Local markets spotlights 5 different areas across the country, showcasing what is uniquely happening in those housing markets. Local real estate agents, loan officers and appraisers share what characteristics are currently defining their housing markets.

San Diego, California

San Diego’s growing economic divisions come through in the city’s housing market. A San Diego Union-Tribune story from this August noted that the city’s unemployment rate hovers around 7%, higher than the national rate of 5.2% at that time, as many leisure and hospitality workers remained sidelined. However, venture capital money is at an all-time high, specifically funding biotech and life science companies. “There’s been a real surge in life sciences and biotech,” said Ross Clark, a Compass agent based in San Diego’s tony La Jolla neighborhood. And that’s created a demand for luxury housing, Clark said, noting that San Diego home prices climbed 20% the past year as neighborhoods gentrify left and right. According to an OJO Labs study, San Diego, whose median home price was $750,000 in September, is more unaffordable to its current residents than Los Angeles.

Honolulu, Hawaii

An agent for 33 years, Anne Hogan Perry sells luxury homes in Honolulu, Maui and Kauai and says that she is enjoying an unprecedented influx of homebuyers who previously lived in New York or Los Angeles for their jobs. “We have started to see work not be so rigid and time specific,” said Perry, who is an agent at Compass. “I sold a home to a hedge fund guy in New York. Now he just gets up at 4, gets done with work at noon and goes to the beach.” The agent said rich “mainland” residents replaced international buyers, who are restricted in their travel amid the pandemic. But overall demand is on the rise. That’s reflected in home prices, where the median Honolulu home sold for $975,000 in the second quarter of 2021, according to the National Association of Realtors, a climb of 20% year-over-year.

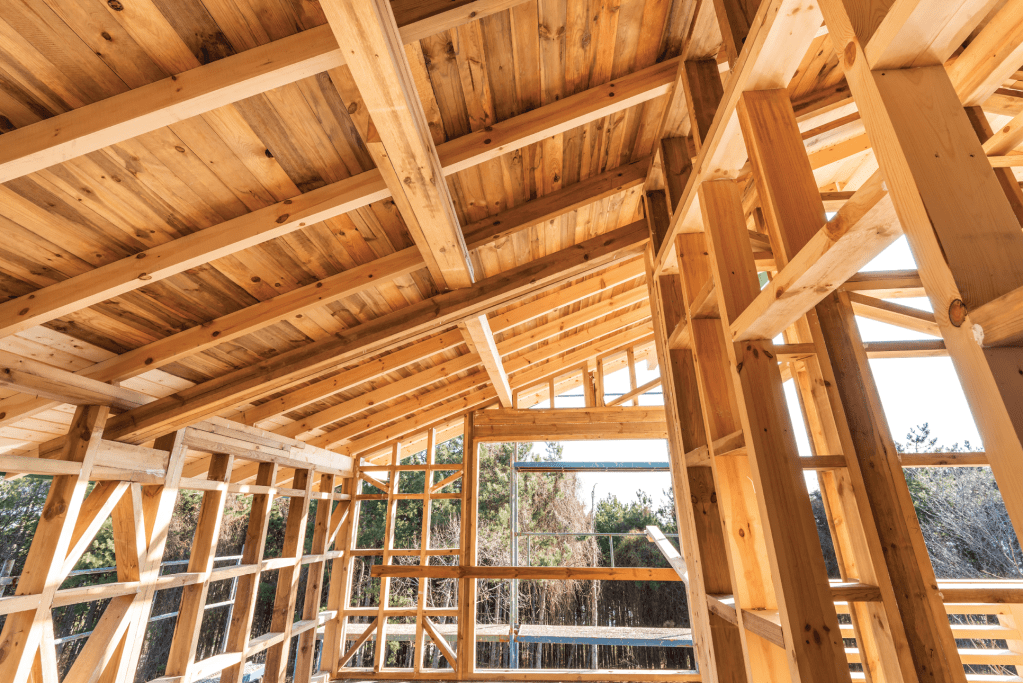

Springfield, Missouri

The “Queen city of the Ozarks” needs more homes. “While we have lots of new construction, there are lots of delays due to shortage of materials and also construction workers,” said Ethel Curbow, an agent at AMAX real estate. “Also, the cost of materials has prevented a lot of people from custom building.” One issue that comes from this, Curbow said, is that buyers are afraid to pursue their dream home. “People fear if they sell their home, they won’t be able to find something and get into a bidding war.” By the numbers, Springfield is dealing with a similar high-demand, low-inventory quandary as the rest of the country, though with lower prices. The median home price has gone up 17% to $182,000 from August 2020 to August 2021, according to Zillow, while nationally, median home prices climbed 15% to $356,000 in the past year.

Augusta, Georgia

Some tourists visit Augusta for the James Brown statue or The Master’s golf tournament, but its economy centers around Fort Gordon, a 60,000-acre terrain that is home of the U.S. Army Cyber Command, and 25,000 employees. The high number of public sector jobs is a bulwark against economic highs and lows, said Matt Kelly, an agent at Blanchard & Calhoun. Augusta home sales this year varied due to events that happen every year such as the start of school leading to fewer sales, Kelly said. Still, Augusta home prices are not immune to national trends. The typical home value in September 2021 is $147,000, according to Zillow, up 20% from August 2020.

Peoria, Illinois

“If it plays in Peoria, it will play anywhere” is not true when it comes to home price appreciation. After the second quarter of 2021, the current home price went up in the central Illinois city by .2% to $129,000, according to NAR numbers. Nationally, home prices climbed 22% in the same time period. Peoria was hit hard by the departure of the Caterpillar machinery plant in 2017, but its August 2021 unemployment rate of 6.1% was higher, but not wildly higher, than the 4.8% national unemployment rate. Peoria’s affordability partly comes from a lack of outside demand. As the overall U.S. population increased 7.4% from 2010 to 2020, Peoria’s population dropped 2.5% to 182,000 residents.

This article was first featured in the Dec/Jan HousingWire Magazine issue. To read the full issue, go here.