There is no place like home. The nature of the crisis this year has emphasized that fact. Even though we love our family members, we all need our space. We expect housing demand and the housing market to remain quite strong in 2021 for those fortunate enough to work in industries that are currently shielded from job loss, while also being more amenable to remote work.

Mortgage rates are at record lows, and many households have realized they need more or different housing than was the case at the beginning of this troubled year.

That is why with robust demand for refinancing and home purchases through the end of this year, MBA forecasts mortgage originations to close out 2020 at more than $3.2 trillion – the most since 2003’s $3.8 trillion.

2020 has been one of the most challenging years in the history of our country. However, the real estate industry should be proud of how rapidly participants moved to ensure home sales transactions and refinancings could take place safely – and with minimal disruption. Our market truly has been one of the very few bright spots of the economic recovery. Millions of homeowners have saved money through refinancing, mortgage servicers have helped over 5 million homeowners stay in their home by offering forbearance, and following a sudden halt in the spring, home sales are booming.

What will the 2021 housing market bring?

Mortgage lenders are operating in a period of heightened uncertainty, given the still unknowable course of the pandemic, and a somewhat hesitant economic recovery. Given this uncertainty, business leaders in our industry – now more than ever – need to consider alternative scenarios in respect to the challenges and opportunities that will drive the pace of activity in the year ahead.

Our expectation is that 2021 will most likely be a year of a continued, but slow economic recovery, with a modest rise in mortgage rates, and the stubborn, ongoing housing market conundrum of inadequate supply in relation to demand. Home prices have risen more rapidly than incomes for years now, and the many challenges that have slowed homebuilding will continue to push home prices higher. The combination of these factors should lead to growth in purchase volume and a falloff in refinances.

Of course, this path presumes that an effective vaccine is being distributed next year, that another stimulus package is passed, and that both arrive in time to prevent a substantial increase in bankruptcies or other business failures.

This is by no means certain. If we take another step back with respect to the course of the pandemic, with tight lockdowns in place again, it could be very damaging for consumer and business confidence and could lead to severe scarring of the economy. This more pessimistic scenario would certainly result in rates staying lower for longer, and as a result would extend the current refinance wave. But all waves crest at some point, and we expect that even in this scenario, burnout would eventually lead to a drop in refinances. Furthermore, a severe and prolonged recession – or meager growth – would hit consumer confidence and likely hinder the purchase market.

The election certainly posed a number of significant uncertainties regarding the market and economic outlook. At this writing, it appears likely that the Democrats will maintain control of the House, and control of the Senate will be determined by a runoff election in Georgia, with President-elect Biden taking over the executive branch.

Regardless of which party takes over the Senate, the expectation is that there will eventually be another stimulus package to help households and businesses. Prior to the election, the possibility of a “Blue Wave,” with Democrat control of the government, raised expectations that there would be much higher levels of government spending, larger budget deficits, and higher interest rates. That would certainly have cut off the refinance wave more quickly.

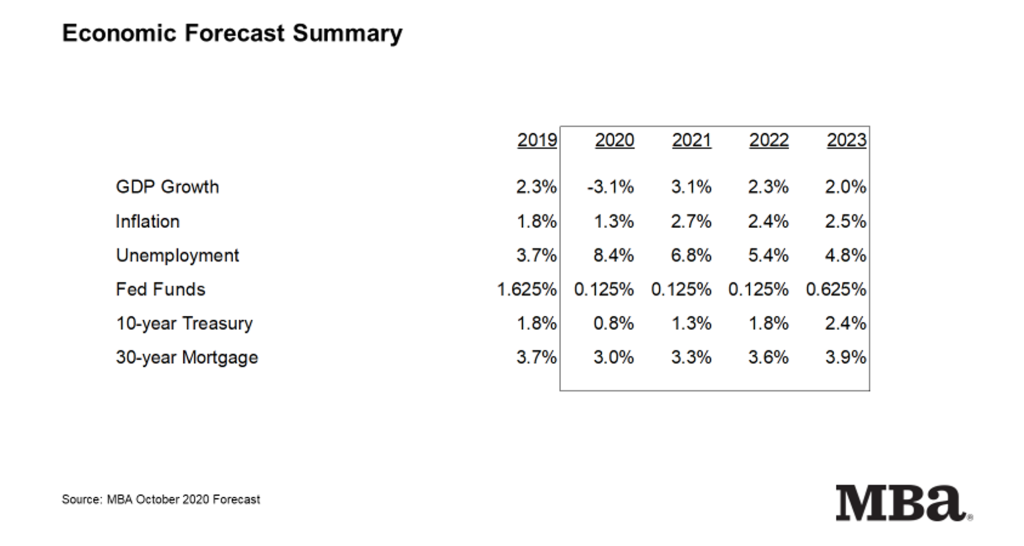

Keeping in mind the alternative paths we might travel in the year ahead, let’s focus more on MBA’s 2021 baseline housing market forecast. The October version of the forecast is shown in the following table.

Our forecast calls for the U.S. economy to expand at 3% next year after dropping about 3% in 2020. This was largely a result of a very sharp drop in the second quarter, a robust rebound in the third quarter, and further growth in the final three months of the year. The expected expansion in 2021, which hopefully should be steadier, will allow the job market to improve, incomes to rise and home sales to meaningfully increase. With further job growth, the unemployment rate should decline next year to average 6.8%, which is a decline from the average of 8.4% in 2020.

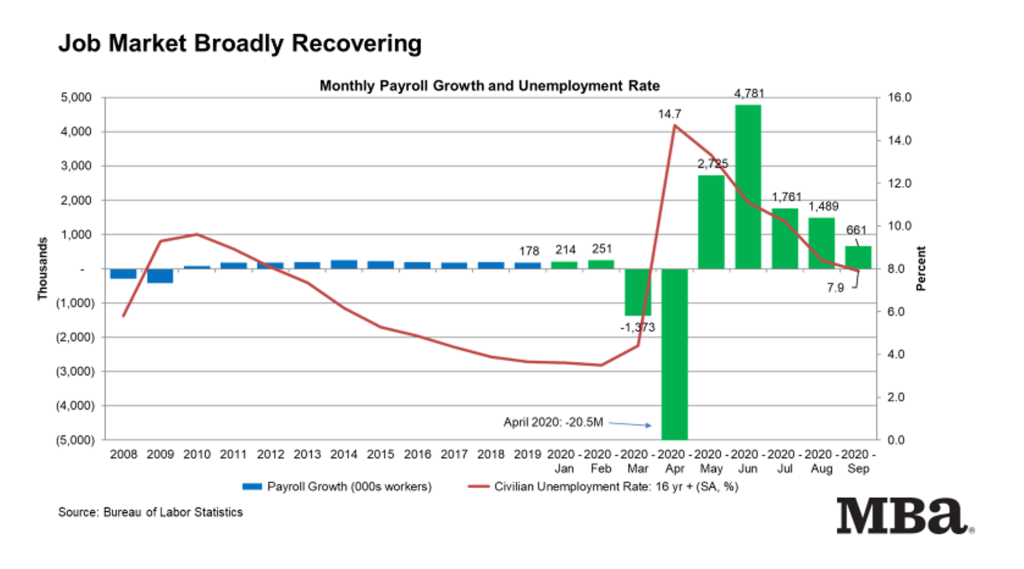

The swings in the job market data have been closely watched throughout this crisis. In February, the unemployment rate was at a 50-year low. By April, with more than 20 million job losses, it had spiked to 14.7%, the highest rate we have seen since the 1930s, and well above the 10% peak during the Great Financial Crisis. However, as states re-opened beginning in May, millions of workers who had been temporarily furloughed were called back to work. And while the pace of job gains has decelerated since June, and total employment still remains well below the level achieved pre-pandemic, the unemployment rate has dropped more quickly than we had predicted at the onset of the recession.

Close followers of the employment reports know that the headline unemployment rate only tells part of the story. Many parents with young children have struggled to work (or conduct a job search) while supervising their kids’ remote schooling. The labor force participation rate has declined, as at least some have (at least temporarily) stopped actively looking for work, and hence are no longer counted as unemployed. Broader measures of underemployment have moved down in parallel with the headline reading, but the drop in labor force participation likely means that the unemployment rate will improve more slowly from here. If the pace of hiring picks up, it would bring more workers back into the labor force, which would keep the unemployment rate from falling more quickly.

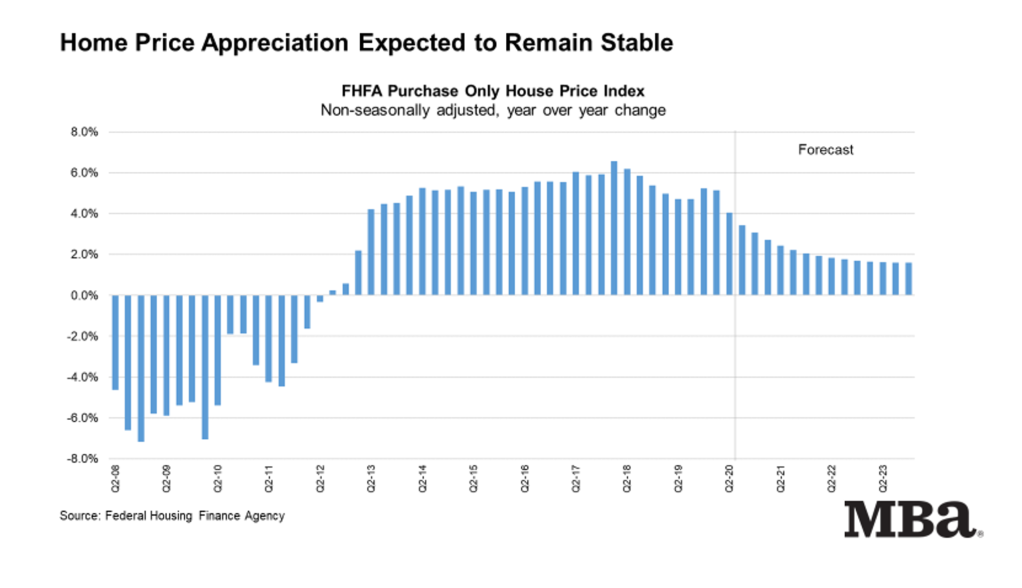

As the job market improves, millions of homeowners find themselves sitting on plentiful equity with many potential buyers ready to pounce the moment they list their house for sale, while others are bursting at the seams and need more space – now. Unfortunately, the lack of inventory – less than three months of existing home supply at September’s sales pace – has provided ample support to home prices. The late-summer reading from the Federal Housing Finance Agency shows home prices nationally were rising at an astounding 8% rate. We expect the pace of price growth in the housing market to decelerate over the course of 2021, as builders pick up the pace of construction, and additional listings of existing homes come online. We do not expect home prices to decline on a broad basis.

Also, bolstering housing demand is the rise in remote work during the pandemic. Many have been given the green light by their employer to work from anywhere and have decided to move to more affordable areas. Additionally, given the rising stock market and increasing wealth, many affluent households are considering a second home for vacation, additional rental income, or as the “satellite” workspace when not back in the office.

All of these factors are why MBA is predicting purchase mortgage originations to grow 8.5% to a new record of $1.54 trillion in 2021, beating the previous record of $1.51 trillion set in 2005.

Refinances – especially in the first half the year – should continue to keep lenders busy. After a substantial 70.9% jump in activity this year, we anticipate refinance originations will slow next year, decreasing by 46.3% to $946 billion. Overall, expect another strong year. Even with an expected overall decline to around 2.49 trillion, the 2021 originations tally would still be the second-highest total in the past 15 years.

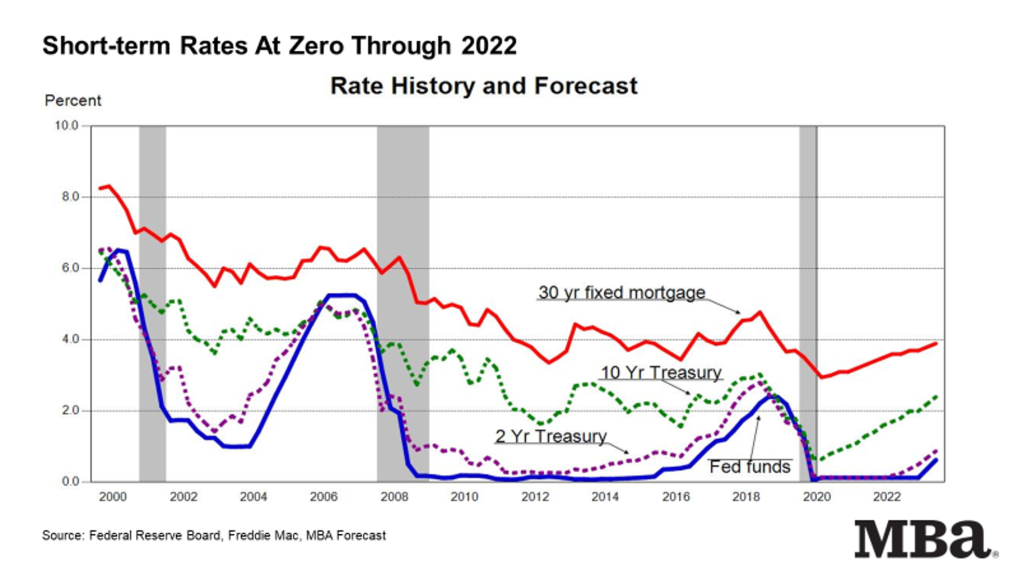

The Federal Reserve has made very clear their intention to keep short-term rates at zero at least through 2022. Given their announcement in August of a shift in their framework from targeting a 2% level of inflation to a more dovish approach of allowing inflation to exceed 2% for a period of time, we expect the central bank to be both later – and gentler – when it comes to increasing short-term rates.

It is also likely in the Fed’s plans to continue their purchases of longer-term U.S. Treasuries and mortgage-backed securities, at least for a time. It is interesting to note that at least some Fed officials have begun to question the benefits of further expanding these asset purchases. Market participants should remember the taper tantrum in 2013, when just the hint of a slowing pace of asset purchases led to a substantial jump in longer-term yields. Next year, be on the lookout for changing circumstances, which could lead to another similar market tantrum.

Beyond the conduct of monetary policy, the stance of fiscal policy will have an important role in determining the direction of interest rates in 2021. The fiscal 2020 federal budget deficit exceeded $3 trillion, and another stimulus package next year could push the fiscal 2021 deficit well above $2 trillion. While we think the economy, the job market, and distressed households and businesses need the support such a package could bring, the size of the debt and the required debt issuance needed to finance these supersized deficits, will likely put upward pressure on longer-term rates.

All in, that means a steeper yield curve in 2021, with short rates locked at zero by the Fed, but longer-term rates pushed upwards by a recovering economy and bulging federal deficits. Mortgage rates are priced off the longer end of the curve, hence the most likely outcome is somewhat higher mortgage rates. Because the supply/demand imbalance for Treasuries will be much larger than that for mortgages, mortgage-Treasury spreads would then likely narrow from the very wide levels observed in most of 2020. If our originations volume forecast is right, lenders will also be less capacity-constrained next year, which would be consistent with narrow spreads as well.

Predicting the path for mortgage rates is always a challenge, but I expect that mortgage rates will start to slowly rise, with the 30-year fixed-rate expected to end 2020 at 3%, before increasing to 3.3% by the end of 2021.

Many mortgage lenders are posting record production profits in 2020, fueled by a surge in volume and strong margins. After struggling to grow capacity this year, lenders need to be prepared to pivot to a somewhat smaller originations market next year – for the reasons I’ve highlighted. However, even with an improving job market and lower unemployment rates, we think the servicing side of the business is going to be challenging in 2021. Obstacles will certainly include elevated delinquency rates – particularly for FHA borrowers – and managing exit from forbearance for millions of borrowers. This will likely result in the need for additional loss-mitigation personnel. Hence, some origination staff this year might be usefully re-deployed into servicing next year. The cyclical and evolving nature of employment in the mortgage industry will continue, and the best and brightest will once again shine.

Ultimately, economic uncertainty will be with us until the public health crisis is solved. A more robust economic recovery greatly depends on slowing the spread of the virus – hopefully through the development of a vaccine and effective treatments. If all goes well, the economy rebounds and grows faster, incomes rise, unemployment goes down, but mortgage rates will rise.

2020 has been an unforgettable year on many fronts. MBA fully expects 2021 to again be a strong year for the housing market, fueled by still historically low rates, an increase in homebuilding and strong demand.

This is the latest installment in our HW+ 2021 economist forecast series that features top economists in the industry. In addition to this HW+ article, we will be hosting a Q&A discussion with each economist on our slack channel each Tuesday at 11 a.m. CT. If you’re not a part of our slack HW+ community, email bnath@housingwire.com.

To read the full December/January issue of HousingWire Magazine, click here.