The lack of affordable housing has reached crisis level in the nation’s cities and suburbs.

The squeeze has tightened across housing segments steadily for years. Between 2005 and 2017, the stock of single-family homes remained essentially flat, resulting in unattainable homeownership for many. Though expected wage increases and moderating home prices should offset some of this higher homeownership cost, the U.S. credit card debt being at an all-time high and the student debt load topping $1.5 trillion means that the down payment needed to purchase a home is simply not possible for many Americans.

With renter demand continuing unabated and many Americans being priced out of owning a home, the single-family market is feeling the pressure of higher interest rates, a lack of affordable single-family supply, and historically high debt loads. According to Harvard researchers, from 2001 to 2016 renters’ median housing costs rose by 11% while their income actually fell by 2%. Even though rental units grew 23% during that span, the rental market has also remained constrained and seen prices soar.

About 108 million Americans, equivalent to approximately a third of the country, are renters. And of this 108 million, 23 million live in a low-income household that pays more than half of its income for rent, according to the Center on Budget and Policy Priorities.

Although solutions to the wide-scale problem are elusive, borrowing programs initiated by the government-sponsored enterprises, Fannie Mae and Freddie Mac, have eased conditions and could even prove game-changing in a pivotal market segment: small multifamily residential properties. Expanding incentives to borrow, the programs have lately caught fire with investors because they increase the affordability of this category of housing for owners and renters alike.

Gary Ghiselli is a prime example of an owner who has taken advantage of these programs. Earlier this year Ghiselli, a surgeon based in Denver, Colorado, looked to refinance a 24-unit property he owned with a low-fixed-rate loan that would shield him from market volatility. A real estate finance company steered him to Fannie Mae’s Multifamily Small Loan program, which gave him the protection he desired—and more—and in less than 45 days. During a rally in U.S. Treasury rates, he locked in a 4.09% fixed-rate loan for 12 years, a vast improvement over the variable-rate, shorter-term bank loan he had previously taken to acquire the property. What’s more, the new loan was non-recourse and interest-only, leaving him with extra cash to pay for upkeep, improvements, and to further invest in workforce housing properties throughout the area.

“Since the rates and fees were low, I was able to refinance the property while keeping rents affordable for the families who live here,” Ghiselli said.

Ghiselli achieved all of this with limited paperwork, low fees and an exceptionally streamlined process – the perfect solution for a property owner whose investments are not the primary source of income.

The small loan financing option does not only benefit the casual investor; WCI Partners, a Harrisburg, Pennsylvania-based real estate development company is leveraging these programs to realize their business goal and mission of urban revitalization. Experts in shaping communities in tertiary markets like Harrisburg, the WCI Partners team saw an opportunity to refinance three of their properties utilizing Fannie Mae’s small multifamily loan program. They received a 10-year, non-recourse, $8 million loan, with a three-year interest only option, and 30-year amortization. Because WCI Partners was able to quickly and painlessly refinance these three properties, they were also able to better focus on their mission to “create residential and commercial projects that are both economically and socially valuable for their surrounding communities.”

Market Transformation

The benefits for lessors and lessees have spurred a sharp rise in GSEs’ share of the multifamily loan market. Traditionally, banks were the dominant source of small loans to fund affordable multifamily housing, with small meaning in the $1 million to $7 million range for buildings often between five and 50 units, and they remain so today. That being said, the small multifamily lending landscape changed after Fannie Mae entered the market in the mid-2000s. This change further accelerated when Freddie Mac introduced their small-balance loan program back in 2015.

Fast-growing cities like Denver, Seattle, San Antonio, Texas and Jacksonville, Florida, are especially fertile territory for agency financing. Secondary and tertiary markets are also benefiting from the streamlined loan offerings provided by Fannie Mae and Freddie Mac because the GSEs can offer data and insights into niche markets thanks to their national reach and broad network of lending partners.

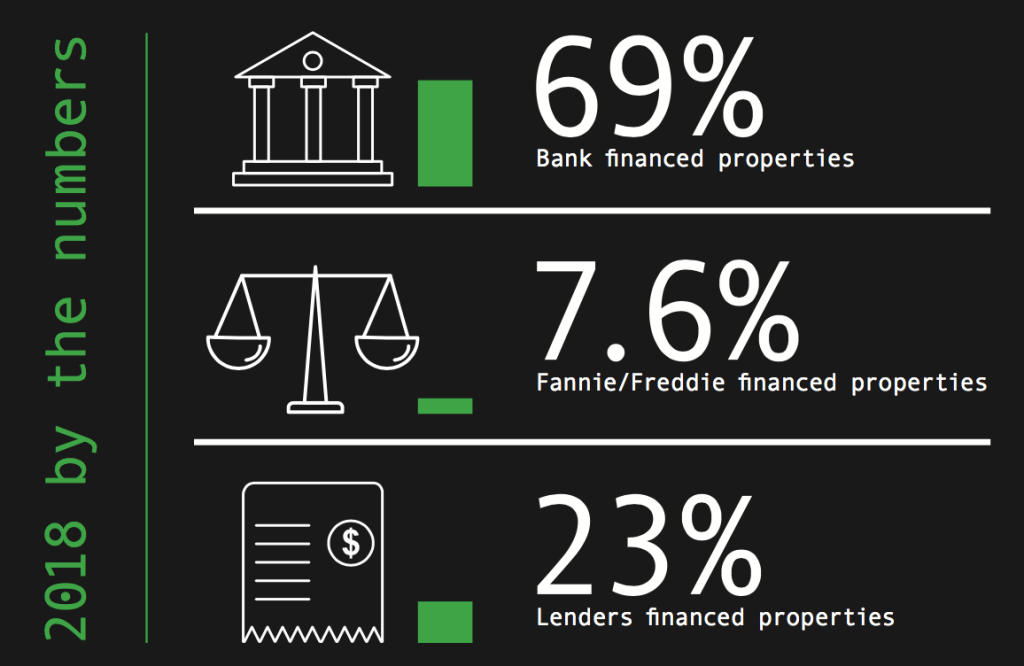

Last year in the U.S., more than 71,000 properties were financed by small loans totaling $169 billion in volume. Banks accounted for $117 billion, or 69%, of the total, while Fannie Mae and Freddie Mac’s share was $12.9 billion or 7.6%. Insurance companies, credit unions and other non-bank lenders such as online lenders, funded the remaining 23%, according to data compiled by CrediFi.

To be clear, Fannie Mae and Freddie Mac do not lend money directly. They market the loans through financial service firms called delegated underwriting and servicing lenders for Fannie Mae and Seller/Servicers for Freddie Mac. Some companies in this category include Walker & Dunlop, CBRE, Arbor and Newmark Knight Frank. The DUS lenders screen borrowers, then underwrite and originate the loans for a fee, after which they continue to provide servicing and asset management for the properties. In some cases, the obligations are then transferred to the agencies, who in turn bundle and sell them as asset-backed securities. After such transfers, the private lenders continue to administer the loans.

These programs are rising in popularity namely because they offer terms and options that meet the specialized needs of borrowers such as Ghiselli, whose multifamily investments represent their side gig.

Some of these options include:

• Non-recourse loans

• Fixed or floating rates

• Longer-terms – 15-, 20- and 30-year

• Lower closing costs than traditional agency financing – Fannie Mae, Freddie Mac, U.S. Department of Housing and Urban Development

• Streamlined processes, with less invasive documentation required of the borrower

• Active lending in all markets; primary, secondary, and tertiary

As a rule, the terms of agency loans soundly beat what one can obtain from banks—primarily loans that do not exceed seven years and are full-recourse, meaning that borrowers are on the hook for the full amount if they default. By contrast, agency-backed loans are mainly non-recourse, and they enable borrowers to lock in attractive fixed rates for up to 30 years.

Banks versus Agencies

But the choice of which to borrow from, a bank or an agency, is not always black and white.

Since banks are licensed to promote loans only in specific markets, their expertise in those markets can be deep, while the agencies are nationwide and have no geographic limits. With respect to underwriting, banks focus primarily on the creditworthiness of the borrower, asking to see individual tax returns and requiring a fairly detailed global cash flow analysis. For example, they provision for borrower credit card debt, car loan debt, personal loans and a variety of other types of debt in order to satisfy the bank’s individual underwriting requirements. This process can be time consuming and complicated, requiring a fair amount digging to fill out the necessary paperwork. In addition, many banks will require the borrower to have a minimum amount deposited at the bank in order to qualify for such a loan.

For borrowers with complicated tax returns, loans handled through Fannie Mae and Freddie Mac are more attractive because there is no need for debt-to-income analysis. The agencies do not require underwriting of individual tax returns and, as non-depositary institutions, do not require deposits. Because the loans they offer are non-recourse, they focus somewhat less on the borrower and more on the characteristics of the property itself, including its past, current, and projected cash flow.

Even so, the agencies favor borrowers who have experience owning and operating multifamily properties or apartments—typically Fannie Mae and Freddie Mac prefer to see at least two years of experience with at least two properties or apartments of a similar size. So, if they are a borrower looking to finance their first apartment loan, bank financing may be a better option. After the borrower has put in a few years owning and operating a portfolio of two or more properties, refinancing with an agency loan at better terms may be a perfect fit. Moreover, if they have improved or renovated the properties and increased their cash flow, the agency may be open to taking out additional proceeds beyond their existing debt.

Agency loans are available for everything from market-rate and rent-stabilized properties to affordable housing communities. In fact, the main focus of the Freddie Mac Small Balance program has been to promote the financing of rental homes throughout the country that are price accessible. As such, they have incentives for completing and funding affordable homes more quickly than their market-rate counterparts.

These properties may include:

• Expiring-use LIHTC financing

• Long term HAP contracts

• Regulatory Agreements that impose rent or income restrictions

• Tax abatements

• Section 8 vouchers

Manufactured home communities – a ubiquitous housing option throughout the country – may also qualify for these new financing options as long as the units have paved roads and two parking spots per home, entry through a patio or raised porch, and 75% of the units are owned by residents. Fannie Mae and Freddie Mac have quickly become the market leaders for these properties.

Loans for mixed-use properties having commercial establishments on the ground floor and multifamily above are also available, as long as the retail space comprises less than 35% of the total building. These properties are most popular in smaller towns and sprawling cities, and cater to renters of all types.

The two government-sponsored enterprises routinely roll out new and improved multifamily loan packages, such as the Targeted Affordable Housing Express Program that Freddie Mac debuted last year. Additionally, Fannie Mae has a Green Rewards program that offers low-cost financing to incentivize landlords to lower properties’ energy and water consumption. For example, these programs often incentivize landlords to update appliances, replace old windows and doors, invest in solar panel systems or improve thermostats and heating controls in order to increase energy savings. In this instance, both the owner and tenant reap cost savings benefits as a result of the owner implementing these green improvements.

DUS lenders have also made steady strides at simplifying and accelerating each step in the lending process.

Each program comes with a unique set of pros and cons depending on the borrower’s investment strategy and business goals. The overall impact of small balance lending, however, extends well beyond the borrower. According to the National Low-Income Housing Coalition, only 37 affordable and available rental homes exist for every 100 extremely low-income renter households.

Small multifamily loans provide sustainable and affordable financing solutions for smaller apartment properties. The market is on a fast track to help satisfy soaring housing demand while addressing the needs of investors and renters. Fannie Mae, Freddie Mac, banks and other alternate players in this space are making a critical difference in the lives of many citizens by providing owners with loans that directly result in affordable housing options for potential tenants. The advent and growing popularity of the small multifamily finance market segment is just one of the many ways we can tackle this affordability crises.