This year’s low rates have led to high loan volumes, and lenders overwhelmed with applications are looking for the best way to handle the increased workload. Growth by scaling up staffing can help, but it can be difficult to find enough people to take care of the manual processes to keep up with the demand. And hiring in a wave of high volumes can mean layoffs when the market is less robust.

Lenders need business growth that is not linear and is not tied to the market cycles – leveraging automation technology can help.

“With automation, you’re removing the dependency on human beings to do tasks that machines can do, so you can really scale up and down in a manner that doesn’t impact your cycle,” said Narayan Bharadwaj, senior vice president of automation at Indecomm Global Services.

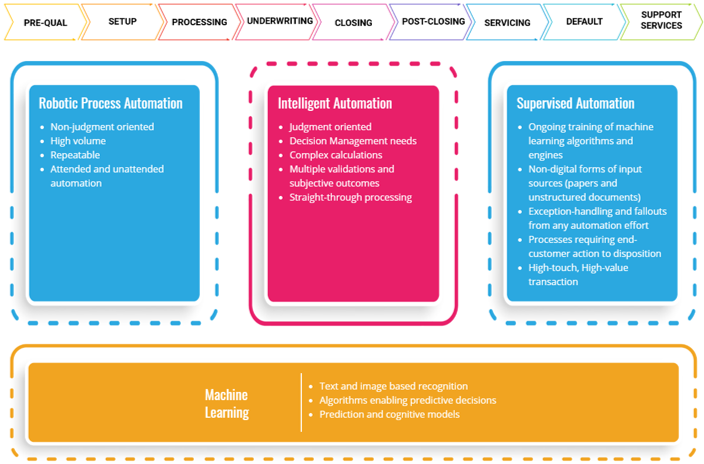

Indecomm approaches automation by looking at practical applications for the technology across the entire mortgage lifecycle, using a framework called the automation continuum for mortgages.

The company’s solutions involve applications of a few different types of automation technology.

Robotic process automation (RPA) is on the simpler end of the automation continuum, as it can be used to handle repetitive, high-volume tasks, but only those that are non-judgment-oriented.

The next level up from RPA is intelligent automation, which is judgment-oriented and capable of handling multiple validations and subjective outcomes for decision management. Essentially, Bharadwaj said, intelligent automation is “extracting the data sitting inside of documents and direct-sourced data to apply those against rules to automate straight-through processing.”

The third type of automation included in Indecomm’s continuum is supervised automation, which involves human oversight for the ongoing training of machine learning algorithms and engines and exception processing to handle fall-outs from any automation effort

All of the above categories of automation solutions are built on a foundation of machine learning solution which has been developed by Indecomm specifically for the mortgage industry over the past several years.

“Despite any automation effort, there will always be exceptions and fallouts that a human being needs to oversee,” Bharadwaj said. “[For example] when there’s an underlying machine learning or an artificial intelligence model, you need to feed the data and train that model, or transactions that require a high touch/velvet glove approach. That is where supervised automation comes in.”

Indecomm’s automation continuum showcases several potential growth opportunities for RPA across the mortgage origination lifecycle.

“Any function that is typically high-volume, repeatable or has a defined set of rules, but is not heavily judgment-oriented, can be automated using RPA,” Bharadwaj said.

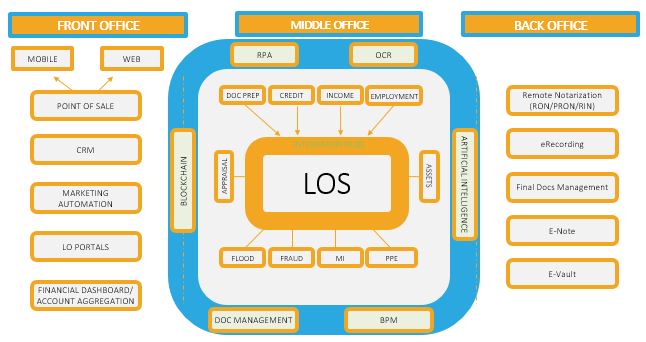

Automation has been applied fairly well to both the front office and back-office sections of the mortgage life cycle, he said, citing tools like point-of-sale and loan officer portals on the front-office as well as the acceleration of digital closing capabilities on the back-office, but there are still opportunities for improvements to the process.

“What’s left is the true middle office, which is where the most complex processes are being performed: the processing, the setup, the underwriting functions,” Bharadwaj said. “These have seen very little automation.”

That lack of automation in the middle of the process can lead to a “digital dissonance” for borrowers. If a borrower is able to use an online portal to quickly and easily submit an application but they’re stuck waiting for 45 days to close their loan, that creates frustration. Completing the digital cycle by leveraging automation technology throughout the entire process creates a more holistic borrower experience and can make a huge difference in borrower satisfaction.

Those middle office functions are where Indecomm sees a majority of the potential for automation to make a difference in the near future.

As lenders look to adopt automation technology as part of their process, Bharadwaj stressed that Indecomm’s automation continuum is neither prescriptive nor a linear path to growth. Instead, lenders should start by examining their current needs and the maturity of their current technology.

“It depends on the level of technology maturity of each lender’s middle office. You identify functions within the technology infrastructure that support automation readily, and then you start automating those pieces,” he said. “Because as much as automation is a long-term vision, it’s also about lenders proving value to the business as they move along the course.”

Indecomm’s automation solutions are designed with its continuum in mind, leveraging multiple types of automation with a focus on growth in innovation for the middle office.

BotGenius is a pre-built set of RPA-enabled bots that address automation in certain workflows and tasks rather than requiring a multi-quarter implementation process.

“We’ve industrialized the process and turned it into more like hiring robots like contract workers,” Bharadwaj said. “The only difference is that they scale up and down and are far more efficient than a human being.”

Indecomm’s IncomeGenius is an income calculation tool that reduces income calculation time by up to 50% through automation technology and robust rules engine, with integrations for source of truth data, LOS and POS providers. AuditGenius uses supervised automation for risk management and quality control. AuditGenius compares data to audit and track loans on every stage of the mortgage lifecycle and report on the exceptions that may expose an organization to risk.

All of Indecomm’s automation tools are built on its proprietary imaging and data extraction platform, which includes machine learning algorithms the company has developed over years of experience.

To learn more about the automation continuum and Indecomm’s solutions, visit https://mortgage.indecomm.net/about-us/.