[Editor’s note: As of November 2022, we no longer use Slack, and we’re happy to share that we’ve moved to Circle for our new community platform. We will be continuing Q&As, live discussions and more in this new community platform. If you’re a member and not a part of our Circle community yet, you can click the link at the end of the article to join.]

The following Q&A comes from the HW+ exclusive Slack channel, where HousingWire Senior Mortgage Reporter Georgia Kromrei answered questions about what is happening with federal regulators. During the Q&A, Kromrei discusses the steady flow of changes at the federal level and how it shows just how big of a priority housing regulation is with the Biden administration.

So much has happened that it has us asking, “What on earth is happening with the federal regulators?”

The following Q&A has been lightly edited for length and clarity.

HousingWire: To begin, how has the Federal Housing Finance Agency’s strategy changed from the previous administration?

Georgia Kromrei: I’ll answer it in two parts: What can we tell from the outside looking in, and what do we know about what’s happening on the inside?

So, it may be obvious to some — the previous administration at the FHFA was really all about reducing the footprint of the GSEs in the market, period.

The previous FHFA administration also took actions that were abrupt, and sometimes out of step with the mortgage industry — even bewildering, to some. The adverse market fee is a good example. At the time, some people said, “Hey, why are the GSEs charging an adverse market fee if they’re currently making money hand-over-fist?” The GSEs actually have performed really well despite the pandemic.

So, clearly, from what we’ve seen over the last two months, the FHFA under Acting Director Sandra Thompson is quite different.

Thompson appears to be more focused on the mission part of the GSEs’ role. We know that because of her public statements, her statements at listening sessions with industry stakeholders and because of actions. We’ll get to those actions a little later.

So, that’s the public part! The other part – what’s going on on the inside at FHFA – may be just as impactful in the long run.

Sources say that Thompson is quite interested in getting feedback from the housing industry. She wants to know what’s going on on the ground. She has gone on a listening tour with stakeholders and held several meetings with industry groups we know about so far. She is interested in listening to the industry — and that is a big difference.

HousingWire: What are some of the immediate challenges the FHFA is facing, after its change in leadership?

Georgia Kromrei: So, I wouldn’t necessarily say that FHFA is putting out fires now after the past couple of years … although some I have spoken to have used that metaphor! I would say right now FHFA seems to be focused on undoing some of the actions the last administration took — the adverse market fee was definitely a big one, and something the industry really welcomed.

There’s a limit to what they can do, and how quickly, but I’ll say more on that later. Another challenge FHFA has to confront — and it may be too soon to tell how successful it will be — is improving morale at the GSEs to address the “brain drain” that Fannie Mae, in particular, has experienced. There are some positive signs on that front. Some GSE sources have told me that moves such as the on-time rental payment change to Fannie Mae’s underwriting made a difference.

The issue is partly one of salary — GSE executive salaries are capped — but also one of mission. People will take a pay cut if they feel their work is meaningful and interesting. The word I keep hearing people use to describe the previous FHFA administration’s effect on the GSEs is “stifling.” We’ll see if FHFA can turn that ship around.

HW+ Member: On the affordability front, how much of a change are the new affordability goals from the previous benchmarks? Will meeting them pose much of a challenge for the GSE’s?

Georgia Kromrei: So, this is another recent announcement that the industry is still parsing. FHFA sets goals for Fannie and Freddie — not on an annual basis, but for several years at a time.

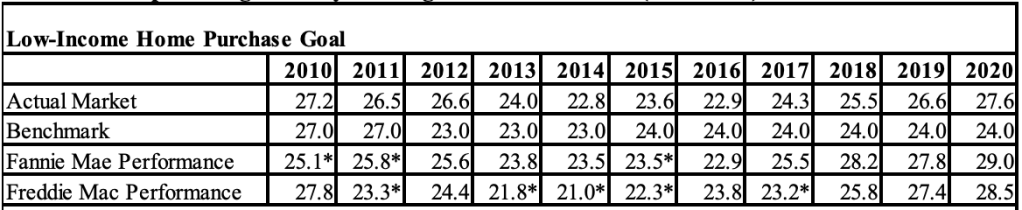

The FHFA’s new proposed affordability goals made a couple of new categories for loans in low-income and minority census tracts. But to answer the question of how hard it will be for the GSEs to make those goals… let’s take a look at their track record! This is from the FHFA’s report on the GSEs housing goals performance from 2010-2020, and we’re just looking at the low-income purchase goals:

HW+ Member: I believe the new administration is more focused on dealing with lower-income households; the problem with affordability is that the concept is flawed due to the household income being the primary factor of the affordability. One way to deal with this isn’t through market forces but to assist in any financial way possible to obtain that fixed debt payment.

The previous crew wanted to destroy the entire housing economic system based on a Mad Max libertarian view of economics. The irony was that the GSE’s were excellent during the pandemic because they weren’t publicly traded companies. So, we have two different planets now at the FHFA

Georgia Kromrei: Another thing I want to point out about the GSEs affordability goals, is that they sometimes lead the market, but sometimes they trail it. It becomes even murkier, however, since the GSEs are obviously not neutral participants in the market — their conduct, in large part, determines the market! So it’s a little bit of a chicken and egg question

HousingWire: Regarding the recently announced inclusion of on-time rental payments in Fannie Mae’s underwriting… why would the FHFA do this — isn’t this a return to the days of irresponsibly expanding access to credit with risky underwriting?

Georgia Kromrei: It’s a fair question. It’s one that many people have asked since FHFA announced that Fannie Mae would factor in on-time rental payments to their underwriting process. It’s a topic that requires a lot of sensitivity but I think it’s important to note how fragmented and diverse the rental market is. Some landlords may own many, many thousands of units, and have a super-slick online rental payment system that automatically reports the paid rent to the credit reporting bureaus.

But there are certainly many people who pay their rent to a “mom and pop landlord” — a person they know — by mailing a paper check, money order, or cash. It really runs the gamut. And what if the landlord is on vacation for three weeks, and cashes a check late? It is also common practice in tenant-landlord legal disputes to hold on to rent checks. So part of the reason that Fannie isn’t penalizing people for lack of on-time rent payments is operational.

But the other part is simple — it’s not that someone who has missed payments will get credit for on-time payments. They just won’t be penalized for late or missed payments. It’s a one-way calculation: If you have the track record, it counts in your favor. If you don’t, it doesn’t.

HW+ Member: To me, allowing the rent payments is one of the easiest ways to open the credit box a little. To Logan’s point, it’s not going to change the overall creditworthiness of a person. There has to be something done if we want to change the calculus for under-served populations.

Georgia Kromrei: According to Fannie Mae research, with this change, 20% more potential borrowers would have qualified!

HousingWire: To add on, how did the agreement between HUD and FHFA on fair lending expand HUD’s oversight powers for the GSEs?

Georgia Kromrei: So, if you blinked you may have missed it … but just this month, HUD and FHFA signed a memo of understanding that formalizes an agreement to share information and cooperate on fair lending investigations and enforcement.

Here’s the moment of the signing:

HW+ Member: To add on, how did the agreement between HUD and FHFA on fair lending expand HUD’s oversight powers for the GSEs? To me, this was a clear sign that HUD has more clout under this administration than in previous administrations

Georgia Kromrei: There are two major camps on what this means! There are some who say, this is not their first rodeo, and this MOU doesn’t mean all that much. And they do have a point. The MOU did not change the law – and HUD has always had broad oversight over questions of fair lending.

That’s a good point! You might say, “Wait! Fair lending is for lenders …. and the GSEs don’t originate loans.” And you would be right! HOWEVER!

Sources at the GSEs tell me that adjustments to their underwriting engines must be approved not only by FHFA but by HUD — to make sure they don’t cause disparate impact

HW+ Member: Any rumors about further amendments to the PSPA’s?

Georgia Kromrei: I have heard from industry stakeholders that the FHFA understands their concerns about the loan caps in the PSPAs. I certainly can’t say whether or not the FHFA wants to change the PSPAs, though. They have not answered my questions on that one. However — even if they wanted to — they’re limited in what they could do.

As you know, the PSPA is this long-standing, complex legal contract with the Treasury … and my sources say that the Treasury definitely has other things it is worrying about right now. So it may not be their first priority. (They may be more focused on dealing with the mess that is the rental assistance program) particularly for the caps on higher-risk loans, if that isn’t changed by 2022, it could cause a real pinch for the GSEs.

On the one hand, FHFA is telling them to buy more affordable loans. On the other, they’re telling them to limit their purchases of higher-risk loans. But some sources say they expect FHFA will get that change done before year-end. Is that wishful thinking? Maybe!

HousingWire: Final bonus question — there’s a lot federal regulators can do to make changes in the housing market using the tools they already have. But in the single-family market, probably the biggest hurdle to clear is the lack of inventory and surging home prices. What proposals are on the table to address those issues?

Georgia Kromrei: Thanks for the question! I hate to be a wet blanket … but, unfortunately, I don’t see much on the table to address inventory and high prices in a big way. There is some funding for affordable housing in the second infrastructure package – but that has a long road ahead before passage.

And even if there were to be a big push to build houses … there is a dramatic lack of building trades workers. It also takes a long time to train people for those skilled jobs.

Take full advantage of your HW+ membership and join our exclusive Circle platform dedicated only to HW+ Members! To join the community, go here.