As week 34 of the Lender Implementation Timeline continues, we’ve passed the half-way mark for the Analyses and Decisions phase. Very soon you’ll be on to the next phase of developing any customizations to in-house solutions, or working with your technology provider(s) to start working those changes into your organization’s environment.

If you’re one of the lenders who hasn’t converted over to a digital closing platform yet, chances are you’re going to be a little lost (and even further behind) when that next phase of development kicks off about two months from now. Which begs a question — what’s stopping you from going digital?

Perhaps it’s the stigma from “eClosings” of recent past basically turning out to be fancy eSigning solutions. Were there key components missing that would have made the transition too painful? Or maybe implementing one meant too much of a painful tech transition for your organization.

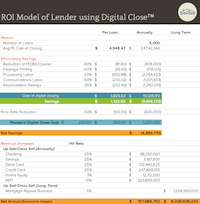

Regardless of the reason, think about it again after you take a look at a model for digital closings out at TILA-RESPA.com . With a great sampling of metrics from a lending organization, this model shows how digital closings on a truly digital platform can save over $1100 per closing.

If you want to play with the metrics so the numbers are specific to your circumstances, you can simply download it from TILARESPA.com– just register for a free account, and model away to your heart’s content.

And while you reconsider your reason(s) for not going digital, also take a look at some of the solutions that are now coming to market. The fact that the Integrated Disclosure rule of TILA-RESPA goes live in about nine months has spurred some new tech solutions with innovative features that haven’t been previously available.

But more on that in a post to come…

All information and views expressed or implied are provided without warranty and are only opinion. Each participant should seek legal representation for legal interpretation of the ruling and the CFPB directly for final instruction and interpretation. The final rule can be found here.