There’s good news and better news for mortgage brokers as the calendar flips to 2019.

The good news is that mortgage brokers continue to outpace their retail counterparts in business growth, a trend that has lasted the better part of two years now, especially as the market has been so heavily dominated by purchases.

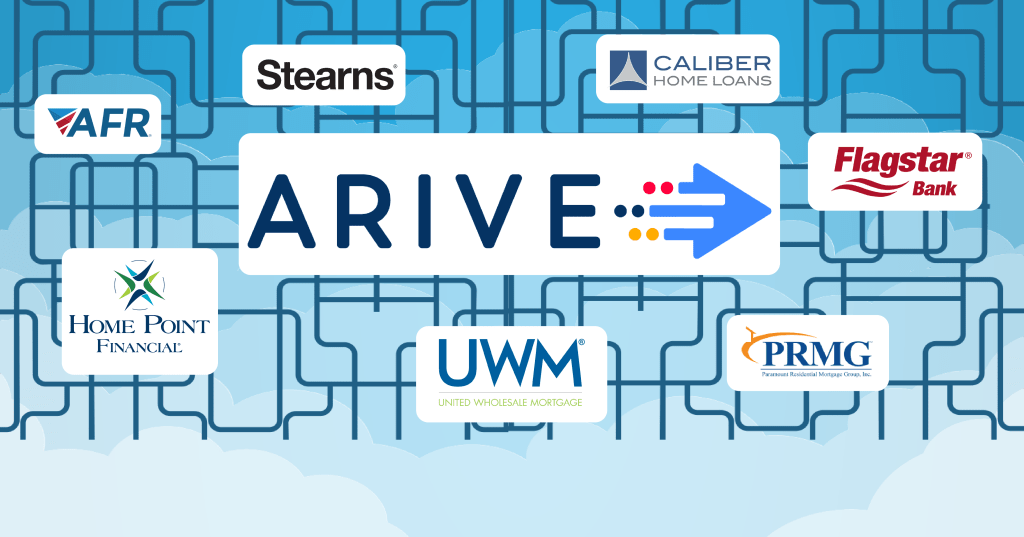

The better news is that brokers will see their competitive advantage intensify following the January launch of ARIVE, the industry’s first centralized digital platform that connects independent loan originators with a network of wholesale lenders, third-party vendors and borrowers.

ARIVE, which was announced by Association of Independent Mortgage Experts (AIME) founder Anthony Casa at AIME’s October Fuse event in Las Vegas, has already established multi-year contracts with a network of more than 20 wholesale lenders that are committed to integrating to align with ARIVE. That includes five of the most widely used wholesale lenders in the country: United Wholesale Mortgage (#1), Caliber Home Loans (#2), Stearns Lending (#3), Flagstar Bank (#7) and Home Point Financial (#8). Combined, these lenders make up nearly half of wholesale market share. Top Renovation Lender AFR Wholesale, Reverse Lender Finance of America Mortgage, and Paramount Residential Mortgage Group are among the additional 20 wholesale lenders connecting to ARIVE.

More than 80 additional lenders are on a waiting list to be added to the platform, with ARIVE expecting to add 15-20 lenders each month. Over 13,000 independent loan originators are pre-registered for ARIVE, with more to come, so partnership opportunities look promising for both sides. Lender and user adoption will begin in January and continue throughout the first quarter of 2019.

A great deal of excitement and anticipation surrounds the launch of ARIVE, as independent mortgage brokers have waited a long time for an all-inclusive platform that simplifies transactions. Instead of abiding by different processes and systems of each respective wholesale lender they send loans to, ARIVE will now allow brokers to more easily shop on their borrowers’ behalf and connect them with the products and pricing that best fit their needs with a standardized end to end manufacturing process.

Visit ARIVE.com for additional information.