The 1004/70 appraisal form used for Uniform Residential Appraisal Reports hasn’t been updated since 2005, despite the changes and innovations that have taken place in the mortgage industry and in technology during the past 14 years.

With its Modern Appraisal Program, Clear Capital is working to bring the appraisal process into the modern era, ensuring integrity and high-quality data collection, reducing risk, lowering turn times and cost, and elevating the homebuyer experience.

Why update the appraisal process?

The primary reason to modernize the appraisal process is to make mortgages close more efficiently while managing risks. Valuation is often one of the longest steps in the home buying process, due to time-consuming processes and inefficiencies. Clear Capital wants to help appraisers use their education and knowledge more effectively by taking repetitive and time-consuming tasks off of their hands, which allows them to focus on their expert work of determining value.

Modern data collection allows appraisers to receive robust information and images of the subject property without needing to visit most properties in person. If the use of non-conventional appraisers in non-subjective property data collection increases, appraisers will be able to use their expertise for higher-level analytical functions, saving time and money while improving the borrower experience.

In addition, there’s a growing belief that non-appraisers can be trained to perform the more objective and standardized data collection process alongside traditional appraisers, which creates further capacity in many markets where the appraisal supply is stretched too thin, with no new talent readily available.

The Modern Appraisal Program and how it works

Earlier this year, Clear Capital rolled out its Modern Appraisal Program, which was developed in collaboration with industry stakeholders. The Modern Appraisal Program supports the use of appraisers and non-appraisers alike in the process of property data collection, including real estate agents and other inspector types.

As part of its Modern Appraisal Program, Clear Capital’s new, intuitive mobile app, ClearInspect, guides appraisers, agents, brokers and other data collectors step-by-step through a property data collection process to ensure quality and efficiency. The app features prompts designed to create an intuitive, step-by-step data collection process, even if new information becomes conditionally required during the inspection process.

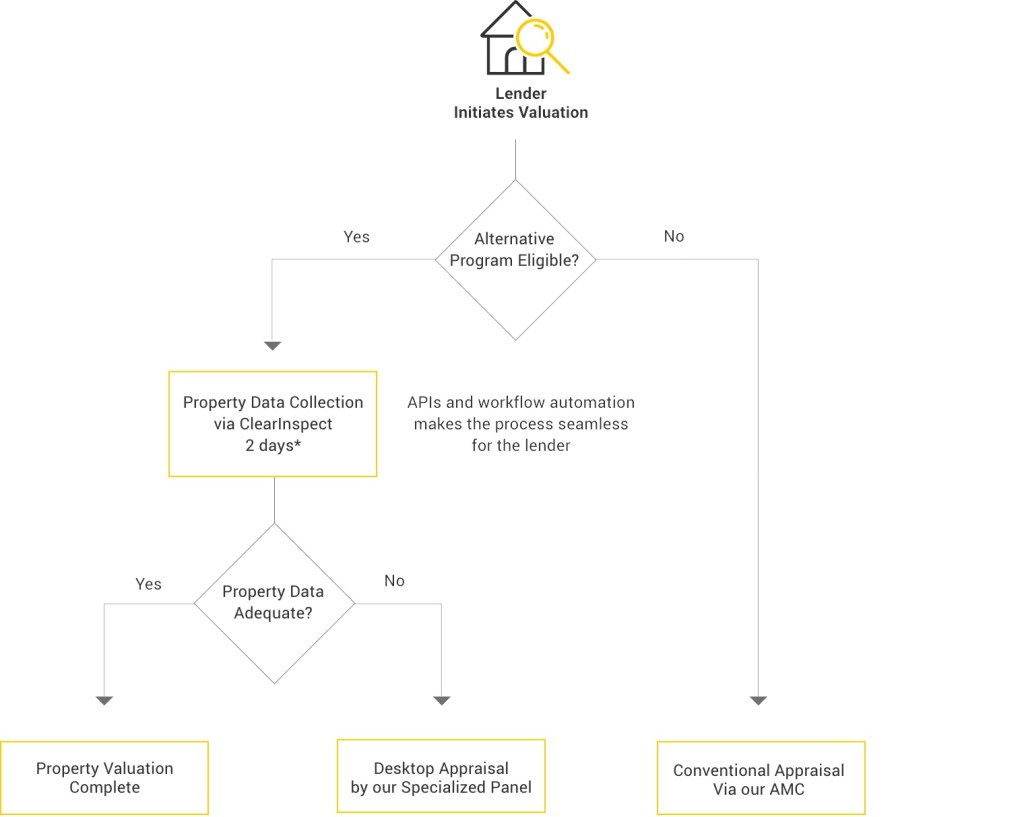

The Modern Appraisal Program and property data collection processes function as follows:

Once the property data has been collected, the results can easily be sent to customers, investors, and appraisers who may perform a desktop valuation based on that property data. Each data submission undergoes a robust quality assurance process and is meticulously reviewed by a highly trained analyst using tools that leverage property data, street and aerial imagery, and ClearProp, Clear Capital’s proprietary property analysis tool.

Expanding the real estate professional’s role

Real estate professionals who want to join Clear Capital’s data collection panel must complete its Data Collection Certification Program, which includes several multi-hour training modules. Prospective data collectors are also required to complete multiple practice assignments on real properties in the field, which are then subject to an in-depth quality assurance review.

To prevent conflicts of interest, Clear Capital thoroughly vets its real estate professional data collectors and does not allow traditional sales agents who generate their income from traditional listing and selling activity to join its data collection panel. Instead, Clear Capital’s panel is comprised of professionals whose work in broker price opinions and property condition reports serves financial institutions and is very similar to property data collection.

“Real estate professionals are able to leverage their local market knowledge out in the field as data collectors, seeing properties and neighborhoods through a homebuyer’s eyes,” said Jeff Allen, executive vice president of valuation strategy at Clear Capital. “They’re more aware of things like marketability, external influence and obsolescence than other types of non-appraisal data collectors who may be more focused on collecting data about a home’s physical condition.”

How does this improve the appraisal process?

Clear Capital has seen multiple benefits from its Modern Appraisal Program, including better turn times, improved customer experiences, and consistently lower costs. The average time saved on a purchase loan was almost three days, representing a 32 percent improvement, and the average time saved on a refinance was more than three days, a 33 percent improvement.

With the use of its ClearInspect app, Clear Capital has found that its real estate professional data collectors perform about 23 percent of their assignments on the weekend. In comparison, the percentage of assignments performed on a weekend using a conventional 1004 form appraisal is about 9 percent. Weekend appraisal assignments are more convenient for homebuyers who may not be able to schedule them during the traditional workweek.

Real estate professionals are also more widely available than traditional appraisers and their fees to complete appraisal assignments have very little variation from market to market. As a result, homebuyers benefit from a lower, consistent cost — Clear Capital has seen a cost savings to homebuyers of almost $250 per loan.

As the next generation of homebuyers come to expect a speedy, flexible homebuying process, valuation is a natural place to innovate, particularly since the process hasn’t been updated in almost 15 years. Clear Capital believes that expanding the data collection workforce and modernizing the appraisal process is a necessary step toward providing homebuyers the elevated experience they’ve come to expect in 2019.