[Editor’s note: As of November 2022, we no longer use Slack, and we’re happy to share that we’ve moved to Circle for our new community platform. We will be continuing Q&As, live discussions and more in this new community platform. If you’re a member and not a part of our Circle community yet, you can click the link at the end of the article to join.]

In this HW+ Slack Q&A, HousingWire Lead Analyst Logan Mohtashami gives the inside scoop on where rates are headed, his insights on the latest economic reports and more.

As a member of HW+, you can us join for regular 30-minute Slack Q&As, where we invite the HW Media newsroom to break down the hottest topics in the industry. The Q&A was hosted in the HW+ Slack channel, which is exclusively available to members. To get access to the next Q&A on April 20th, you can join HW+ here.

The following Q&A has been lightly edited for length and clarity. This Q&A was originally hosted on April 6th.

HousingWire: To begin, how is the supply data looking this year now that we are in April?

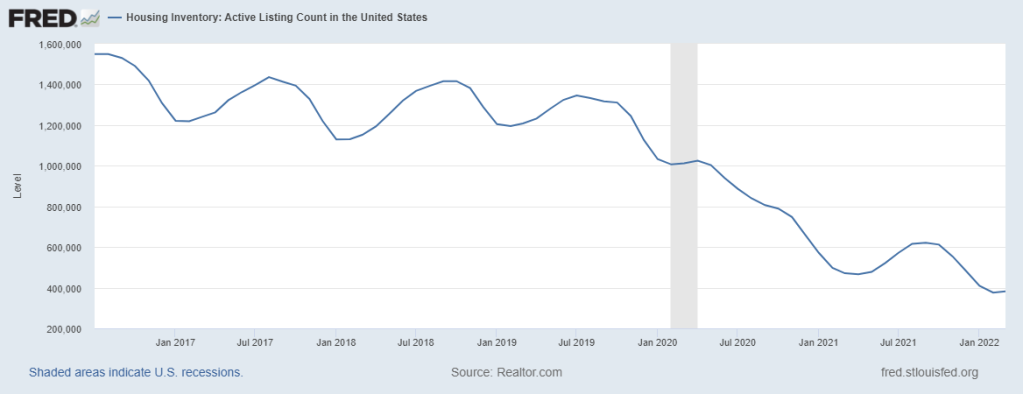

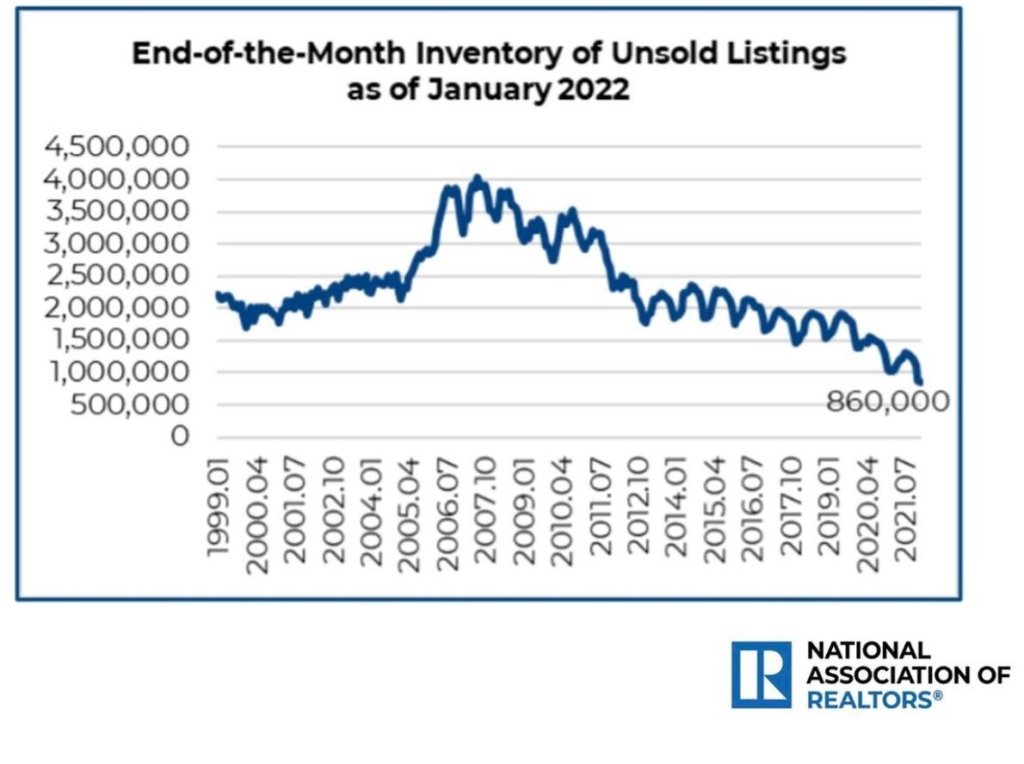

Logan Mohtashami: Supply has gotten worse and worse this year, every single week in 2022 on a year-over-year basis. The most recent data shows us down 17.6% on a year-over-year basis, and we are in April! This was the last thing we needed to see for the Housing Market, which went from unhealthy to savagely unhealthy.

What I am hoping for is that higher rates create more days on the market, cool price growth down, and at some point this year, we stop being negative and be positive on a year-over-year basis. We started the year out at all-time lows and it got worse as the year went on. Seasonal inventory is about to rise, so let’s hope for the best.

HousingWire: Do you think more reports, like the one from the Dallas Fed, will start to use the word bubble?

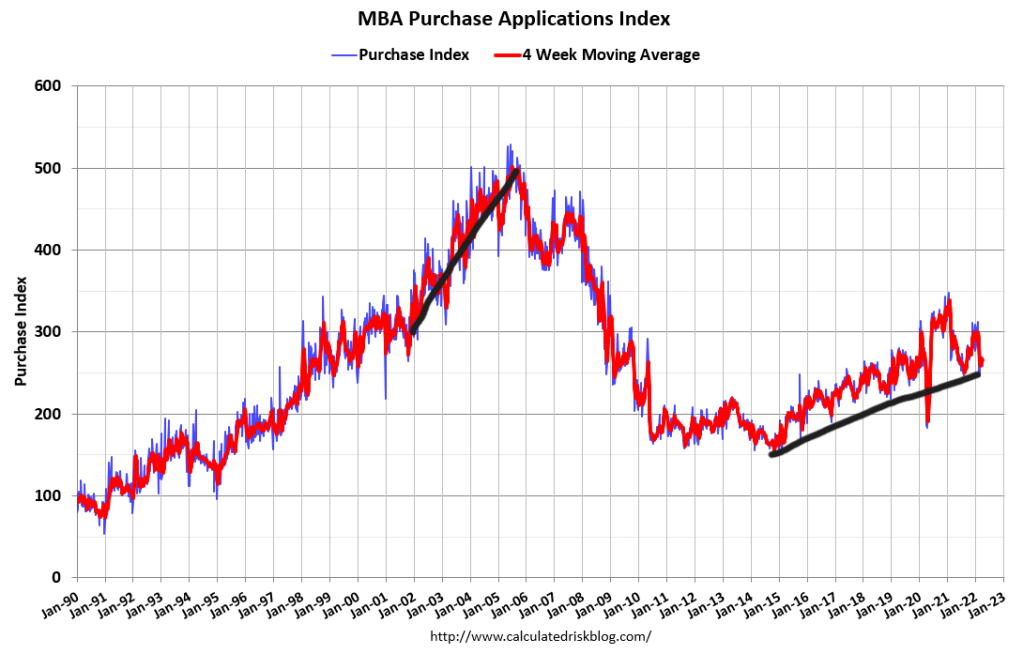

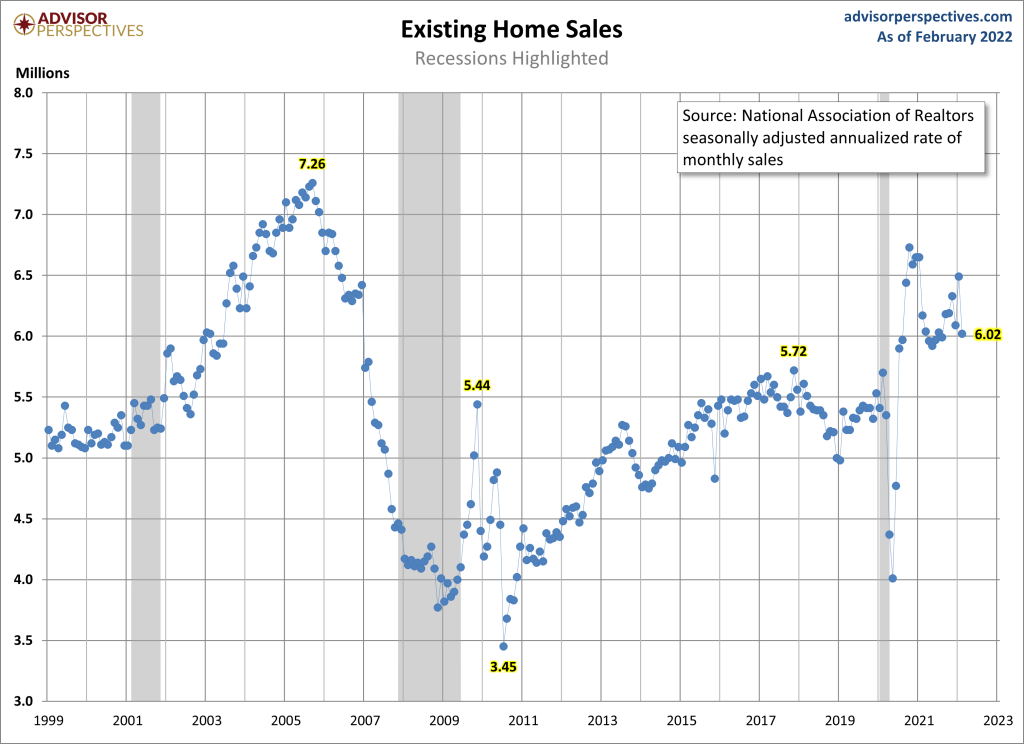

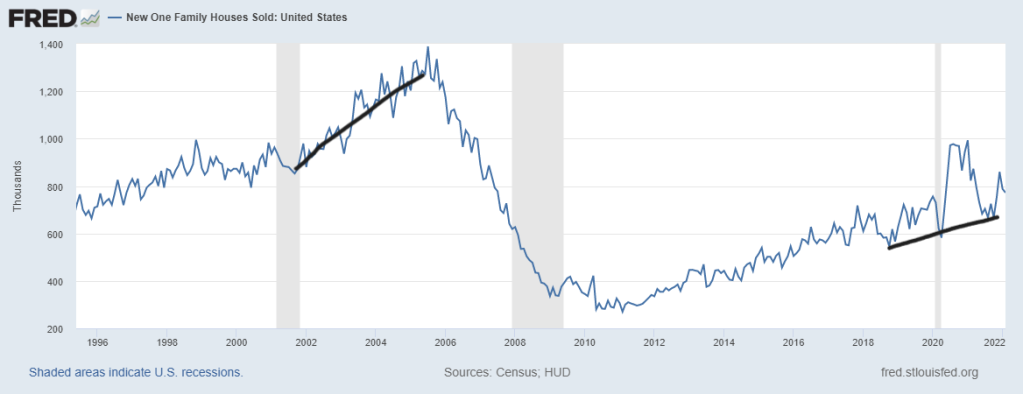

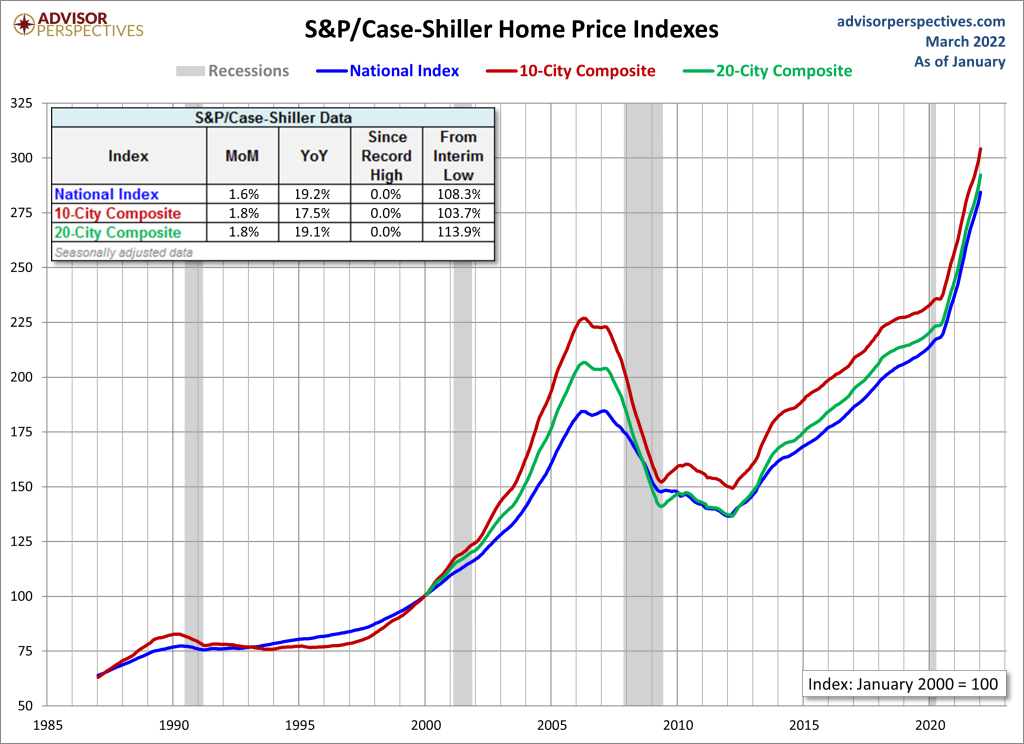

Logan Mohtashami: Whenever home prices are rising, and then rates rise, people look up the term Housing Bubble; it’s the nature of the beast. I liked the Dallas Fed’s article; I thought they were much calmer about the housing market than I am. However, the demand curve of what we have in housing too doesn’t resemble the speculation demand curve of what we saw from 2002-to 2005. So the type of massive decline in sales in such a short term isn’t going to happen.

A good example is last week’s purchase application data was up 1% week to week, which was down 3% week to week. Even today, we aren’t even at 2002 levels in the MBA index. So the type of boom and bust we would need to see to reflect bubble speculation demand isn’t in this market like we saw from 2002-to 2005. Housing peaked in 2005 and then declined for many years.

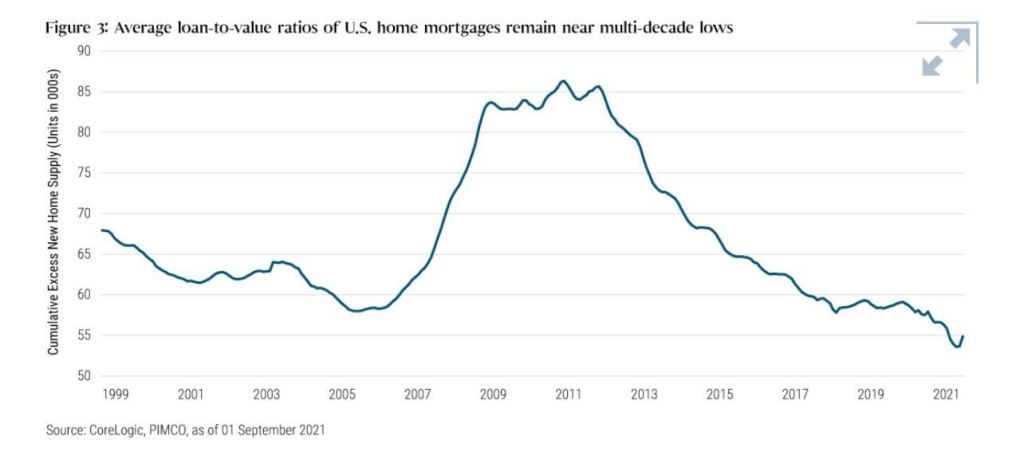

Also, the LTV data lines are much different:

Mortgage credit can’t get too tight in relation to where the demand is currently.

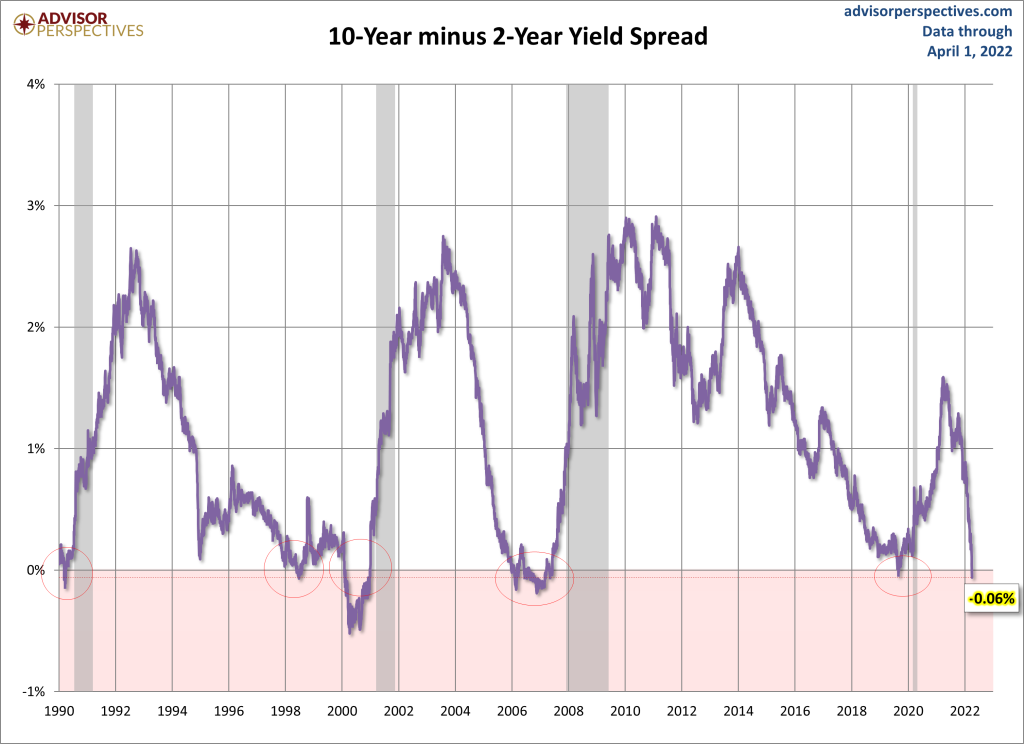

HousingWire: The 3rd recession red flag is raised, what should be looked at now going ahead?

Logan Mohtashami: Yes, the 3rd recession red flag was raised. The Inverted Yield curve, which I was on watch for since Thanksgiving of 2021.

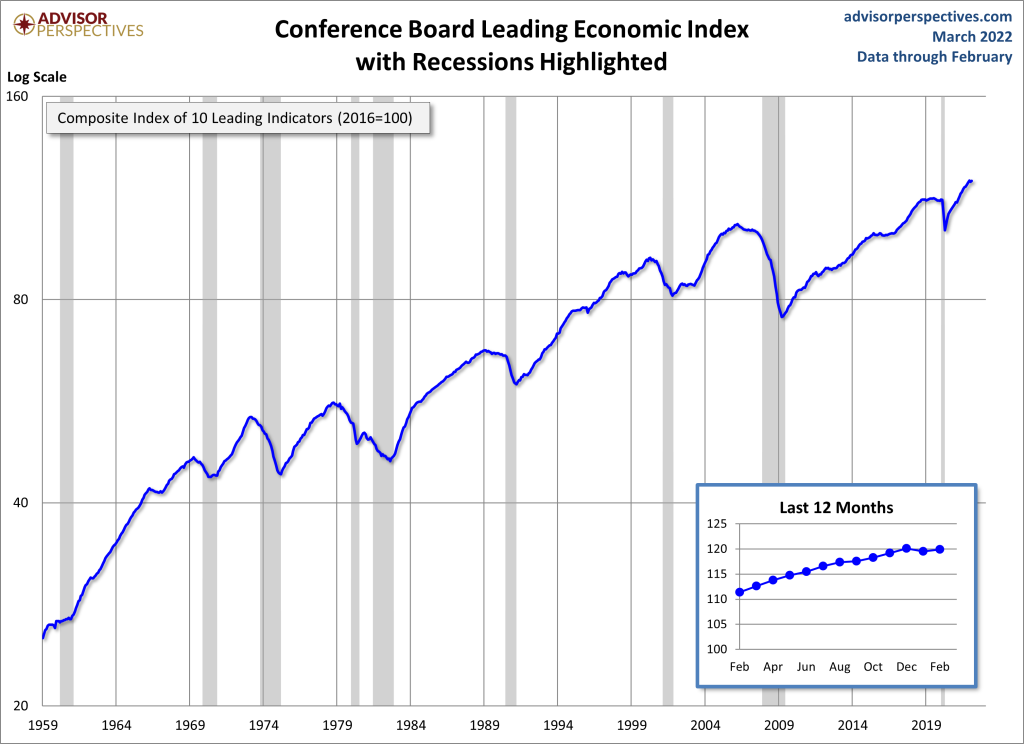

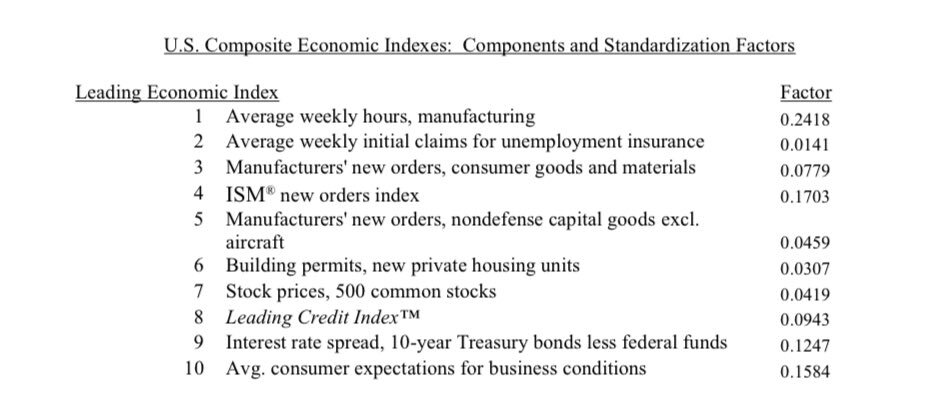

My first three recession red flags are more about the progression of an economic expansion that has matured. The next 3 are much more important. Leading Economic Index, typically falls 4-6 months into every recession, barring a shock-like COVID-19. We are still okay here.

These are the components of this index:

HousingWire: Why do you believe higher rates are a good thing for housing?

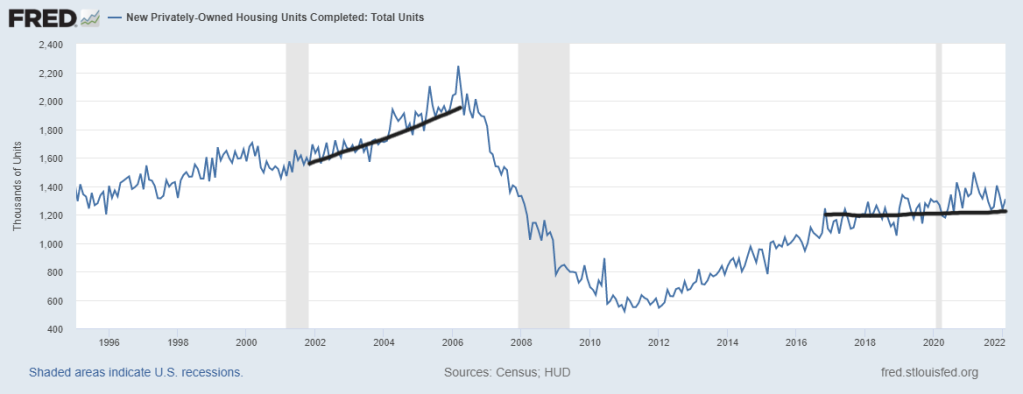

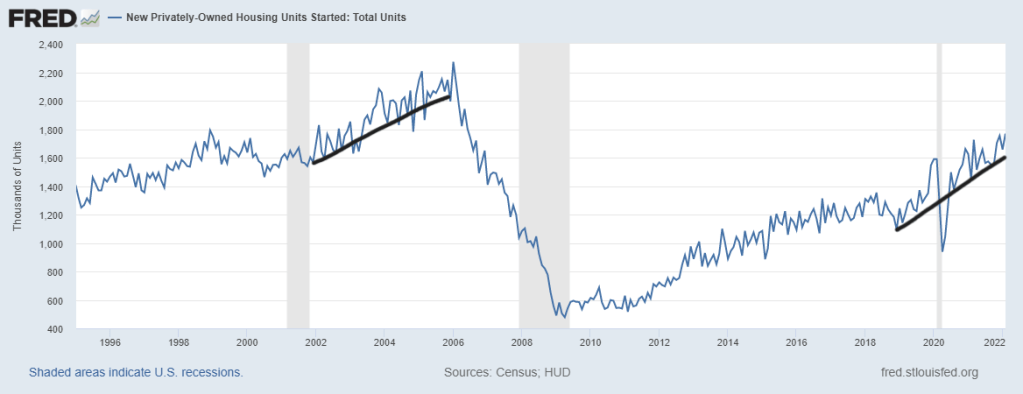

Logan Mohtashami: New home sales and housing starts typically fall in a recession. We do have risk toward this sector now with rising rates, so this sector needs a close eye on.

Higher rates are a must because the way we were heading, we would have easily had 40% home price growth in 3 years with inventory looking to start a fresh new all-time low in 2023. This is not a positive for the housing market but a real net negative.

The only thing we have that can cool down housing is higher rates. So, since I lost my five-year growth 23% cumulative price growth model in two years, I need to see inventory rise and prices cool off. We need balance, and we don’t have any in our housing market.

Sub 4% rates weren’t creating any balance; they made things worse, and so sticking to my 2020, then what can cool down housing? A 10-year yield over 1.94% will, we got there, and for me, it’s a good thing.

HousingWire: To end, are homebuilders at risk in this higher rate world?

Logan Mohtashami: Yes, the builders have many homes that haven’t been finished yet, and rates have gone up 1.50% – 2% on these people. We need to keep an eye out on the cancelation data in the upcoming months.

Higher rates are alarming for the builders; their stocks are down big, much like in 2018. This is a risk to housing construction because 5% mortgage rates paused construction for 30 months back then.

Take full advantage of your HW+ membership and join our exclusive Circle platform dedicated only to HW+ Members! To join the community, go here.