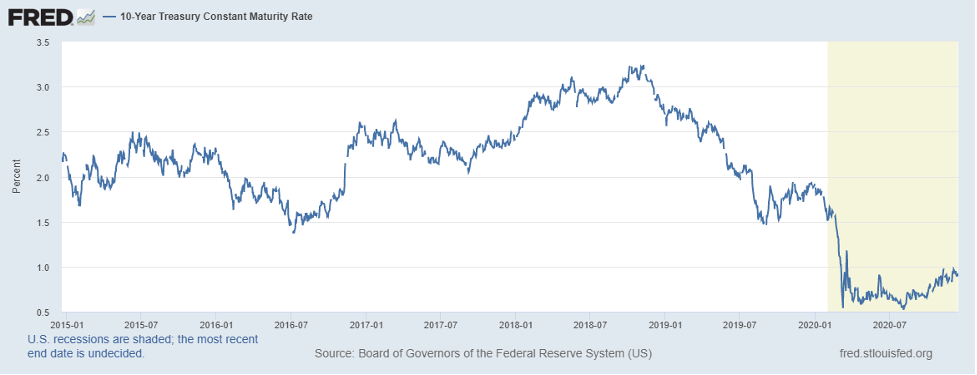

In 2015, I made my first bond yield forecast for the coming year. predicting that the 10-year yield would be in a range of 1.60%-3%, and as such mortgage rates would be in range of 3.5%-4.75%. From 2015 to 2020, I’ve made the exact same forecast, and for the most part, over the years, this range has held.

In 2019, after the inverted yield curve event, I talked about how critical it was for the bond market to trade 1.94% because that would show the U.S. economy would grow faster in 2020 then 2019. But it never got above that level.

In 2020, when the risks to the economy associated with the COVID-19 pandemic became more apparent, I predicted that recession yields in America would be in the range of -0.21% to 0.62%. The 10-yield traded as low as 0.32% but for most of 2020 traded above 0.62%, indicating to me that the bond market had confidence in the future economy.

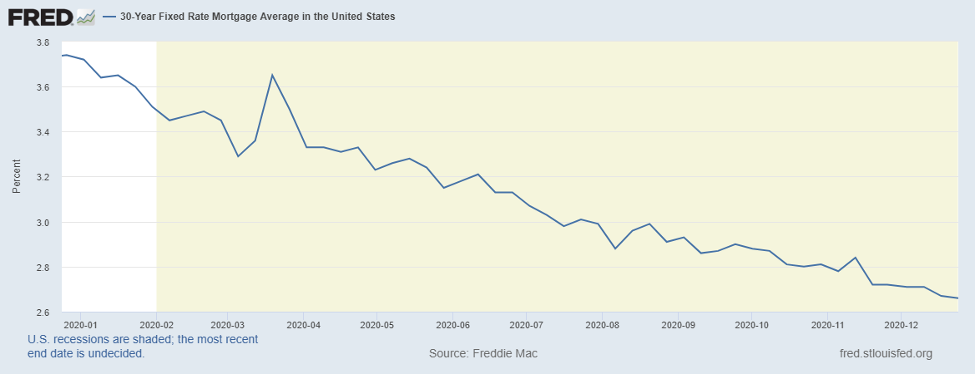

Mortgage rates never got priced correctly during this crisis. External factors, such as the mortgage market meltdown in March, kept mortgage rates higher than they should have been based on the 10-year yield. On social media I discussed how mortgage rate pricing would get better after Sept. 30 as these external risks faded, and that has occurred recently. Even though the 10-year yield has been rising since August, mortgage rates are just catching up to correct pricing.

For the housing market in 2021, the range in the 10-year yield will be between 0.62% and 1.94%, but consider these caveats.

We have a lot of headline risk early in the year that could drive rates lower. For one, the stock market hasn’t had a noticeable 10% plus correction since early 2020. For my 2020 forecast published in December 2019, I said that if we get headline drama, which will take dollars from stocks into bonds, don’t ignore the bottom range of my 10-year yield forecast. So don’t just assume we have clear path to higher yields. If bond yields do test the low level of my range, look for mortgage rates to be between 2.25% to 2.375%. There will always be the risk that non-economic headlines will create fear in the markets.

Mortgage rates should rise over the year as the economy achieves better footing. As more and more people get vaccinated and COVID hospitalizations fall, we can expect an improved employment picture. A high-level range for mortgage rates should be between 3.375% and 3.625%. For my AB economic model, I said we should see the 10-year yield get to 1% in 2020 as the economic data got better. The highest print so far recently has been 0.99%.

For the 2021 housing market, I would like to see the 10-year yield in the range of 1.33% to 1.60%. If we accelerate vaccinations and provide disaster relief as part of a year-long economic recovery plan, then getting to 1.33% and higher is achievable. I would be terribly disappointed if we didn’t see 1.33% on the 10-year yield in 2021.

Now, if the economy takes off to an even greater extent than anticipated, we could see a 10-year yield as high as 1.94%. This would be extremely bullish for the economy but would also impact the 2021 housing market. This would be a good problem to have. Even with this, though, I can’t see mortgage rates going over 4% or the 10-year yield above 2% while dealing with COVID-19.

Existing-home sales

Based just on February’s report, we should have ended the year with existing home sales between 5,710,000 and 5,840,000, but COVID-19 messed up all the data lines. The housing market froze in the early weeks of COVID-19 and then rebounded to a “too-hot” market.

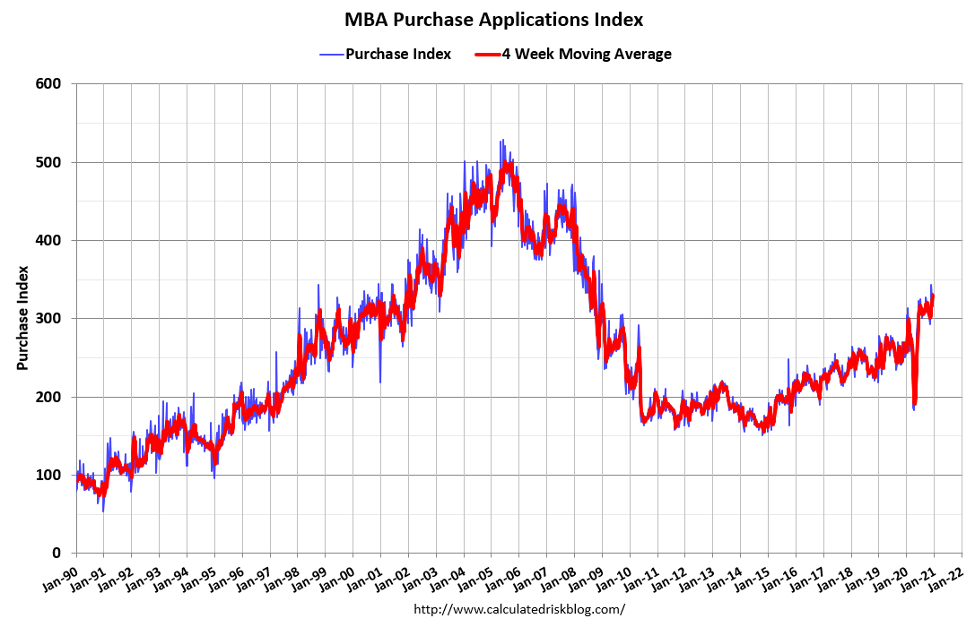

Purchase applications, a forward looking metric for existing home sales, had 10% year-over-year growth up until March 18. Then we had nine negative year-over-year prints followed by 31 straight weeks of over 20% growth, year over year.

The housing data has not moderated back to trend yet, but it will happen. This is a good thing, so don’t overreact to declines in the sales data such as we saw in the recent new home sales report.

We can expect the prints following the recent very high existing home sales print to be lower, even below 6.2 million, as the data starts to normalize. This can be considered normal market behavior following a deep freeze and a too-hot rebound. We are still making up for lost ground as we are not yet in the range of 5,7100,000 to 5,840,000 in sales for 2020 with only one report left. Existing home sales were flat in 2019, at roughly 5.3 million. If we reach 5.84 million in 2020 that will be the biggest jump in sales in the past many years

However, don’t think of housing as a boom in sales. Think instead that the sector will have a healthy supply of replacement buyers each year. Then you add move-up, move-down, and cash buyers into the mix, you have stable demand. If mortgage rates stay low, sales will grow for the 2021 housing market. I use the term replacement buyers to reinforce the idea that during the years 2020-2024, we have a lot of Millennials, and they need somewhere to live.

New home sales and housing starts

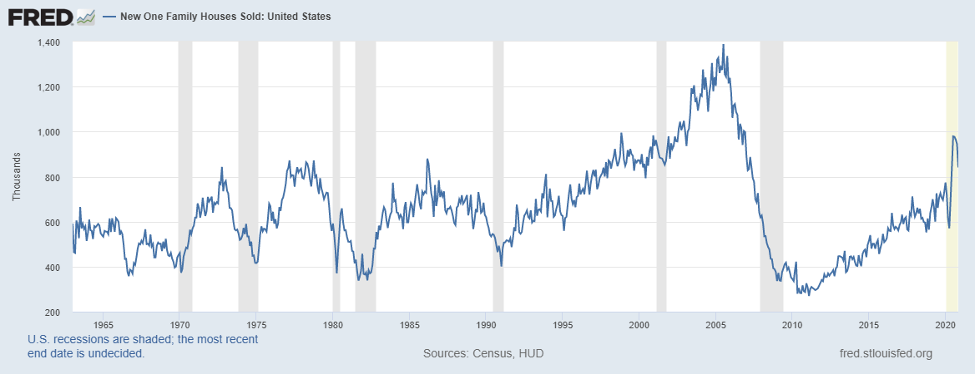

Like existing home sales, the new home sales sector started strong in 2020. New home sales showed solid demand early in the year because demographics were improving for housing and the new home sales sector benefits the most from lower mortgage rates. Similar to other housing metrics, this sector froze during the shutdown period then had a parabolic rebound in sales, which will moderate to a more normal trend.

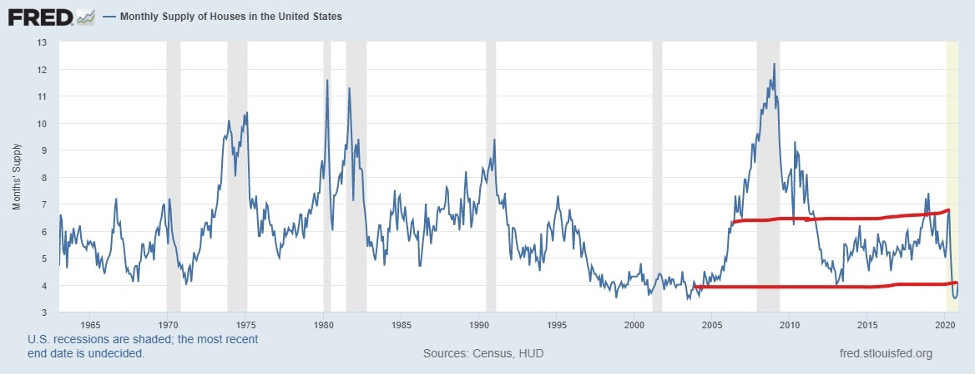

The best metric to anticipate new home builder behavior is the monthly supply. When monthly supply is 6.5 months and higher, builders take this as an indicator of weak demand and will pull back from construction until the supply dwindles. We saw this in 2018 and 2020. When supply is between 4.4 and 6.4 months, builders feel OK enough to build. In 2020, monthly supply levels broke under 4.3 months, which is where it should be when demand is really good, something we didn’t really achieve in the years 2008-2019.

Having said that, we should see some growth in new home sales in 2021, but we need to be mindful of the effect of higher mortgage rates, should this happen. New home sales compete the best in a declining mortgage rate environment. When rates rise, the existing home sales market offers more affordable options to the buyer.

Because the previous economic cycle had the weakest new home sales ever, sales have room to grow, but keep in mind the factors that have the potential to limit this growth. We will see a modest 5.1%-6.2% growth in this sector, so don’t expect to be blown away. Remember to keep an eye out on higher yields and supply in this sector.

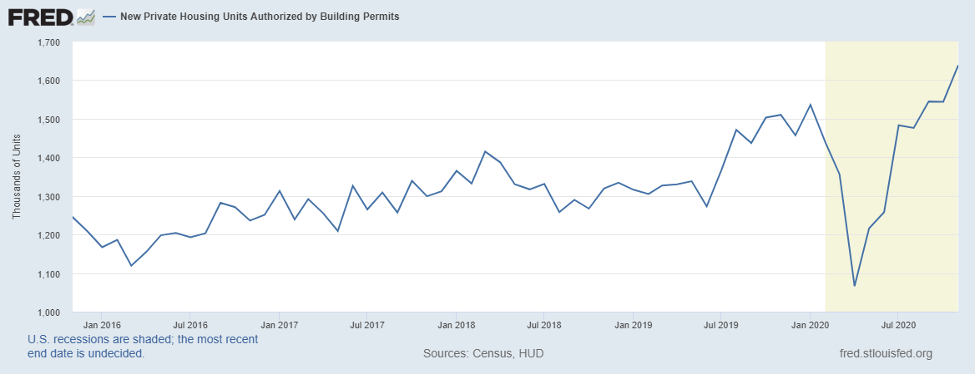

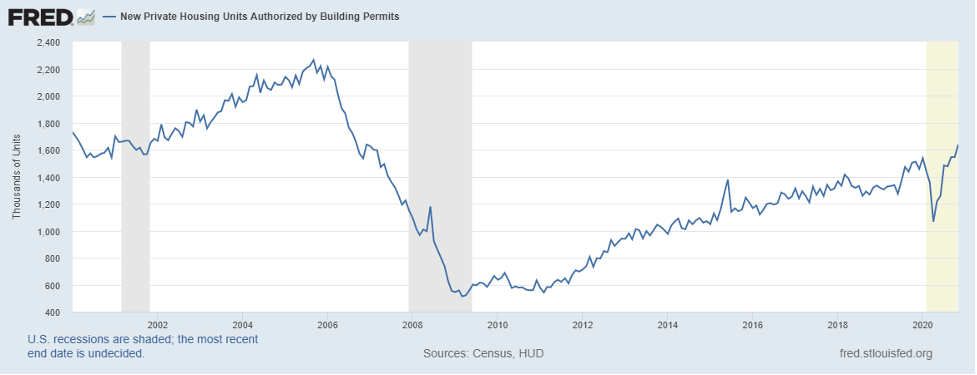

Housing starts showed a similar pattern in 2020. In February, we had nearly 40% growth in starts compared to the same month last year. As monthly supply went over 6.5 months, housing starts fell, but quickly rebounded like all housing data. As long as new home sales grow and inventory stays low, this sector has legs for slow and steady growth as it also came from the weakest housing start expansion ever in years 2008-2019.

In the previous expansion, multifamily starts buoyed up this sector. At this stage of the housing cycle, though, it’s all about single-family homes. Only a targeted, deficit-financed stimulus plan to build homes can boost housing starts to any significant level that could impact inventory, and that is not going to happen, as I wrote about recently on HousingWire.

Home prices

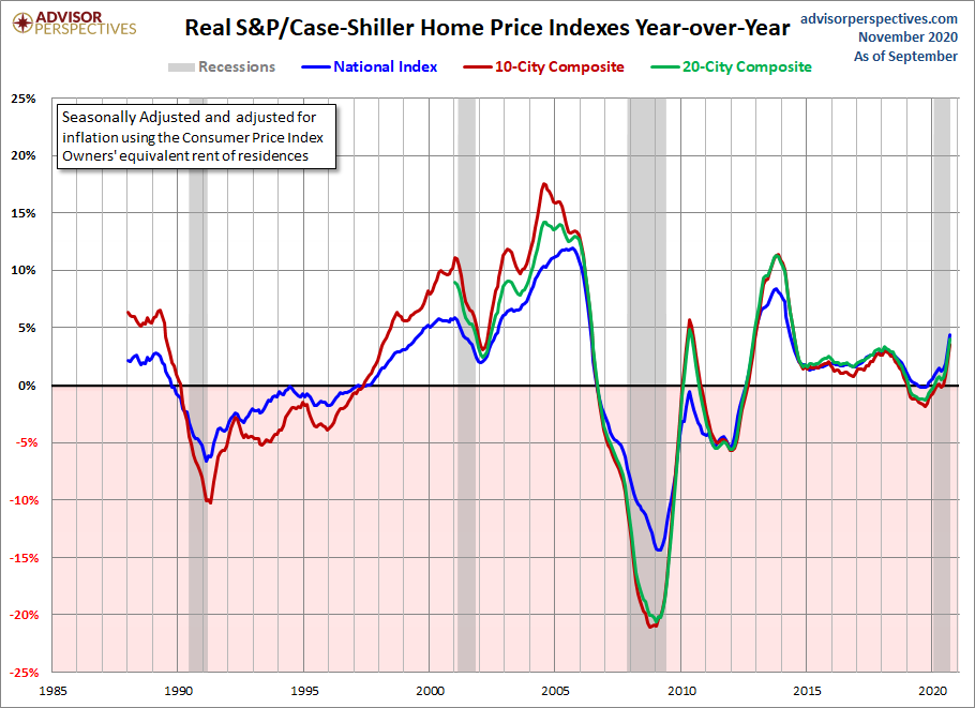

My biggest fear for the housing market in the years 2020-2024 was that real home price growth would be too strong. When you have the best housing demographic patch ever recorded in history occurring at the same time as the lowest mortgage rates ever, with housing tenure doubling in the last 12 years, it’s the perfect storm for unhealthy price growth.

When I talk about real home-price growth being too strong, I mean nominal home price growth above 4.6% each year during this five-year period. I believe if this happens it won’t be a positive for the housing market. The COVID crisis has kept mortgage rates abnormally low because the rest of the economy is not performing as well as the housing market. I expect forbearance plans will be extended for the entire year of 2021. This means that foreclosures have more to do with pre-COVID-19 backlog than homeowners distressed by COVID.

The only hope we have for cooling home price is higher mortgage rates and we need the economy to recover more fully before that will happen. I do expect to see inventory increase for the 2021 housing market, but because inventory is currently so low, that isn’t saying much.

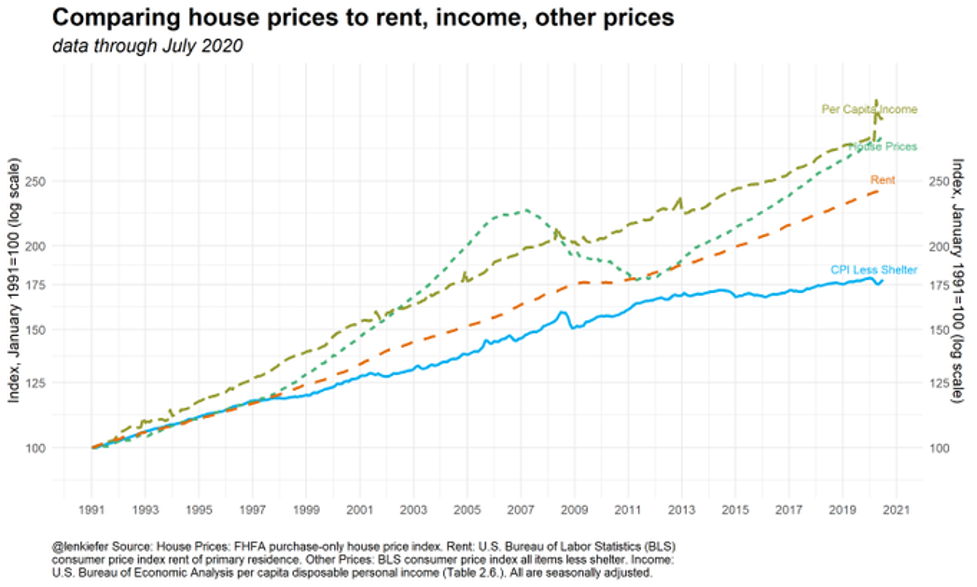

If nominal home price growth stayed in the range of 0.1% to 4.5%%, it is manageable. Above that level for a number of years now can be problematic later on. As you can see below from economist Len Kiefer at Freddie Mac, we are getting to the point where home prices surpass per capita income. The last time we breached above this level was back in 2002.

Home price growth in 2021 looks to be trending more in the range of 4.3% to 6.2%, assuming some increase in mortgage rates. In 2019, real home prices went negative and I cheered and wrote how healthy that was. I will be rooting for the same in 2021, but it’s harder to see that reality with mortgage rates this low and forbearance most likely going to be offered for the entire year.

The X factor for housing

Housing tenure has doubled from five years in the years 1985-2007 to 10 years currently. In part because we have built bigger and bigger homes for decades, many families have no need to “move up.” Before COVID-19, I believed that in the coming decade we would start to shrink housing tenure because homeowners had better financial profiles than the previous decade and thus would be more capable of moving up if they desired a bigger or more luxurious home.

But the COVID crisis has changed the world of housing. If the work-from-home model becomes more widely adopted, we could see more movement happen from higher-priced areas to more affordable areas. We can see more housing sales that would not have occurred without this work-at-home model. These moves may not even be to a different state – just to areas outside of expensive urban centers to more affordable surroundings.

Whether this is a real sociological trend or just a temporary flight of fancy, only time will tell. This is something we need to keep an eye on for 2021 housing — as possibly one of the most exciting things to happen the U.S. housing market since…forever. I caution, however, to be careful about believing in major changes that happen in a crisis.

Economy

The 10-year yield above 0.62% is good indicator for the economy that things will be ok. If the 10-years falls below this level due to a negative headline, then it should bounce back relatively quickly. The main goal for the economy is to see the 10-year yield get to 1.33%. We should be able to get there at some point this year. If not, then we are not providing enough disaster relief or vaccinating enough people.

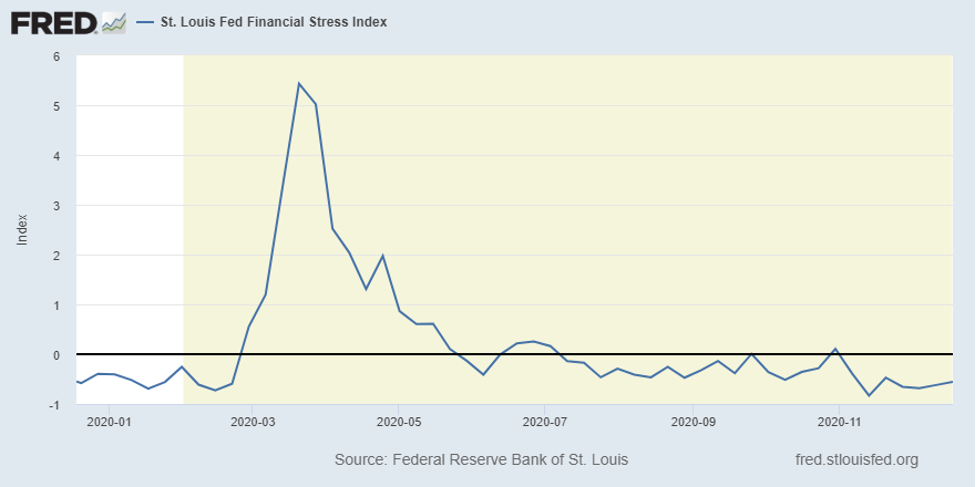

Also, keep your eye on the St. Louis Financial Stress Index. As long as this index stays below 1.21%, we should be fine in 2021. Staying below zero runs in line with an expanding economy and we have stayed below zero for the most part in the last seven months.

Once we are free of the virus, the big things that gave us the strong expansionary economic data in January and February of 2020 will get us through. Good demographics, low interest rates, low energy prices, low inflation and solid consumer balance sheets will all conspire to lead us through this dark tunnel into the light in 2021. We still have a lot work to do as a country, but we can do this together; that is always when we perform the best.

“Hope smiles from the threshold of the year to come, whispering ‘it will be happier’…”

― Alfred Lord Tennyson

Logan

Your insghts are on point and invaluable

Thank you for sharing your intelligence

Robert

Great insights Logan, thanks!

Wow, Logan. This is the full picture. Great article!