If there was a chance that a new loan application was sitting in a corner of your office right now, would you look for it? Of course you would. This is not a market where any lender can afford to lose a prospective mortgage deal — every loan matters. That’s why looking closer at each borrower to gauge their closing potential is so important.

In the past, lenders would underwrite a new loan and expect that the emerging details were pretty much set in stone. The applicant’s capacity to repay was visible in existing assets, bank accounts and payroll records, the appraisal report provides a view into the value of the collateral and the credit report illuminates any risk in the consumer’s credit history.

Capacity, Collateral, Credit. The 3 Cs of lending. We all know them. We’re suggesting you look at the final C, credit, in a new way.

Credit is dynamic. You can and should look at every credit score not for what it is, but for what it could be. Seventy percent of all borrowers, regardless of initial credit score, could improve their score by at least one 20-point credit band within 30 days. This has the potential to save you thousands in LLPA premiums and the borrower tens of thousands in interest expenses over the life of their loan. You can’t judge a book by its cover. Nor can you judge a credit score as it first appears.

It just takes a glance, a moment’s time, to see the potential in a credit score. These few minutes spent could result in a higher likelihood of sitting down at the closing table with the borrower. Pull-through, after all, is one of the keys to greater profitability.

Why every loan matters now more than ever

Every lender and loan officer reading this article knows what’s happening in the market today. We don’t have to replay the news to make the point that loan originations are a fraction (about 30%) of what they were two years ago.

It’s actually a bit worse than that.

Most of the data we have in our industry is lagging, some as much as several months after the deal closes. An analysis of our internal data revealed a different market indicator, one that is forward-looking and exposes the actual demand in the market for a new mortgage loan.

Further, we can determine this demand by 20-point consumer credit band to get a very accurate view of who is in the market for a new loan. We have wrapped this data up into a free monthly report and a numerical index we call the Mortgage Credit Potential Index (MCPI).

The Mortgage Credit Potential Index (MCPI) is a monthly reporting of mid-score mortgage credit pulls analyzed by CreditXpert’s predictive analytics platform. The MCPI highlights the volume of mid-score mortgage credit pulls by 20-point credit bands between 360 and 850. When compared to prior months and years, the MCPI serves as an indicator of changes in query volume.

Data for the month of July 2023, shows clear shifts in mortgage demand for prospective borrowers at both the lower end of the credit spectrum and those with higher scores. Interestingly, the demand curves are moving in different directions.

Demand, as a percentage of total demand, among borrowers with credit scores in the low– to mid-credit score bands (679 and below) has been decreasing since April 2023. On the other hand, borrowers with higher credit scores (700 – 799), exhibited increasing mortgage demand.

While this may sound good, given the fact that borrowers at the top of the credit spectrum are very likely to be approved while those at the bottom are far less likely to be, it’s actually not good news. We expect to see demand for new mortgage credit in the higher credit score bands. These are the borrowers who have the most capacity to invest in new homes. These are the borrowers everyone is competing for, which makes them harder to win and keep from falling out.

The real value for the lender who wants to find new business is further down the credit spectrum. And these borrowers need your help if they are to realize the homeownership dream.

Not taking consumer credit at face value

Our analysis of the most recent data suggests that lenders are leaving business on the table in the lower bands. The fact that demand in these score bands is decreasing may mean that these borrowers are getting discouraged. All the more reason to engage with them.

But they still have to qualify for a loan the lender can sell them. If their score is too low they won’t constitute new business.

Of the three Cs we mentioned above — capacity, collateral and credit — the applicant’s credit score is the only one with the potential to change within 30 days. And which borrowers have the most potential to raise their scores in that time period?

We call that potential energy and provide an index in each MCPI.

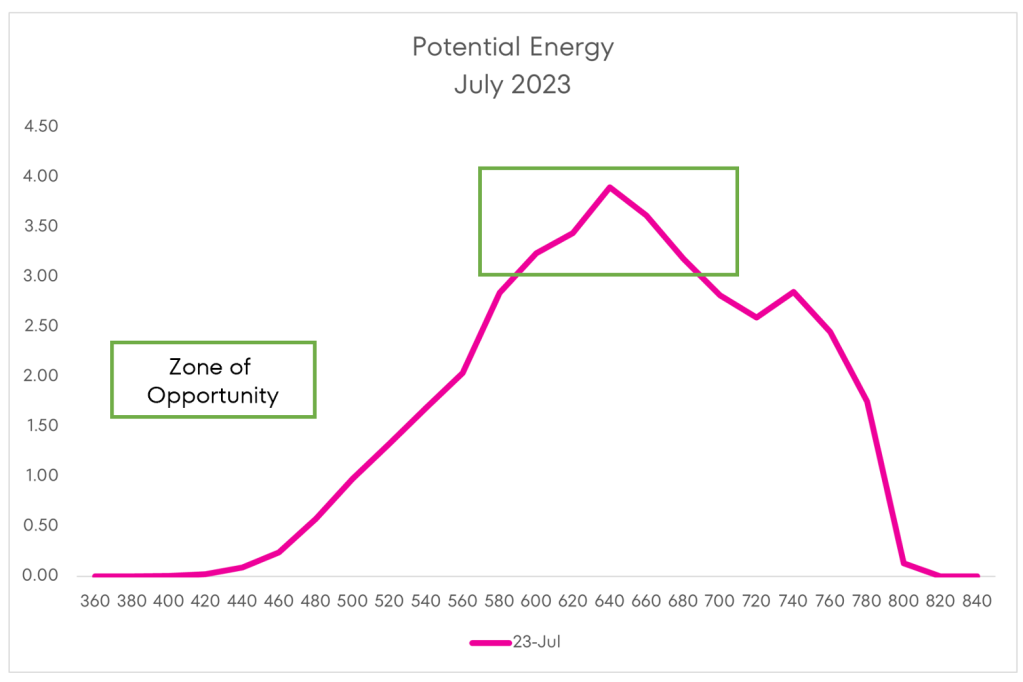

We have highlighted the Zone of Opportunity from the most recent MCPI in Figure 1, below. Notice that it extends from borrowers in the 580 FICO bucket all the way up to the 680 FICO. Admittedly, borrowers who fall into these credit bands do not typically make up the largest segment of the lender’s business. Consider, however, that these are the borrowers who need the most help and can be very appreciative to the lender who offers it.

Lenders are leaving business on the table in the lower bands if they don’t take action to help these consumers. These are the borrowers that lenders have the most chance of helping raise their credit scores. Failing to do so will mean these borrowers will put off homeownership, meaning lost business, not just for a single lender but for the entire industry.

Figure 1: The Zone of Opportunity

Increasing Credit Potential is the key to new business for lenders

As overall credit inquiry volume decreases, so does the number of those borrowers who can increase their credit score by at least one 20-point band, though this falloff is happening at a decreasing rate. At first, that may seem counterintuitive, but consider the following graph.

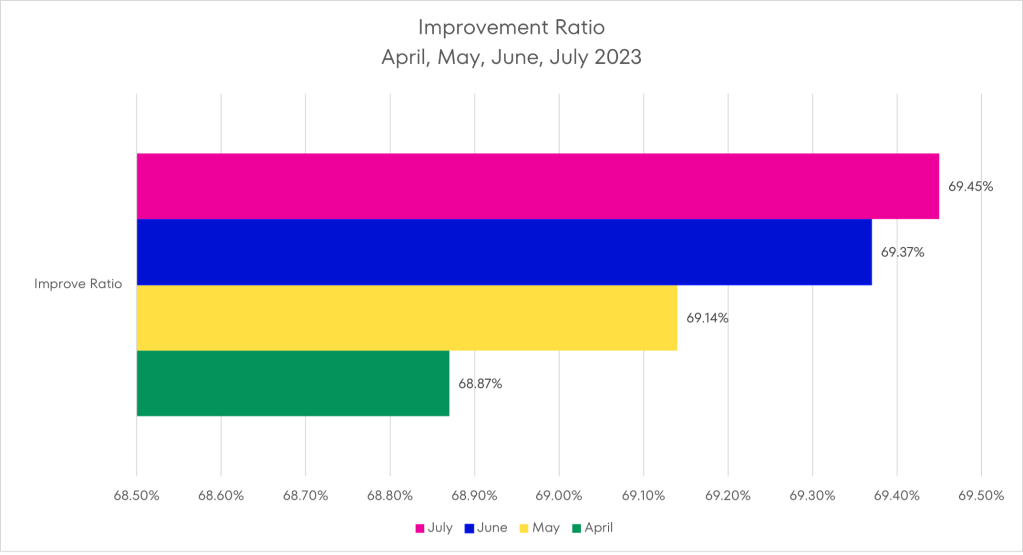

Figure 2: Credit Score Improvement Ratio

Figure 2 shows the Improvement Ratio by month for April through July. Paradoxically, it would seem, the ratio of those who can improve their score by at least one 20-point band has increased ever so slightly every month since April.

In April the ratio was 68.87%; July’s figure was 69.45%. The difference isn’t large, but the trend is clear. More borrowers every month have the potential to increase their credit score and, quite possibly, qualify for a loan they would not have otherwise.

This means that taking the potential homebuyer’s credit score at face value is a mistake. It also means that helping these loan applicants understand their ability to optimize their credit and then take simple steps to improve it will win the lender more business.

It will be like looking in the corner of your office and finding a new mortgage loan there, ready to be processed and funded. And who wouldn’t want to do that?