Last year, the market’s wish for record-setting volume was granted – but at a cost. The only way to capture that volume was to hire, hire and then hire some more. Outsourcers were at capacity and talent pools quickly drained. Those available were able to command record-setting compensation. Mortgage lenders had no choice but to throw money at this problem, which is neither sustainable nor profitable.

Now, as the volume slacks, mortgage lenders are reassessing their cost structure. A big issue is the cost of underwriting, which has escalated dramatically both in total expense and as a cost per loan. Based on 2020, many mortgage lenders are now exploring technology. More specifically, how technology could leave them less exposed to excessive underwriting costs and make them “market ready” for any volume.

Don’t blame the robots

Over the last several years, robotic process automation (RPAs) were hailed as holy grail solutions that would automate mortgage manufacturing. While there was a lift in some areas, there wasn’t much change among underwriting that brought a significant economic benefit.

But don’t blame the robots. RPAs are rigid and designed to handle repeatable tasks. The type of tasks conducted the same way every time, without exception. They were not built to be dynamic or adaptive – think auto assembly line.

The unpredictable nature of underwriting requires dynamic adaptability to pivot when the introduction of new data changes a previous conclusion of risk assessment. That means RPAs can’t manage credit risk, underwrite a loan or significantly decrease the exposure to excessive underwriting costs.

Because it’s unpredictable, underwriting can’t be broken down into a set of predetermined tasks. That’s because the information from 1003 documents and other data in aggregate is always 100% unique to every loan. Even when borrower scenarios are apples to apples.

Net-net: you can’t rely on robots and expect them to be dynamic.

Optimization: the big picture

As mortgage lenders take a good hard look at potential robots and technology solutions, they first must identify the many complex layers of risk the solution should address. This risk stems from the inability to automate processes, coupled with the reliance on expensive resources. This layered risk can be identified in manufacturing efficiency, eligibility optimization and portfolio optimization.

“Getting at that micro-level data is critical to making faster, more thoughtful decisions on workflow.”

Elijah Pallante, SVP Enterprise Innovation LoanDepot

Mortgage lenders seek a solution that can both reduce absolute human dependency and harvest the rich loan manufacturing data necessary to inform future process innovations. This dream machine would close these gaps and enable the development of future solutions to address tomorrow’s challenges.

The machine that’s coming for the robots

Only an Expert System can handle layered, complex and unpredictable problems like those presented in underwriting. An Expert System is built using a form of AI called knowledge engineering. In short, an Expert System simulates the decision-making ability and high-level cognitive tasks of human experts. It takes years to build an Expert System because it transcends basic software development.

Instead, knowledge engineering requires extensive, painstakingly detailed information gathering from domain experts. This includes: insights, reasoning, domain expertise and expert knowledge. Then, highly technical expert knowledge engineers will determine important concepts, such as taxonomy, semantics and hierarchy, and create correct and efficient representations of the complexities in the domain.

Consider a medical diagnostic software platform. It wasn’t software developers that decided what the next symptom question or diagnostic test should be to identify an illness. It’s the combined knowledge set of doctors of many disciplines. Imagine the time required just to gather that intelligence on every symptom a person may experience!

With that in mind, imagine the tens of thousands of micro-decisions made on any given data point on every single loan. Now, consider that those decisions are not made in a consistent manner from person to person.

This begs the question: What has been the barrier to incorporating Expert System technology that to diagnose and cure risk? The short answer is, it’s very hard to build.

Candor offers the only Expert System in the mortgage Industry

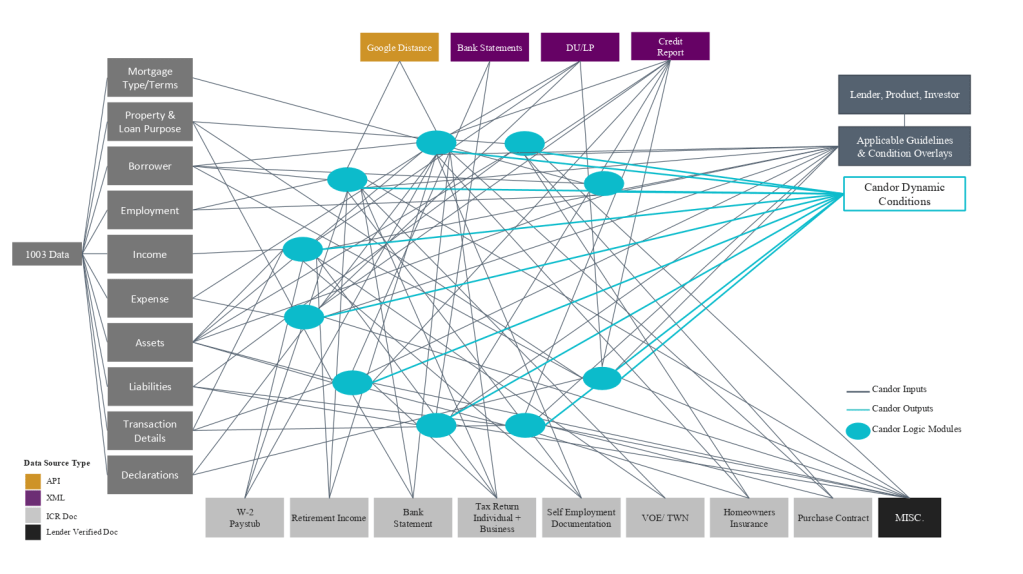

Candor’s patent-pending Loan Engineering System is an Expert System that is predicated upon that very AI technology known as knowledge engineering technology, which Candor has trademarked as CogniTech. CogniTech makes Candor’s underwriting engine dynamically adaptive to underwrite loans, manage risk and contain costs. This solution has taken more than four years to design and develop and has been built in close coordination with established, nationally known mortgage lenders who have played a fundamental role in getting LES to its current level of productivity.

The economic benefit to Candor’s clients has proven to be significant, including an 18.7 day reduction in cycle time.

It took a rocket scientist to bring an Expert System to mortgage

In the early part of his career, Candor CEO Tom Showalter was literally a rocket scientist. What do mortgage manufacturing and rocket science have in common? For starters, complex calculations, elaborate workflows, enormous risk and a zero-tolerance for errors. The most important requirement is the ability to immediately find a solution to resolve unpredictable and critical issues in real-time.

Tom is the architect of the company’s patent-pending Loan Engineering System and its underlying CogniTech Expert System Technology. CogniTech thinks through issues and resolves them in real-time, just like a seasoned underwriter.

A few highlights of Candor’s benefits:

- Move underwriting forward in the process

- Increase underwriter capacity to work highly complex files

- Receive directional, loan-specific conditions

- Information and Credit risk is assessed in a consistent manner

- The consumer receives complete requirements earlier in the process

- Faster time to surety: when the consumer knows he/she has a loan

- Qualifying loans are insured by a major carrier

“On loans we put through Candor, we’re close to 10 – 12 underwrites per underwriter a day. That keeps costs predictable no matter where volume levels are.”

Joh Gwin, COO American Financial Network

Candor is embedded in the LOS for “business as usual” implementation and adoption. No new systems or interfaces to learn.

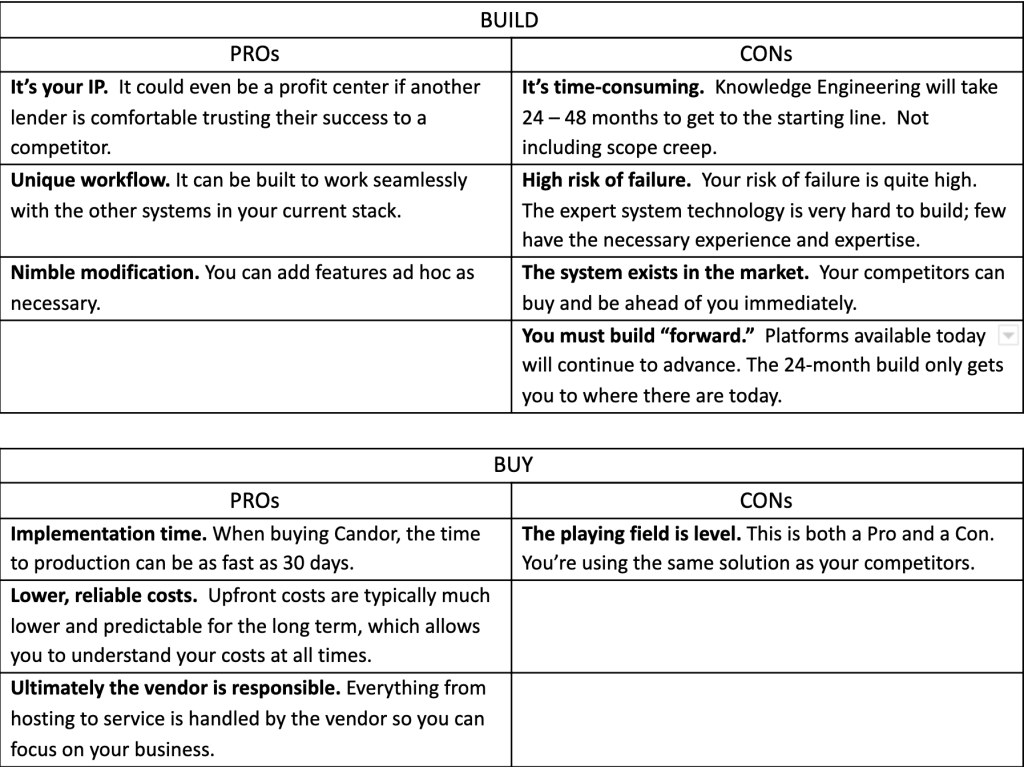

Build or buy an Expert System? The billion dollar question

While there are many drivers to this question, market speed to implementation is chief among them. Some mortgage lenders prefer a platform tailored specifically to their business, but at what cost? Losing a competitive foothold or market position makes purchasing a ready-to-use solution the natural choice regardless of the mortgage lender’s size.

Interesting note: A number of Candor’s early customers are mortgage lenders who tried and failed to develop a Candor-like solution. In turn, they joined Candor in a co-development process.

The bottom line

Be realistic about your chances of successfully developing a platform in new and complex technology. And, set expectations about ROI if you decide to send a robot to do a machine’s job.