Amanda and Taylor Hall were married in May 2017 and, like nearly 60% of the primary residence market last year, they were faced with one of the most important decisions of their young lives – to continue renting or to buy a new home. They were renting a one bedroom converted apartment that was part of a twin home. With noisy tenants upstairs and a family of six who lived on the other side of their shared twin walls, the newlyweds were ready to explore new options.

For many, the thought of renting is much easier due to several conveniences, such as only paying your rent and a handful of utilities, having a landlord to fix any problems, the flexibility to move from city to city and a set monthly rent payment.

But there are also downsides to renting that many people don’t consider. According to Zillow, the median rent in the United States rose 2.8 percent over the past year to $1,445, the fastest pace of appreciation since May 2016. The Halls had to deal with the common pitfalls of renting such as application fees and strict rules around pets, nonrefundable security deposits and decorating improvements such as painting and hanging photos.

In comparison, while the benefits of homeownership are well understood for most people– a predictable monthly payment with a fixed mortgage, potential tax benefits, wealth and equity accumulation and security, to name a few – often the main reason that first-time homebuyers (FTHB) give for pursuing this major purchase is simply the desire to own a home of their own.

Purchasing a home is an important decision and has major benefits that renting just cannot provide. Like one-third of the homebuyers last year, the Halls were FTHB and needed help to navigate through this process. When the Halls’ real estate agent sat down with them, he explained some significant facts:

- Stability: first and foremost their house is their home, not a landlord’s property. It’s a place FTHB will call their own.

- It’s an investment in their future. Each month that they make a payment, they are one step closer to paying off the mortgage loan, while continuing to build equity along the way.

- Their purchase may provide a tax deduction. Each year, buyers may be able to write off their mortgage interest payments and property tax on their personal residence. There are other potential tax deductions tied to owning a home too. For some, this can be a significant tax savings. The real estate agent advised the Halls to consult their tax professional to determine what makes sense for them.

- Market Value Appreciation. While not all home values rise and fall at the same rate, over time, property values have kept up with inflation and can provide some price appreciation, which is helpful if a homeowner wants to sell to move to a new location or into a bigger home. The combination of equity build up and the appreciation in the home value will start them on the path to wealth creation.

- They get to make it their own. Paint, decorate, remodel….when it’s their own home, they decide what improvements they want to make.

- No more rent increases. When homebuyers purchase a home with a fixed rate mortgage, the payment for the principal and interest on their mortgage stays the same for the life of the loan, unlike rent, which typically increases every year (sometimes significantly!).

- Loan payoff means no more mortgage payment! When they pay off their mortgage, which will happen over time, they will wake up one day and realize the joy of no more mortgage payments!

Even with all of the benefits of homeownership explained, of particular concern to the Halls was how much was needed for a down payment. For many FTHB, while they want to say “Au Revoir” to renting and “Bonjour” to homeownership, the downpayment is a major financial hurdle. There is a misconception that homebuyers need 20% of the home price as the down payment.

At Radian we want all FTHB to be prepared, so we provide tools to help them understand how buying their first home could be within their reach. A key part of a buyer’s educational journey includes a discussion about the benefits of mortgage insurance — a financial tool that creates a path to homeownership by allowing buyers to purchase sooner with less money down. Sometimes, eligible buyers can secure a conventional mortgage with as little as a 3% down — a much more feasible option for many FTHB. When thinking about how much they had to pay for their apartment and comparing it to how much they would have to put down to secure a loan, the Halls felt more confident about the idea of homeownership.

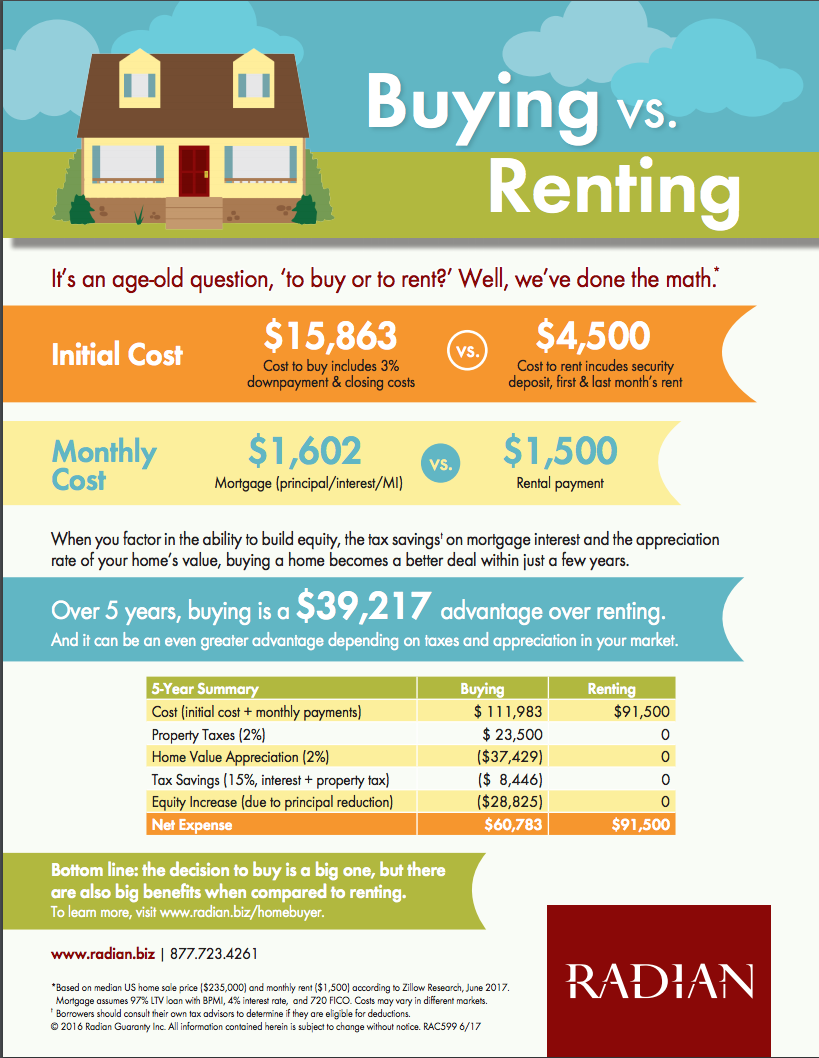

To help simplify things for both real estate agents and FTHB, Radian’s home buying tools help prospective buyers make an educated, financial decision. Some homebuyers don’t even realize that in many areas of the country, buying a home can actually be more affordable than renting.

A great resource is Radian’s homebuyer website, AchievetheDream.com. The website is an excellent source of information and makes it easy to get familiar with the home buying process. With their agent’s help, the Halls discovered a helpful Rent vs Buy interactive calculator on the Achieve the Dream website, giving them the opportunity to compare the true cost of renting versus owning a home to help determine which would be most cost effective for their family.

The calculator compares things such as rental payments and insurance, utilities, security deposit and max rent increase to a home’s sale price, credit score, interest rates, down payment, taxes and property insurance, closing costs and annual appreciation rates. The Halls plugged in their personal information, watching the numbers change as they compared renting to buying a home. The numbers showed that financially it was a better investment to purchase a home than rent.

Seeing actual numbers is a big wake up call for wishful homebuyers. However, helping them understand the possibilities and how to financially get there ultimately makes for happy and successful first-time homebuyers.