Slowing home price appreciation has eroded potential fix-and-flip profits over the past year, but demand at foreclosure auctions has remained strong as buyers shift to a renovate-to-rent strategy.

“Last year we actually bought two properties on Auction.com. One we were able to fix and flip it, and one, due to the market, we held on to it as a rental,” said Ty Stanley, a real estate investor who operates Real Home Solutions Ltd. Co., buying properties in South Florida and across the state. “The market was just flooded, and it was more so a buyer’s market. We were not able to hit the numbers we were looking for, so rather than sell it below market we held on to it as a rental.”

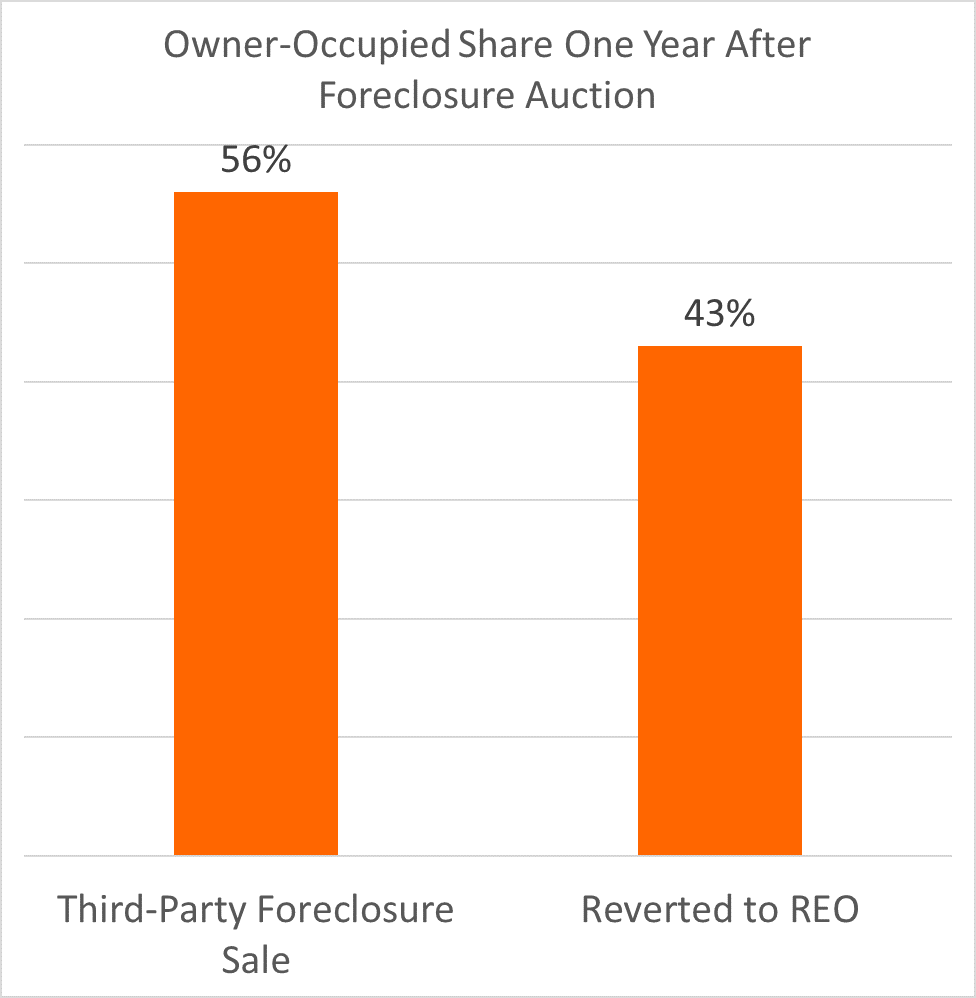

Stanley’s experience is similar to that of many buyers using Auction.com, according to an analysis of more than 9,000 properties sold at foreclosure auction via the Auction.com platform in Q2 2018. While the majority of these purchases (56%) were rehabbed and resold to owner-occupants, 44% were still non-owner-occupied a year later, indicating they were being held as rentals.

Favorable market conditions

Stanley said that rental property is cash-flowing thanks in part to changing market conditions that make renovate-to-rent more attractive. The U.S. homeownership rate dropped for the second consecutive quarter in Q2 2019, following 10 consecutive quarters with increasing or flat homeownership rates, according to the U.S. Census Bureau.

A lower homeownership rate translates into more demand from renters, which places upward pressure on rental rates and downward pressure on vacancies, both favorable trends for rental property owners. The U.S. rental vacancy rate dropped to 6.8% in Q2 2019, down from 7.0% in the previous quarter and unchanged from a year ago, according to the Census data.

Those same market conditions are helping to fuel what CNBC recently called an “exploding” build-to-rent market.

“We are becoming more of a rentership society than a homeownership society, and that is playing into the build-to-rent model,” said Bruce McNeilage, co-founder and CEO of Kinloch Partners, which is doing build-to-rent projects in five markets across the Southeast: Nashville, Atlanta, Raleigh, North Carolina, and Greenville-Spartanburg and Columbia in South Carolina. “We’re primarily focused in on doing entire subdivisions … self-contained subdivisions with their own homeowners’ association.”

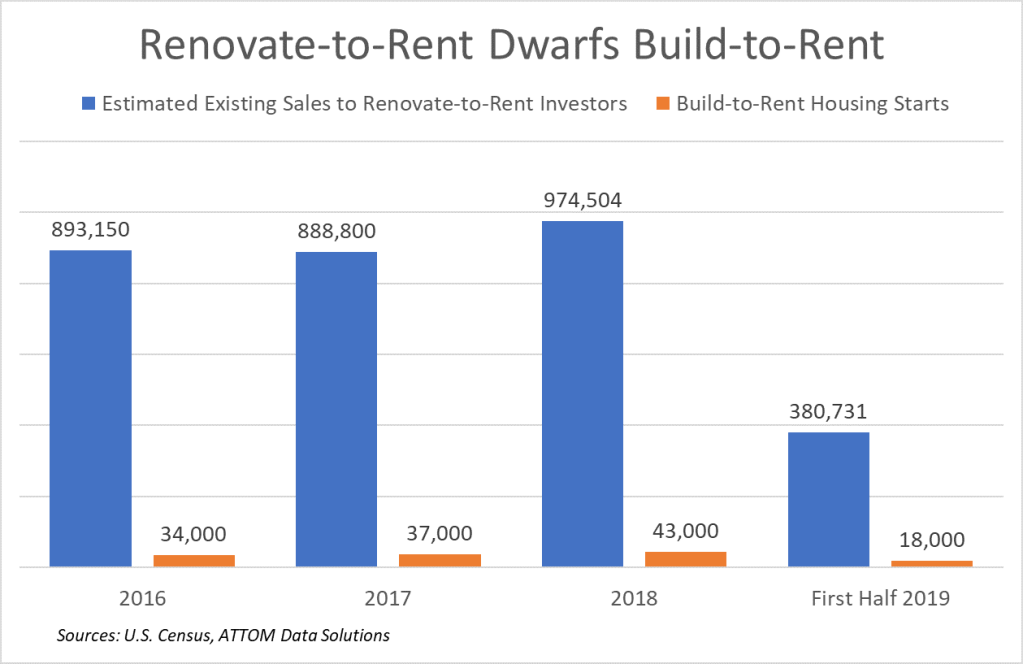

According to the Census bureau, 43,000 homes were built as rentals in 2018, up 16% from 2017 and representing about 5% of all new homes built for the year.

Renovate-to-rent up 10% in 2018

Even by conservative estimates, the renovate-to-rent market is much larger than build-to-rent, according to an Auction.com analysis of public record data from ATTOM Data Solutions. More than 1.1 million single family homes and condos (1,163,184) were sold to cash buyers in 2018, representing 26% of all existing home sales during the year. While not all of those cash buyers are investors, the vast majority are likely investors either buying the home as a rental or to flip.

The analysis shows that 242,356 homes were flipped — sold for the second time in 12 months — in 2018; however, 53,676 of those flipped homes were re-sold to cash buyers, likely investors holding the properties as rentals. That results in roughly 974,000 properties purchased by rental investors in 2018. Using the same methodology for 2017, the number lands just north of 888,000, implying a 10% increase in purchases by rental investors in 2018 compared to 2017.

36% of auction buyers prefer renovate-to-rent

More than one in three buyers (36%) purchasing at foreclosure auction or bank-owned (REO) auction said hold-for-rent is their most preferred investing strategy, according a June 2019 survey of buyers who have purchased multiple properties on the Auction.com platform.

Similarly, an analysis of more than 9,000 properties sold at foreclosure auction via the Auction.com platform in Q2 2018 shows that 44% were non-owner-occupied a year later, in July 2019. That non-owner occupancy status a year later indicates the properties are being held as rentals.

The analysis also looked at an estimated rental yields — based on an automated rental valuation model provided by Collateral Analytics — for those 9,000 properties. As evidence that investors are picking the optimal investing strategy, the average potential gross rental yield for the 44% of properties still investor-owned a year later was higher than it was for the 56% of properties that were owner-occupied a year later — 11.7% for the investor owned versus 10.5% for the owner-occupied.

Renovate-to-rent investors bid higher at auction

The higher potential gross rental yield for investor-owned properties was not based on investors getting a better deal at foreclosure auction. In fact, the average winning bid-to-credit bid ratio for the 44% of properties held as rentals was higher at 116.2% compared to 115.1% for properties that were subsequently sold to owner-occupants after being purchased at foreclosure auction.

“Lenders are confronted with a classic cost-benefit decision at the foreclosure auction, and the credit bid is typically the reserve price over which the benefit of selling at foreclosure auction outweighs the opportunity cost — the benefit lenders would get from taking back the property and reselling or holding as a rental,” said Jesse Roth, SVP of Strategic Partnerships and Business Development at Auction.com. “The slightly higher ratio of price-to-credit bid for properties held as rentals means that sellers at foreclosure auction continue to benefit from a consistent pool of buyers willing to pay above the reserve price even as the housing market shifts toward one that is more favorable to rental investing.”

Renovate-to-rent investors likely have a higher price ceiling than fix-and-flip investors in the 2019 market because their potential returns hinge on rental rates — which continue to increase steadily in most areas of the country given the aforementioned market conditions — while fix-and-flip returns are more dependent on home price appreciation, which has begun to slow in an increasing number of local markets.

“If I was going to flip the property I might be able to pay 80 (thousand) for it, but if it was a rental I might be able to pay 90k,” said Paul Lizell, a Philadelphia-area real estate investor who said he is focused on picking up more rentals in 2019.

var divElement = document.getElementById(‘viz1574178812051’); var vizElement = divElement.getElementsByTagName(‘object’)[0]; vizElement.style.width=’1000px’;vizElement.style.height=’827px’; var scriptElement = document.createElement(‘script’); scriptElement.src = ‘https://public.tableau.com/javascripts/api/viz_v1.js’; vizElement.parentNode.insertBefore(scriptElement, vizElement);