Luke Johnson won’t be accused of avoiding controversy to gin up business for his fintech mortgage lending shop, Neat Capital. You might say he’s actively courting it.

“In the financial services community, most companies are afraid of taking an active voice in any community health issue, or any issue of importance because it is politicized and we work in a highly regulated environment,” Johnson said in an interview Thursday with HousingWire. “And we tend to say any noise is bad noise, even if it’s good for the community.”

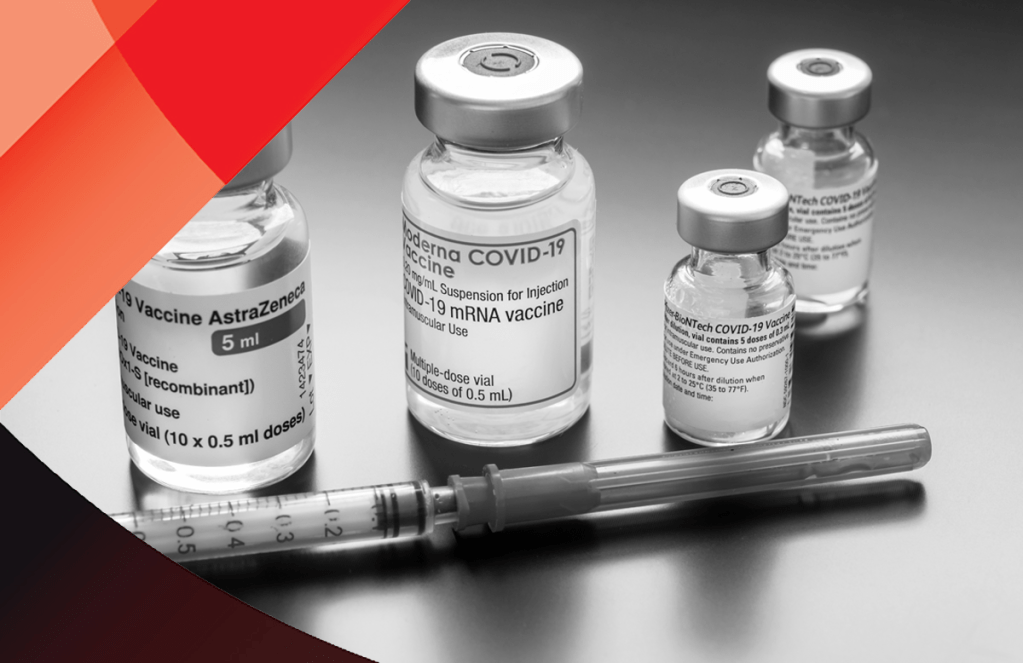

Johnson’s company announced this week that it would offer a $500 discount to customers who show proof that they’ve been vaccinated.

About two-dozen mortgage loan originators wrote to HousingWire in response to the news. Many said they felt the company was out of bounds and should “stick to mortgage lending.” Some described the initiative as “disgusting,” “inappropriate,” “discriminatory,” “wrong,” and “un-American.”

Johnson is unfazed, and says that since the announcement was made, Neat’s phones have been ringing off the hook with new customers (as well as general members of the community who were supportive of the initiative).

“We aren’t discouraging applicants from different backgrounds [from applying], this is just an additional discount,” Johnson said.

The company will be parsing out the $500 discount through its digital mortgage lender entity Neat Loans. The money can go towards closing costs for a residential purchase or for refinance mortgage loan applications. To qualify for the promotion, a borrower must present a digital or electronic picture of a vaccine record that shows that they have been vaccinated. The fintech added that applicants are eligible regardless of vaccine manufacturer or the number of doses received. (So even if you have Sputnik, you should hypothetically qualify).

Johnson said that the decision to offer a vaccine-related discount was two-fold.

On the one hand, Neat Capital wants to “create an environment of safety, whether a customer is meeting our loan officer, or an employee that will be interacting directly with their team, knowing that this is a safe place to be is important,” said Johnson.

And on the other, an initiative of this sort is a good way to recruit like-minded personnel.

“Knowing that this is a safe place to be is also good for recruitment, for many looking to join a new industry and learn new things they would prefer to be learning from those surrounding them,” Johnson said.

The company’s press release also said that potential borrowers who are unvaccinated but can “attest that they are unable to be vaccinated due to health status or religious reasons,” can still qualify for the credit.

Johnson said he was not worried that the discount would violate the disparate impact standard or put him in hot water with regulators.

“We are making sure that everyone has access, that they have childcare and a ride to get the vaccine and making sure that the vaccine is for free,” he said. “From an economic perspective this is a completely no risk proposition where you can go get vaccinated, there is no worry that people don’t have access to the vaccine because of socioeconomic status.”

But such an initiative could result in reputational risk for the company, said Garris Horn LLP attorney Troy Garris, who works on mortgage compliance issues.

“If a company comes out and says that [they’ll] give you this benefit if you show proof that you’re vaccinated, you might have people that decide not to do business with that company, or begin attacking the company in social media or other places,” Garris said.

Meanwhile, from a legal regulatory risk perspective, Garris remarked that this discount did not appear to violate any provisions of the Real Estate Settlement Procedures Act, but could potentially be a concern under fair lending laws.

“Fair lending laws sometimes prohibit lenders from asking certain questions,” said Garris. “Can you ask whether someone has a condition that prevents them from getting a vaccine? That’s moving into uncharted waters.”

Despite the company waving a vaccine requirement for those with underlining health conditions, the overall message may discourage applicants, which could lay the groundwork for a Equal Credit Opportunity Act (ECOA) violation, he said.